Gold (XAU/USD) PRICE, CHARTS and ANALYSIS:

- Gold Bulls Return as Dollar Index Rally Stalls.

- Fed Chair Powell Sticks to Similar Rhetoric as Post FOMC Press Conference.

- Lack of High Impact Data Means Fed Speakers Will Drive Market Moves.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

MOST READ: Dow Bulls Have Another Chance, Dollar Needs a New Foothold to Keep Climbing

Gold (XAU/USD) FUNDAMENTAL BACKDROP

Gold continued its push higher ahead of the European open this morning before stalling, helped largely by a weaker dollar index and improving sentiment. The precious metals rally could also be attributed to updated growth forecasts for China by Fitch Ratings. Fitch Ratings now sees economic growth peaking at 5% up from 4.1% for 2023, reflecting a quicker recovery in consumption and activity.

The dollar index has lost momentum following Fed Chair Powell’s remarks at the Economic Club in Washington DC yesterday. In his first speech since the blockbuster jobs report last week Chair Powell’s remarks were not hawkish enough and similar to his press conference following the FOMC meeting last week. Market participants were expecting a more hawkish tone owing to the jobs report to keep the USD recovery on track. The Fed Chair did mention that the process of rate hikes and fight against inflation will be a long one. Markets found further solace in Powell’s remarks around disinflation which saw risk assets rally with US indices all but wiping out the previous two days of losses. The dollar index (DXY) continues to be driving factor for markets as a whole with the continued repricing of the Fed Funds peak rate holding the key.

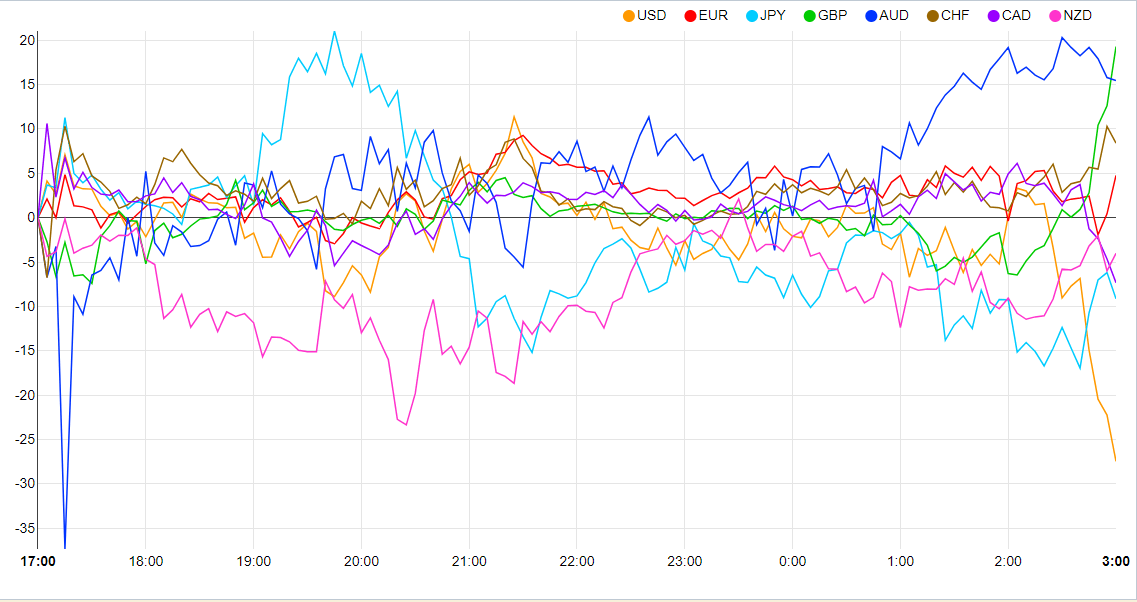

Currency Strength Chart: Strongest - GBP, Weakest – USD

Source: FinancialJuice

Gold is in need of a catalyst if we are to see a final push higher toward the key $2000 handle. There remains a lack of high impact data releases until Friday, when we have the preliminary Michigan Consumer Sentiment release. For now, attention will be on the various Federal Reserve policymakers and their rhetoric, which will likely be the driving factor for the precious metals next move.

For all market-moving economic releases and events, see the DailyFX Calendar

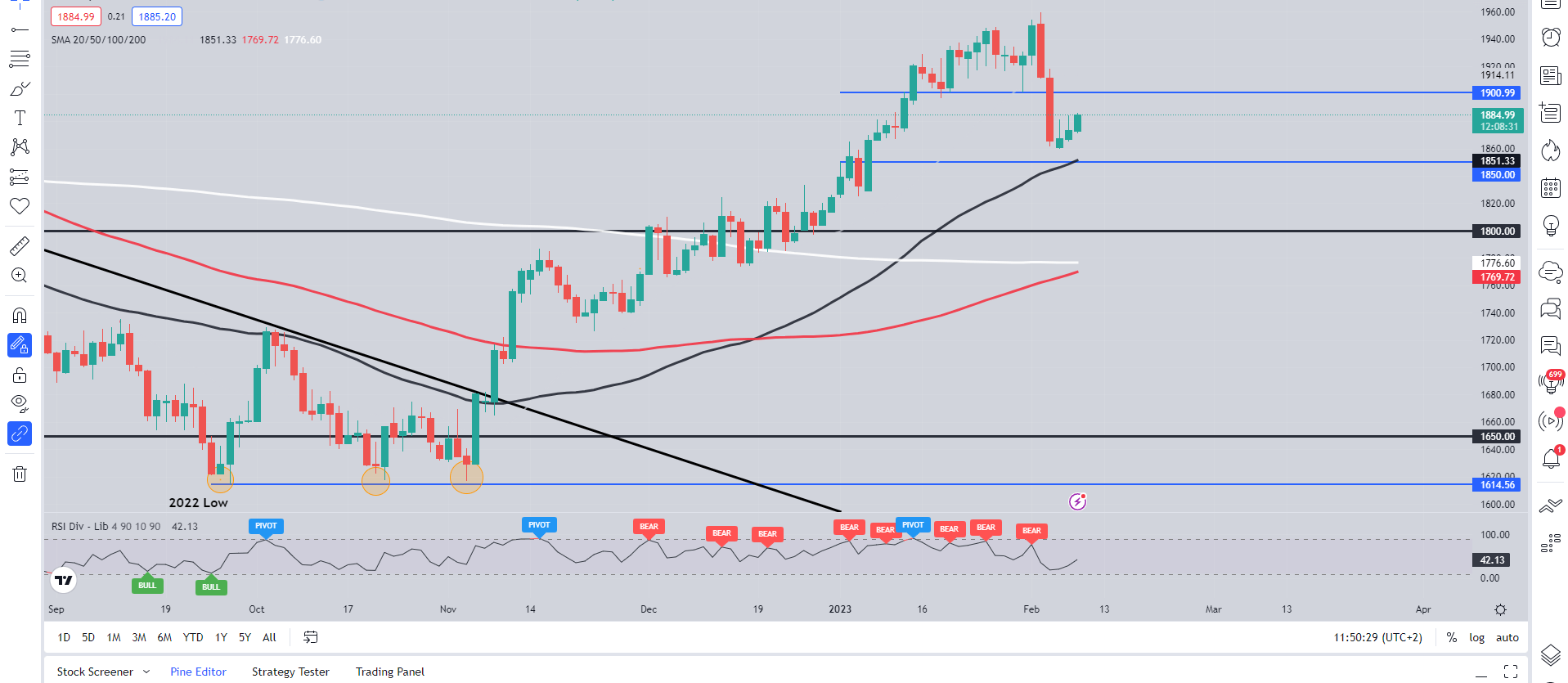

TECHNICAL OUTLOOK

From a technical perspective, Gold is on course for its third consecutive day of gains. It does however remain within a $26 range between $1860-$1886 with a breakout to the upside looking more likely at this stage.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Immediate resistance rests at $1900 with a daily candle close above required if we are to see the bullish momentum continue. Should the Fed policymakers inspire a dollar comeback, the $1850 key level which lines up with the 50-day MA has yet to be tested but remains some distance away at present.

Gold (XAU/USD) Daily Chart – February 8, 2023

Source: TradingView

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on XAU/USD, with 66% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment and the fact that traders are LONG suggests that XAU/USD may fall.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda