USD/CAD ANLAYSIS & TALKING POINTS

- Crude oil via OPEC+ gives CAD a boost.

- BOC rate hike expectations remain on the fence.

- Death cross established, where to next for USD/CAD?

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

CANADIAN DOLLAR FUNDAMENTAL BACKDROP

The Canadian dollar powered through some key technical levels last week and opened up relatively strong this week although marginally weaker against the USD. The primary driver has been the OPEC+ meeting on Sunday that featured further crude oil production cuts by Saudi Arabia (1 000 000 bpd) to a total output of 9 000 000 bpd. The supply limits will follow through to 2024 as well giving the crude oil linked loonie some support from a commodities point of view.

From a US dollar perspective, a NFP headline beat was not enough to swing money market expectations in favor of another interest rate hike due to the increase in unemployment and a decline albeit marginal in the average earnings figure. The Bank of Canada (BOC) discloses its interest rate announcement on Wednesday 7th June and is anticipated to remain on hold; however, forecasts show an almost 50/50 split between a pause and hike which may stem from strong Canadian GDP last week. With no real impactful Canadian data between now and Wednesday, I tend to favor the BOC holding rates steady.

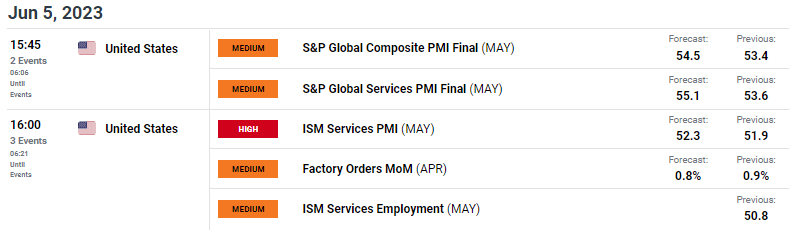

The economic calendar today (see below) includes some key information about the US economy via services PMI data with more focus on the ISM report. This data print is important due to the fact that the US is primarily a services driven economy and with forecasts pointing to the upside, the greenback may find some additional backing – possible increasing the probability of a Fed rate hike as the services sector has been a major driver of US inflation.

USD/CAD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

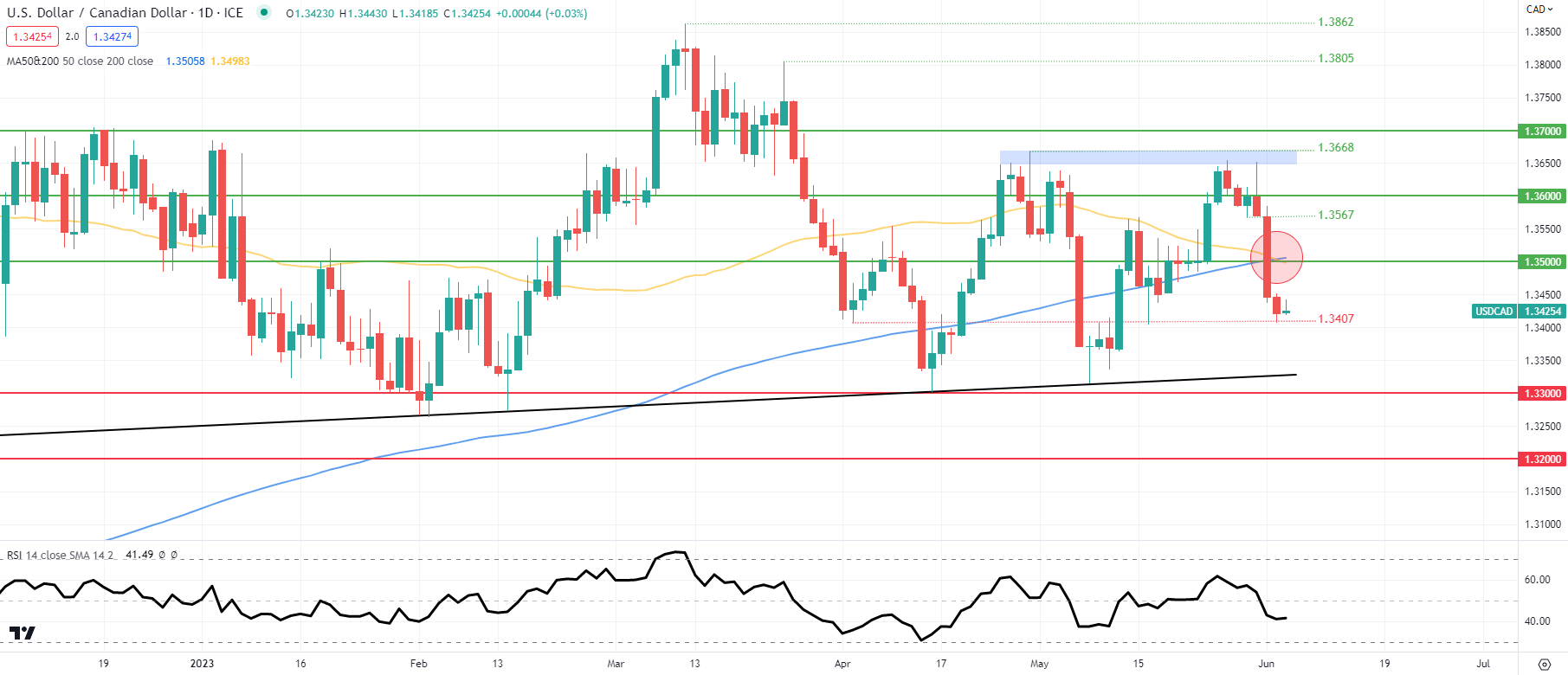

USD/CAD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily USD/CAD price action may be on the cusp of extending the short-term CAD rally with the formation of the death cross (red). A candle close and break below the 1.3407 swing low could prompt a large move lower towards trendline support (black).

Introduction to Technical Analysis

Moving Averages

Recommended by Warren Venketas

Key resistance levels:

- 1.3567

- 200-day MA (blue)

- 1.3500/50-day MA

Key support levels:

- 1.3407

- Trendline support (black)

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently LONG on USD/CAD , with 66% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside disposition.

Contact and followWarrenon Twitter:@WVenketas