EUR/USD Forecast - Prices, Charts, and Analysis

Download our Brand New Q1 2024 Euro Technical and Fundamental Forecast

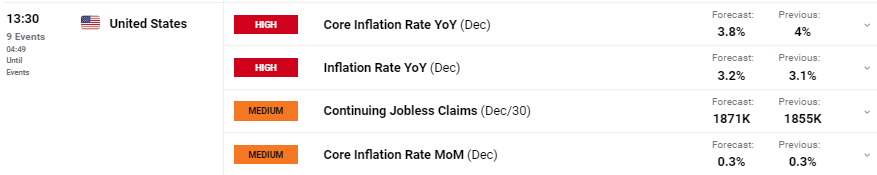

The main economic release of the week, US CPI, will hit the screens today at 13:30 UK and will likely spur a round of volatility in what has been a quiet FX market so far this year. Headline inflation (y/y), currently at a five-month low, is seen ticking up by 0.1% to 3.2% on stubborn energy prices, while core inflation (y/y) is seen falling to 3.8% from 4.0% in November.

For all market-moving events and data releases, see the real-time DailyFX Calendar

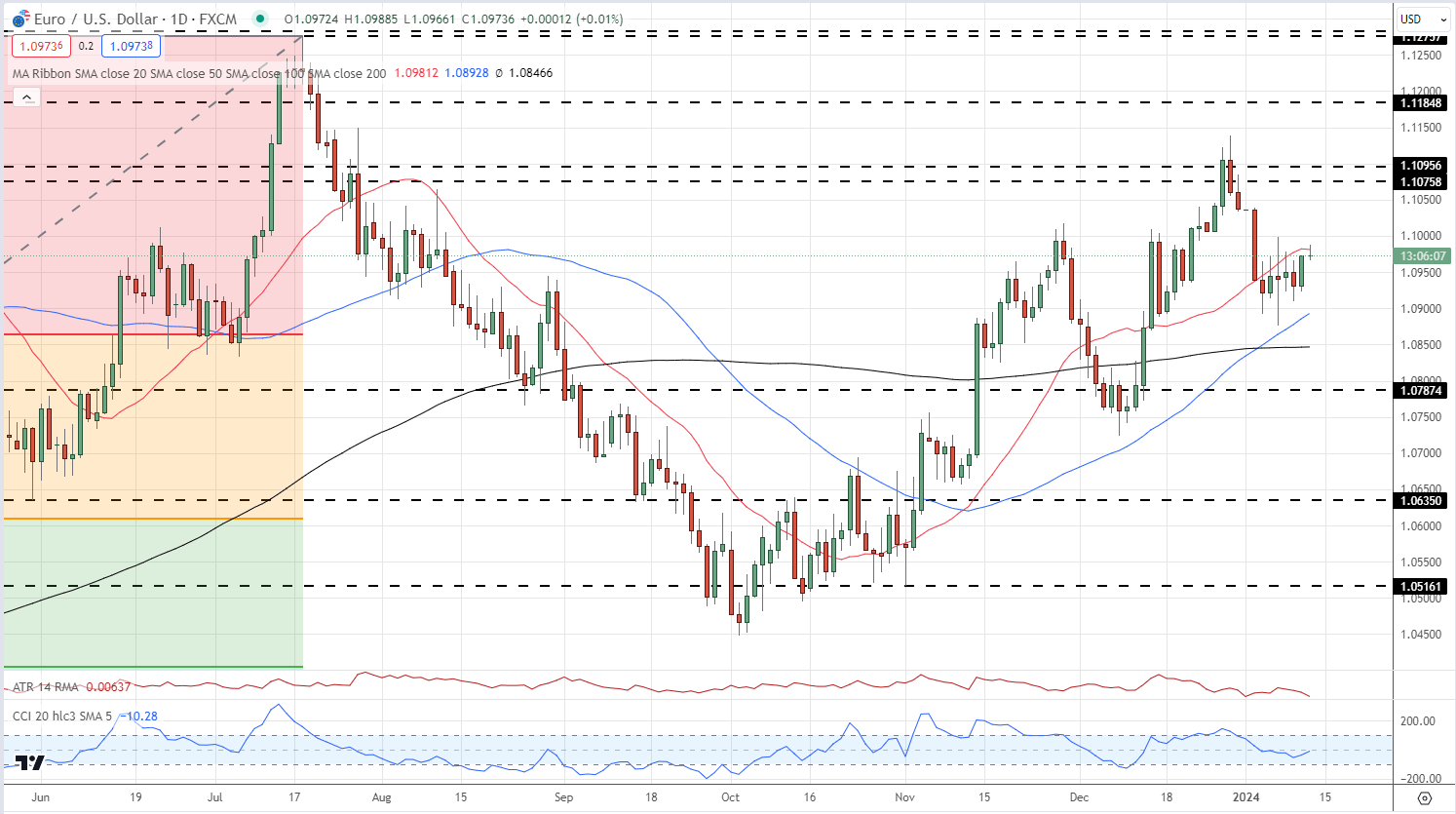

EUR/USD is trying to push higher ahead of the US data. The daily chart shows that a series of higher lows and higher highs that started in early October remains in place, with a trade above the December 28th high at 1.1138 needed to keep the trend going. The early January Golden Cross is providing support while the CCI indicator sits in neutral territory. EUR/USD needs to make a confirmed break above the 20-day simple moving average, currently at 1.0981, to keep pressing higher towards the 1.1075-1.1100 zone.

EUR/USD Daily Chart

Chart Using TradingView

IG retail trader data show 43.22% of traders are net-long with the ratio of traders short to long at 1.31 to 1.The number of traders net-long is 12.07% lower than yesterday and 15.16% lower than last week, while the number of traders net-short is 10.15% higher than yesterday and 19.62% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

To See What This Means for EUR/USD, Download the Full Report Below

| Change in | Longs | Shorts | OI |

| Daily | -19% | -10% | -14% |

| Weekly | -24% | 26% | -3% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.