USD/JPY OUTLOOK:

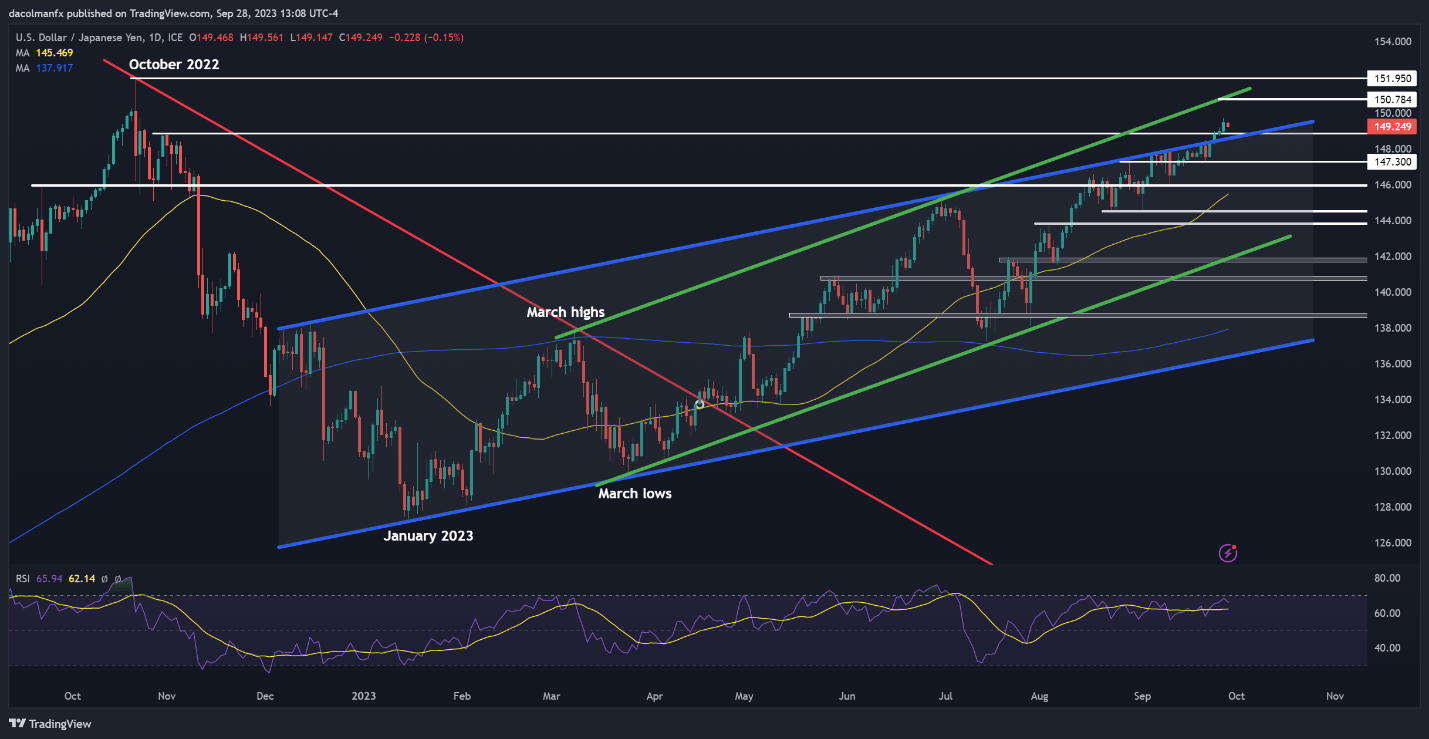

- USD/JPY halts its advance near 11-month highs after breaching channel resistance earlier in the week.

- Despite some market hesitation, the U.S. dollar maintains a bullish outlook. Absent FX intervention by the Japanese government, the pair may soon break above the 150.00 level and head higher.

- This article looks at key USD/JPY’s technical levels to watch in the coming trading sessions.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Most Read: Euro Forecast: EUR/USD on Breakdown Watch, EUR/GBP Stuck in No Man’s Land For Now

USD/JPY was a touch softer on Thursday, but clung near 11-month highs after breaking above the 149.00 handle and breaching channel resistance earlier in the week. Against this backdrop, the pair was down around 0.12% in afternoon trading in New York, to hover around 149.25, in a session characterized by a lack of major catalysts ahead of Friday's key August U.S. personal income and outlays figures.

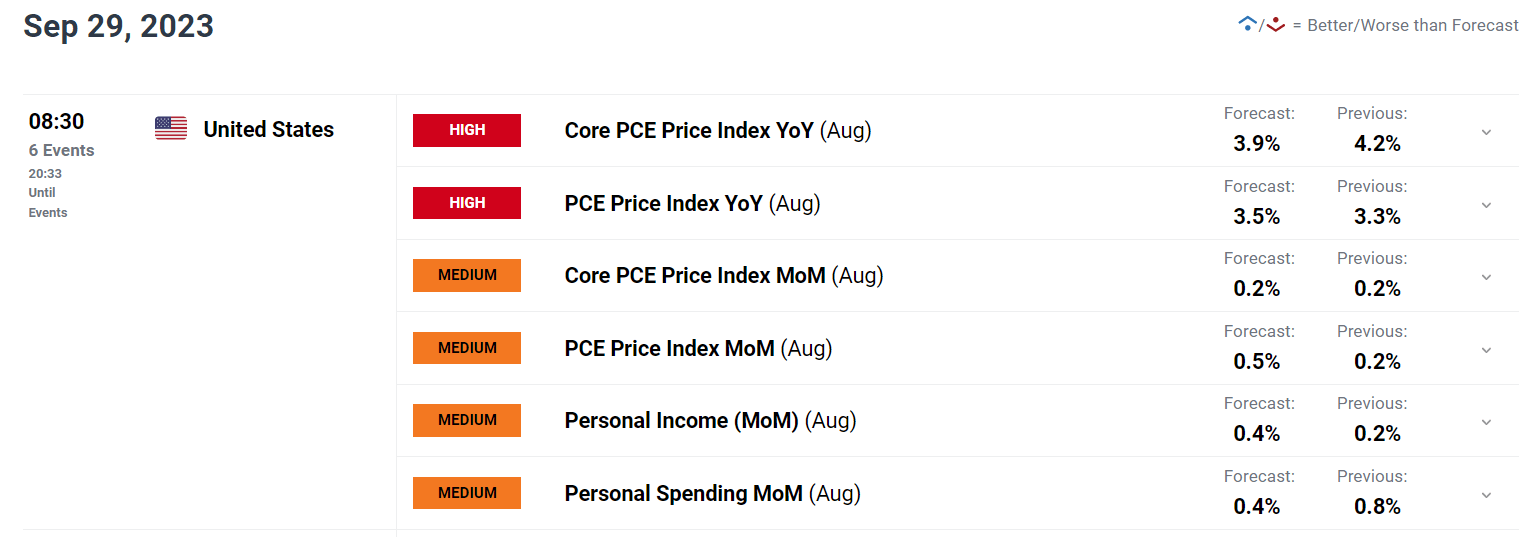

In terms of expectations, household spending, the main driver of the country's economic activity, is forecast to have risen 0.4% last month, following a 0.8% increase in July. Meanwhile, core CPI, the Fed's favorite inflation gauge, is seen climbing 0.2% monthly, allowing the annual rate to ease to 3.9% from 4.2% previously.

Overall, if the American consumer keeps up their robust spending and inflation remains sticky, the U.S. dollar might stay in a leading position. In this regard, any upward deviation of tomorrow’s data from consensus estimates could spark a rally in U.S. yields by strengthening the case for “further policy firming” and “higher interest rates for longer”. This could push USD/JPY above 150.00.

If trading losses have left you scratching your head, consider downloading our guide on the "Traits of Successful Traders." It provides practical information on how to avoid the common pitfalls that may result in costly missteps.

UPCOMING US DATA

Source: DailyFX Economic Calendar

In the event that USD/JPY breaks above the 150.00 mark, however, traders should exercise caution and proceed with vigilance, as the Japanese government may step in to prop up the yen. This is especially pertinent if such FX intervention takes place on a Friday during U.S. trading hours, when other major markets have already closed, as the lower liquidity environment heading into the weekend could amplify exchange rate moves.

Take your trading game to the next level with a copy of the yen's outlook today! Seize the opportunity to access exclusive insights into potential market-moving factors for USD/JPY!

USD/JPY TECHNICAL ANALYSIS

USD/JPY breached medium-term channel resistance at 148.50 earlier in the week, pushing towards its highest level since October 2022. After the latest leg higher, the pair has stalled and its propulsion tapered off, but that could be related to profit-taking by traders with bullish positions rather than a loss of momentum or a market reversal. That said, the underlying bias remains constructive for now.

In terms of potential scenarios, if USD/JPY manages to hold above support extending from 148.80/148.50, buying interest could re-emerge, setting the stage for a move towards 150.75, the upper boundary of an ascending channel in place since March 2023. On further strength, buyers could be emboldened and initiate an all-out assault on the 2022 highs around 151.95.

In contrast, if the bears regain control of the market and trigger a pullback, initial support rests at 148.80/148.50. Further down the line, the focus shifts to 147.25, followed by 146.00.

Discover the power of crowd sentiment. Download the sentiment guide to understand how USD/JPY’s positioning can influence the pair's direction!

| Change in | Longs | Shorts | OI |

| Daily | -9% | -6% | -7% |

| Weekly | -17% | -4% | -8% |

USD/JPY TECHNICAL CHART