To gain a more comprehensive understanding of the euro's technical and fundamental outlook for the fourth quarter, we invite you to download your complimentary trading guide today. It's packed with valuable insights!

EUR/USD ANALYSIS

EUR/USD fell sharply on Monday, weighed by broad-based U.S. dollar strength amid soaring U.S. Treasury yields, with the 10-year note pushing above 4.65% and hovering near its highest level since 2007. In this context, the pair sank about 0.5% in early afternoon trading in New York, steadily approaching the 1.0500 psychological level, a key near-term support to keep an eye on.

Today's moves in FX markets were due to several factors. First off, the greenback benefited from a last-minute agreement in Washington to fund the government and avoid a shutdown over the weekend. Better-than-expected economic data, which showed a moderate recovery in output in the manufacturing sector in September, also helped the U.S. dollar at the expense of the euro.

In contrast, disappointing factory activity in Europe dragged the single currency. According to HCOB, the eurozone's final manufacturing PMI sank further into contractionary territory last month, sliding to 43.4 from 43.5 in August, a sign that the sector is trapped in a sharp downturn that may preclude additional ECB tightening.

Given the Eurozone's economic challenges and the continued strength of the U.S. economy, there may be scope for further EUR/USD weakness in the short term. One reason is that the Fed has ammunition and cover to hike rates once again in 2023 and keep them high for longer, while the ECB has very limited options to maintain a hawkish stance.

Unlock the potential of crowd behavior in the world of FX trading. Download the sentiment guide to grasp how EUR/USD's positioning can steer the course of the pair in the near term!

| Change in | Longs | Shorts | OI |

| Daily | 1% | 1% | 1% |

| Weekly | -22% | 18% | -5% |

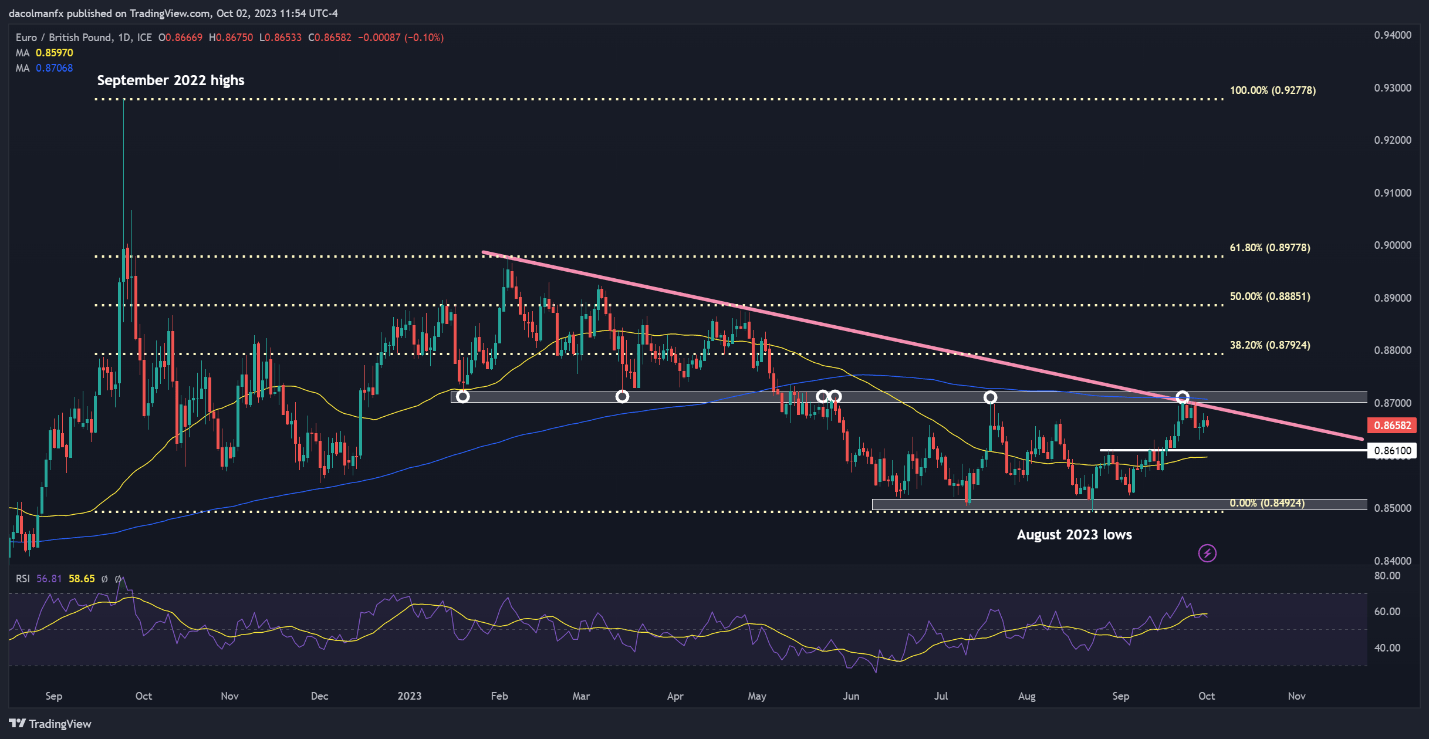

EUR/USD TECHNICAL ANALYSIS

After the recent pullback, EUR/USD has dropped towards an important support zone near the 1.0500 psychological level. While the pair could bottom out in this region before rebounding, a breakdown could accelerate downside pressure, setting the stage for a move towards 1.0406, the 50% Fibonacci retracement of the Sept 2022/Jul 2023 rally. On further weakness, the focus shifts to 1.0350.

On the flip side, should buyers manage to regain control of the market and trigger a bullish move, the first technical barrier that can act as a ceiling for further advances extends from 1.0615 to 1.0640. Upside clearance of this region could reignite upward pressure, paving the way for a rally towards trendline resistance at 1.0700, followed by a move higher towards 1.0775.

EUR/USD TECHNICAL CHART

EUR/USD Chart Creating Using TradingView

Hunting for trading ideas? Don't miss out on DailyFX's top trading opportunities for the fourth quarter – a valuable and free guide!

EUR/GBP ANALYSIS

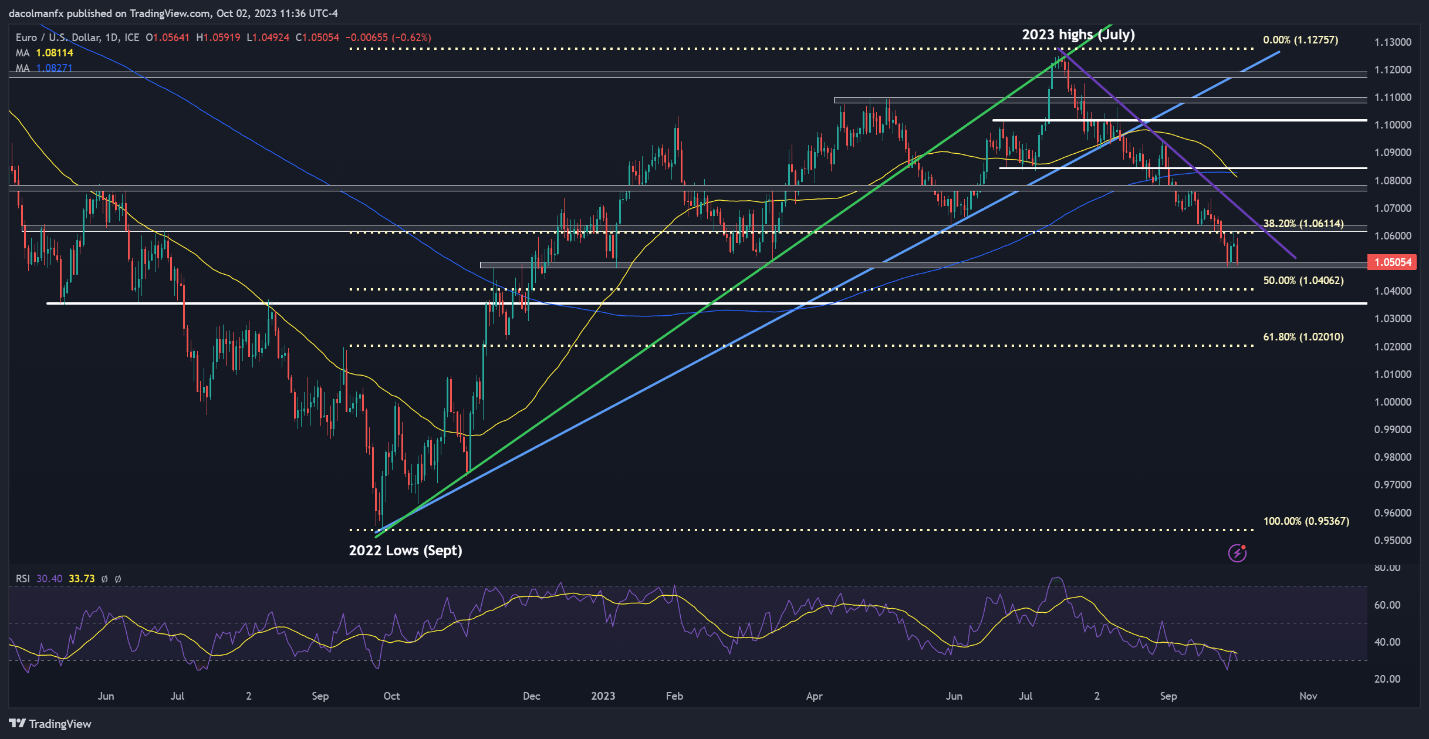

EUR/GBP began an upward trajectory in early September, but from a broader perspective, the pair has lacked directional conviction, primarily treading a sideways path, ensnared within a well-defined lateral channel. This sideways movement can be viewed as a manifestation of uncertainty, mirroring the feeble underlying fundamentals of both currencies.

Ranging markets can be predictable and easy to trade at times. The key idea revolves around establishing a short position when the price nears resistance, in anticipation of a retracement, or going long at technical support levels, with hopes of a potential rebound.

Examining EUR/GBP, prices are sitting slightly below the upper boundary of the horizontal range at 0.8700, where a key trendline aligns with the 200-day simple moving average. A re-test of this area could see the pair rejected to the downside, but in the event of a breakout, the exchange rate could head towards 0.8792, the 38.2% Fibonacci retracement of the September 2022/August 2023 decline.

In case of a bearish rejection, the prospect of a drop towards 0.8610 arises. With further weakening, the focus may transition to 0.8520, a region closely linked to the 2023 lows.

EUR/GBP TECHNICAL CHART