AUD/USD ANALYSIS & TALKING POINTS

- Aussie strength endures on rate cut expectations.

- US jobless claims data to come.

- Can AUD/USD confidently pierce long-term trendline resistance?

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar has reached multi-month highs on the back of a weaker US dollar as markets continue to build on easing monetary policy expectations from the Federal Reserve. Money markets remain steadfast on roughly 155bps of cumulative interest rate cuts by the Fed in 2024 thus providing upside impetus for the pro-growth AUD. The Reserve Bank of Australia (RBA) is projected to begin cutting rates around May/June 2024 but incoming data will be of utmost importance as to overall guidance and timing of the dovish pivot to a more accommodative stance.

China being a major trading partner with Australia from a commodities perspective will be under the spotlight as we prepare for the NBS manufacturing and non-manufacturing PMI report as the final high impact data print for 2023 (31 December). The nation has been adopting stimulus measures in an attempt to bolster the sluggish economic growth after COVID restrictions were lifted. Should there be an upside surprise from this data, the Aussie dollar may begin the new year on a solid footing.

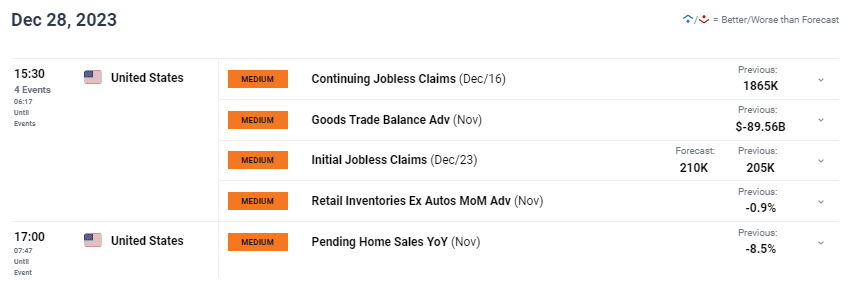

The economic calendar today (see below) is focused on US data, primarily initial jobless claims that has proven to be sticky. The robust US labor market will continue to be a key point of contention considering inflation has been on the decline. Moving into the first week of 2024, Non-Farm Payroll’s (NFP) will be central.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

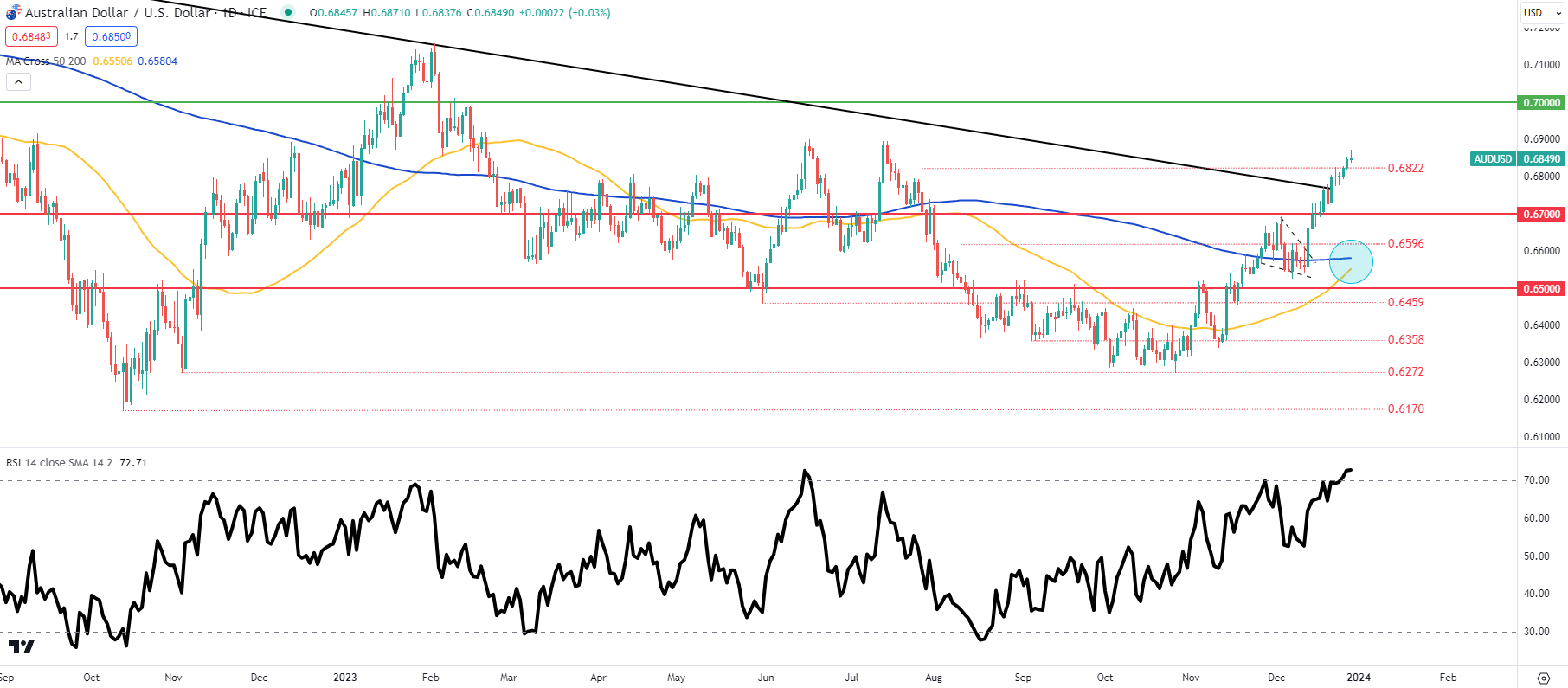

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

AUD/USD daily price action keeps the pair in overbought territory on the Relative Strength Index (RSI) as the 0.6900 psychological resistance level comes into consideration. Another factor to study is the weekly close with regards to whether or not AUD/USD closes below the long-term trendline resistance (black) as last week saw an unconvincing close marginally above this zone. This influential resistance zone has held firm since February 2021 and may expose 0.7000 should it be breached successfully. Looking at the respective moving averages, it would be wise to monitor the looming golden cross (blue) that may provide bulls with additional support.

- 0.7000

- 0.6900

Key support levels:

- 0.6822

- Trendline resistance

- 0.6700

- 0.6596

IG CLIENT SENTIMENT DATA: BULLISH (AUD/USD)

IGCS shows retail traders are currently net SHORT on AUD/USD, with 60% of traders currently holding SHORT positions.

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

| Change in | Longs | Shorts | OI |

| Daily | 27% | -21% | 7% |

| Weekly | -7% | -1% | -5% |

Contact and followWarrenon Twitter:@WVenketas