Euro, EUR/USD, US Dollar, Treasury Yields, Trend Break - Talking Points

- Euro appears to be re-asserting itself against the US Dollar

- Treasury yields have pulled back from recent peaks with a changing mood

- If the macro picture remains supportive, will technicals boost EUR/USD?

The Euro has managed to rally to start this week after a volatile trading session through the US time zone.

Most notably, Treasury yields climbed higher overnight before retreating lower after famed investors, Bill Ackman and Bill Gross Tweeted some bullish dynamics for US government debt.

Ackman said that his organisation had covered its short bond position due to concerns about the outlook for the US economy.

Not long after, Bill Gross, a fixed-income specialist, made public his preference for buying the Treasury inverted yield curve in the 2s 10s and 2s 5s.

He is expressing a view of buying the short-end bonds and selling the long-end bonds on the basis that the Federal Reserve mantra of ‘higher for longer is yesterday’s news’.

He also sees problems ahead for the US economy and is buying near-term interest rate futures outright that will settle in 2025.

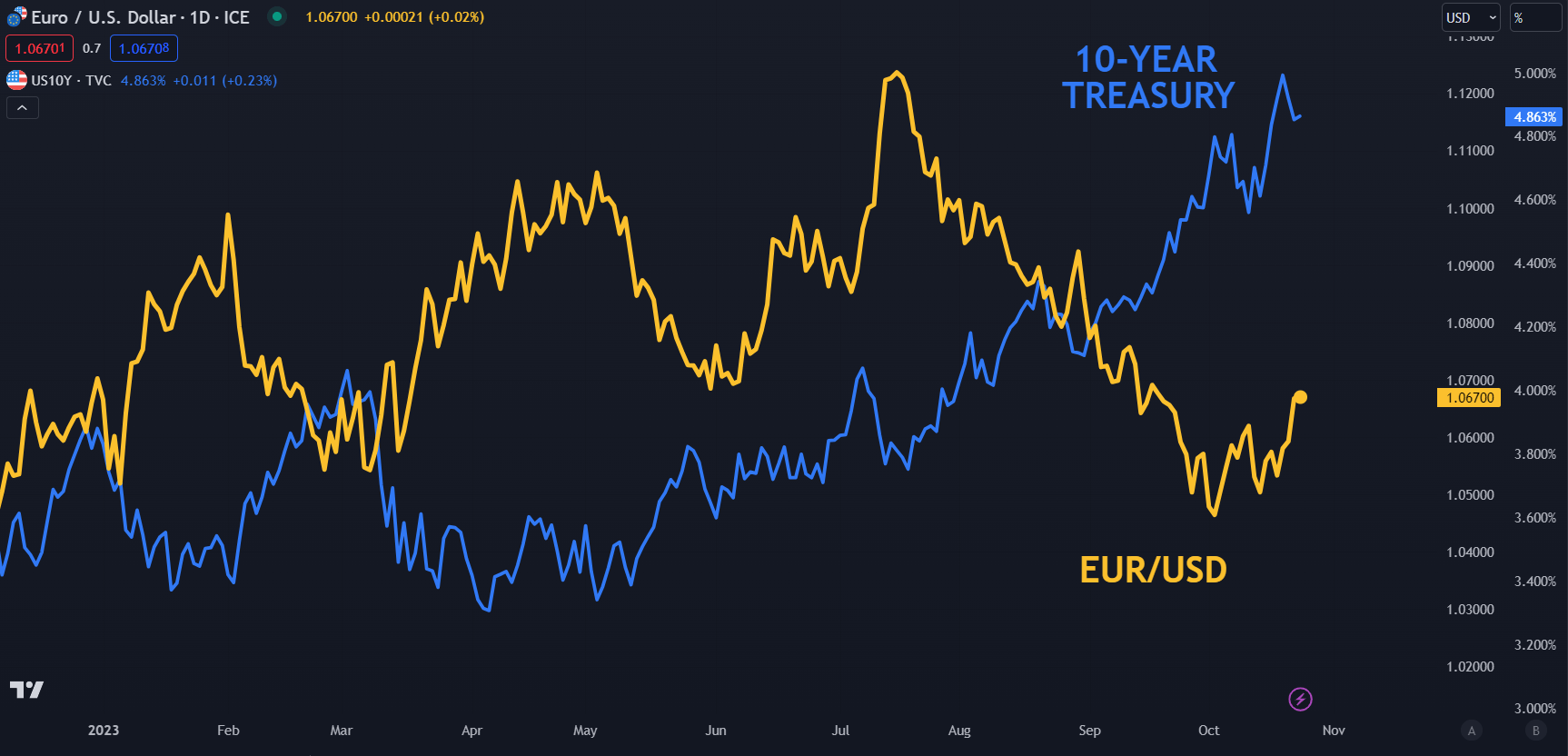

The context for EUR/USD is the possibility that Treasury yields might have peaked, particularly for the benchmark 10-year note. Time will tell if the ‘Bills’ are correct or otherwise.

EUR/USD AND 10-YEAR TREASURY YIELDS – AN INVERSE RELATIONSHIP AT TIMES

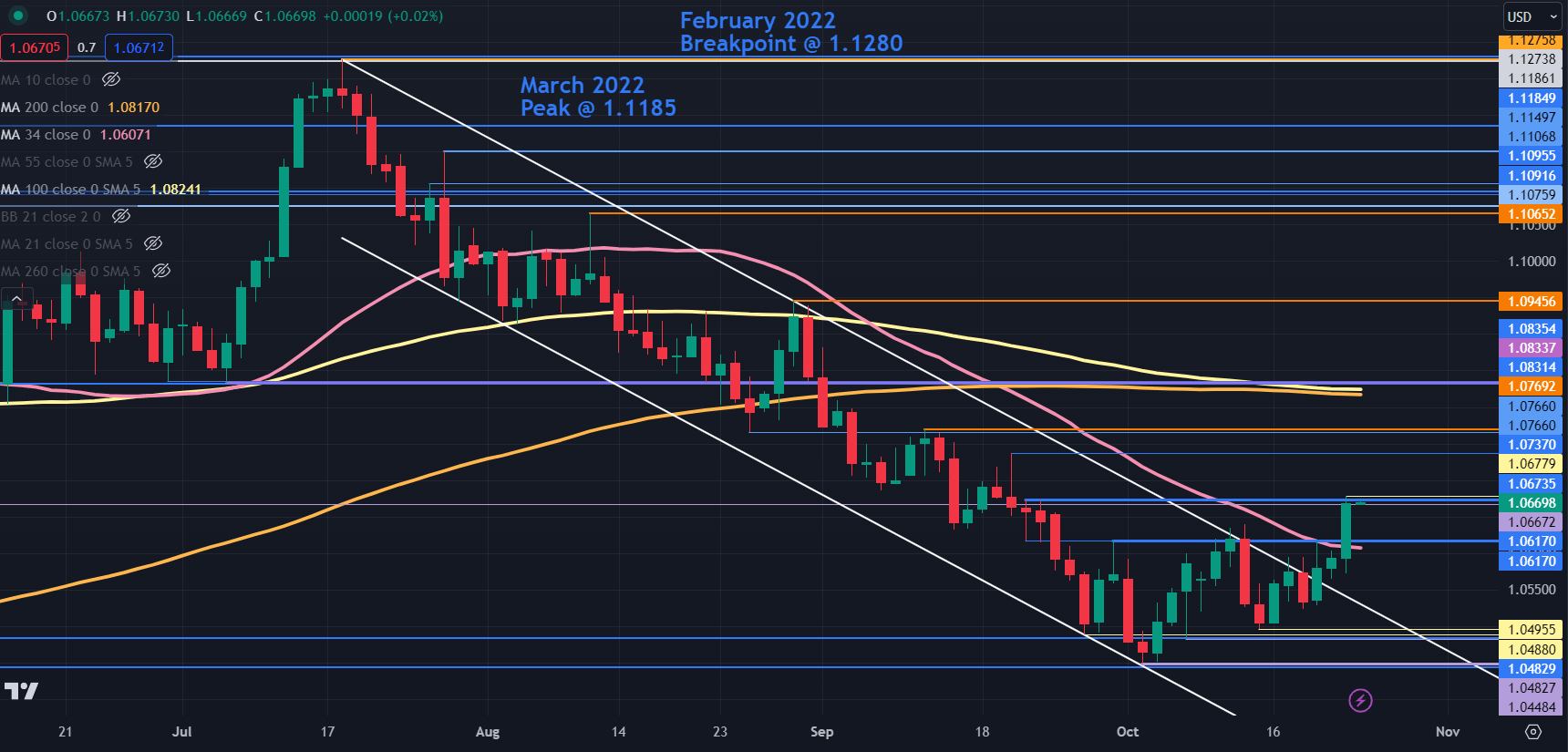

EUR/USD TECHNICAL ANALYSIS UPDATE

EUR/USD cleanly broke through the topside of a descending trend channel last Thursday and continued higher before pausing at minor resistance levels near 1.0680 today. To learn more about breakout trading, click on the banner below.

The next resistance levels could be at the breakpoints and previous highs near 1.0740, 1.0770, 1.0835 and 1.0945 ahead of a cluster zone of potential resistance in the 1.1075 – 1.1100 area.

The 100- and 200-day simple moving averages (SMA) are both near 1.0825 and may offer resistance.

On the downside, nearby support might lie near the breakpoint at 1.0617 which also has the 34-day SMA just below, potentially lending support.

Further down, a series of breakpoints and prior lows in the 1.0480 – 1.0495 area might provide a support zone. Below there, the lows of early 2023, which were tested at the start of this month, may provide support near 1.0440 levels of note.

EUR/USD DAILY CHART

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter