EUR/USD ANALYSIS

- Sharp repricing on ECB rate forecasts keep euro on offer.

- Euro area retail sales and US jobs data under the spotlight later today.

- EUR/USD vulnerable to further downside.

Elevate your trading skills and gain a competitive edge. Get your hands on the Euro Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

EURO FUNDAMENTAL BACKDROP

The euro has opened flat this morning after a slew of daily closes in the red. Weak economic data from the euro area including yesterday’s composite and services PMI’s that remain in contractionary territory as well as increasingly negative economic growth over the next 12 months (European Central Bank (ECB) survey). Adding to EUR downside was the fact that US ISM services PMI’s surprised to the upside although JOLTs openings did miss to the downside reaching its lowest level for 2023. ECB officials have been become increasingly dovish of recent and this reflects in money market pricing of the ECB’s rate path (refer to table below):

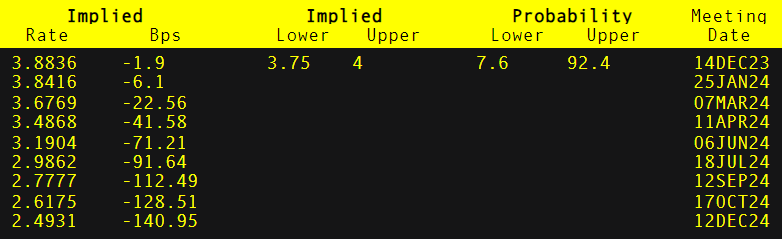

ECB INTEREST RATE PROBABILITIES

Source: Refinitiv

Markets see the first round of rate cuts around March 2024 and could really weigh negatively on the euro should we continue to see weak euro area economic data. The significant repricing occurred after the ECB’s Schnabel (known hawk) stated that “INFLATION DEVELOPMENTS ARE ENCOURAGING AND THE FALL IN CORE PRICES IS REMARKABLE.”

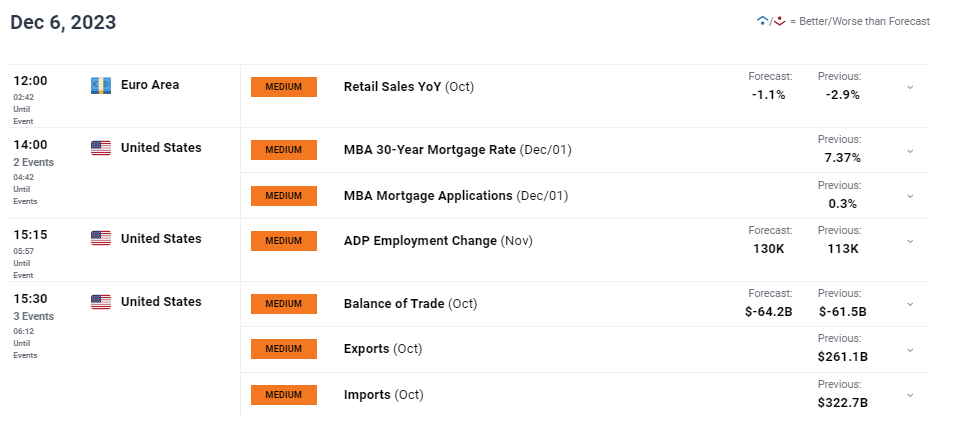

Later today, eurozone retail sales will come into focus while the main volatility driver is likely to stem from ADP employment change ahead of Friday’s Non-Farm Payrolls (NFP). The ECB’s Nagel is also scheduled to speak and will give some additional insight into the ECB’s thinking.

ECONOMIC CALENDAR (GMT+02:00)

Source: DailyFX Economic Calendar

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

TECHNICAL ANALYSIS

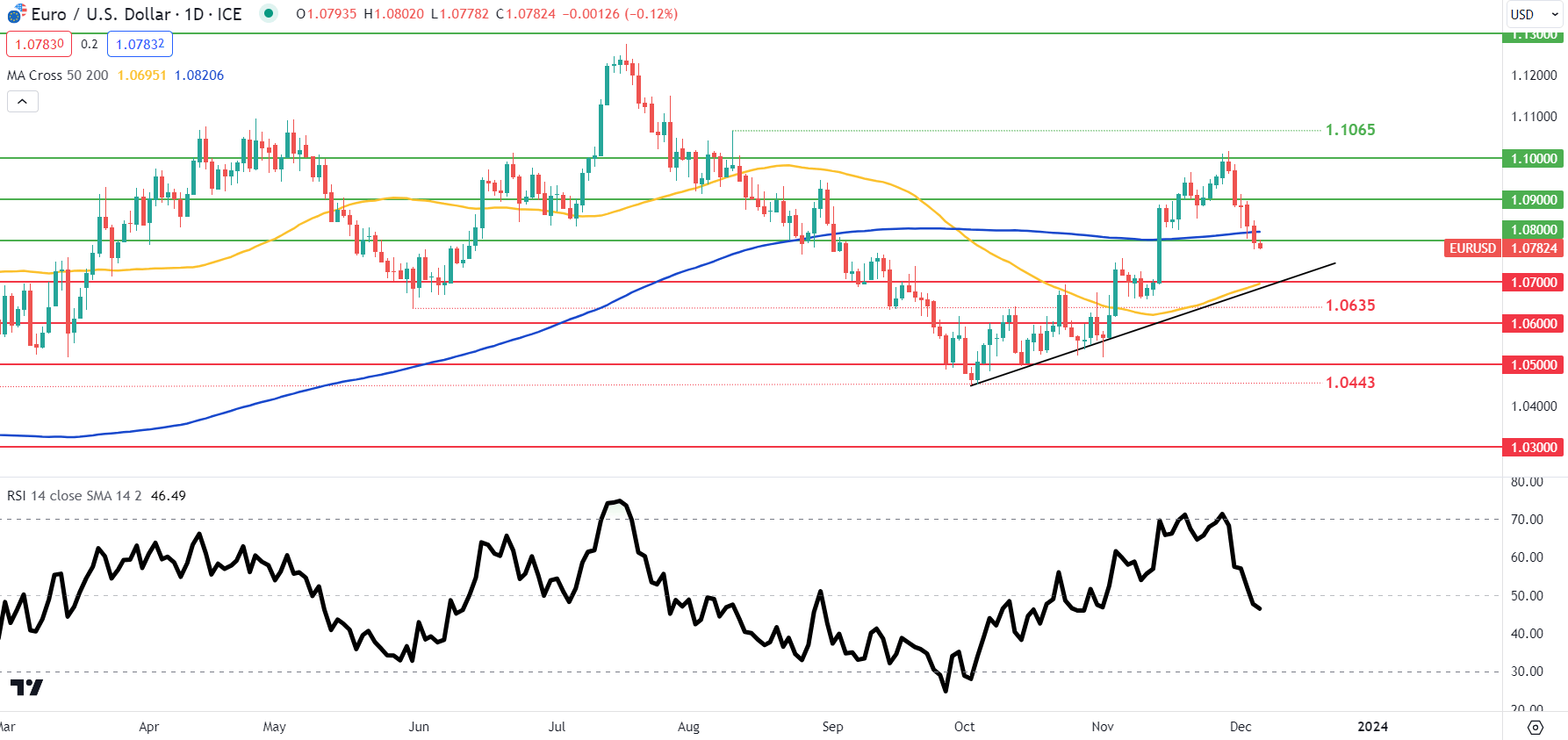

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD chart above has the pair below both the 200-day moving average (blue) and the 1.0800 psychological handle. The Relative Strength Index (RSI) now suggests a preference towards bearish momentum which brings into consideration the 50-day moving average (yellow), 1.0700 and trendline support (black).

Resistance levels:

- 1.1000

- 1.0900

- 200-day MA

- 1.0800

Support levels:

- 1.0700/50-day MA/Trendline support

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently neither NET LONG on EUR/USD, with 55% of traders currently holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas