USD/JPY OUTLOOK

- USD/JPY weakens on Monday ahead of two major events later in the week: the Federal Reserve’s interest rate decision on Wednesday and Bank of Japan’s monetary policy announcement on Friday

- The Fed is expected to raise interest rates by 25 basis points to 5.25%-5.50%

- Meanwhile, the BoJ is seen keeping its policy settings unchanged, although some traders speculate the institution could tweak its yield curve control program

Most Read: Euro Outlook - EUR/USD and EUR/GBP’s Path Tied to Fed and ECB Policy Outlook

USD/JPY (U.S. dollar – Japanese yen) traded lower on Monday, weighed down by cautious sentiment and slightly weaker U.S. Treasury yields ahead of two major market-moving events later in the week: the Federal Reverse’s interest rate decision on Wednesday and Bank of Japan’s monetary policy announcement on Friday.

Focusing first on the Fed, the bank led by Jerome Powell is seen delivering a quarter-point interest rate hike, bringing the target range to 5.25%-5.50%, the highest level since 2001. Investors have already discounted this move, so the focus will fall squarely on forward guidance.

Although the softer-than-forecast June U.S. inflation report argues for a less aggressive stance, the FOMC may lean toward a hawkish tone to keep its options open in case price pressures regain momentum later in the year and further tightening becomes necessary.

If Powell resists external pressure to embrace a dovish posture and signals that more work is needed to restore price stability, traders will likely reprice the central bank’s terminal rate slightly upwards, sending Treasury yields higher. This scenario could boost USD/JPY.

Related: Gold and Silver Prices Forecast - XAU/USD and XAG/USD Left Uncertain as Gains Vanish

Turning to the Bank of Japan, the consensus expectation is that the institution will hold its policy settings unchanged, although some traders speculate that there will be some kind of adjustment in the yield curve control (YCC) program in the face of rising inflation.

Any tweaks in the YCC will be seen as the start of the policy normalization cycle, regardless of how the central bank characterizes it, creating a positive backdrop for the Japanese yen to rally against its major peers in the coming days and weeks.

On the flip side, if the BoJ sticks to its ultra-accommodative position, refraining from engaging in any preliminary discussions to alter the outlook, the yen could take a hit in the FX space, allowing USD/JPY to push higher in the near term.

| Change in | Longs | Shorts | OI |

| Daily | 9% | -1% | 2% |

| Weekly | -4% | -9% | -7% |

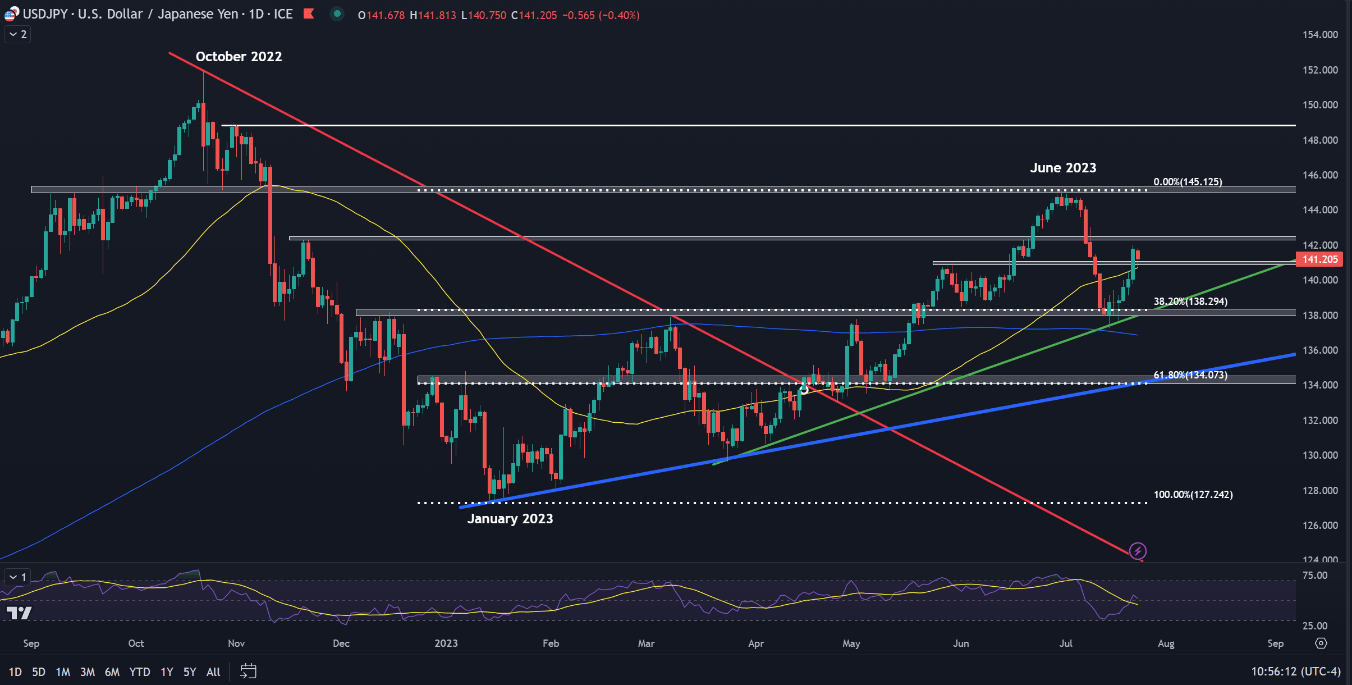

USD/JPY TECHNICAL CHART

USD/JPY Chart Prepared Using TradingView

KEY TECHNICAL LEVELS TO WATCH

Support 1: 141.00-1.39.70

Support 2: 138.30, 38.2% Fib retracement of January/ June rally

Resistance 1: 142.50

Resistance 2: 145.12