Euro (EUR/USD, EUR/GBP, EUR/JPY) Analysis

- EUR/USD bearish continuation underway as the dollar hits its stride

- EUR/GBP shows early signs of longer-term bearish continuation

- EUR/JPY takes advantage of a depreciating yen

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

ECB Minutes Stress Progress on Wages a Prerequisite for 2% Target

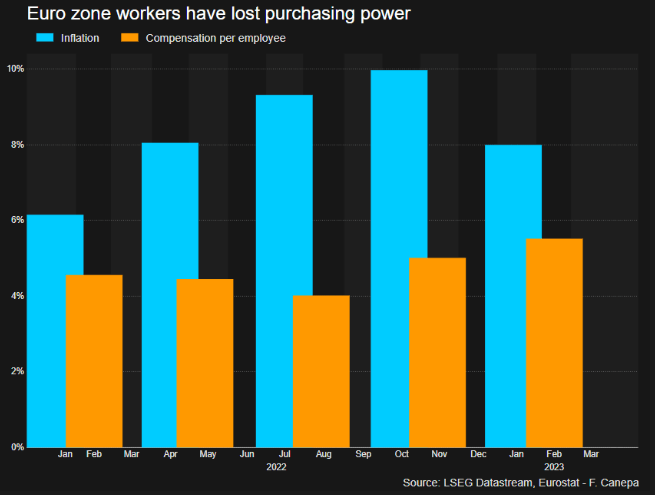

The ECB minutes relating to the mid-December ECB meeting continued to warn against complacency as sticky price pressures can jeopardise reaching the 2% target before 2026. One of the chief concerns for the ECB has emerged via wages and the prospect of labour unions lobbying for higher wages in 2024 after seeing declines in real wages in 2022 and 2023. Higher labour costs run the risk that firms pass on the increased expense to the end consumer, potentially stoking price pressures further.

Customize and filter live economic data via our DailyFX economic calendar

The chart below portrays how inflation has been outpacing wage growth in Europe but the gap is becoming smaller as disinflation takes hold and nominal wages have been on the rise.

The ECB minutes also revealed that some Governing Council members preferred to end full reinvestments of PEPP (the central bank’s version of QE) earlier than agreed but otherwise consensus was achieved among the group.

EU Wage Growth vs Inflation

Source: Refinitiv, LSEG, prepared by Richard Snow

EUR/USD Bearish Continuation Underway as the Dollar Hits its Stride

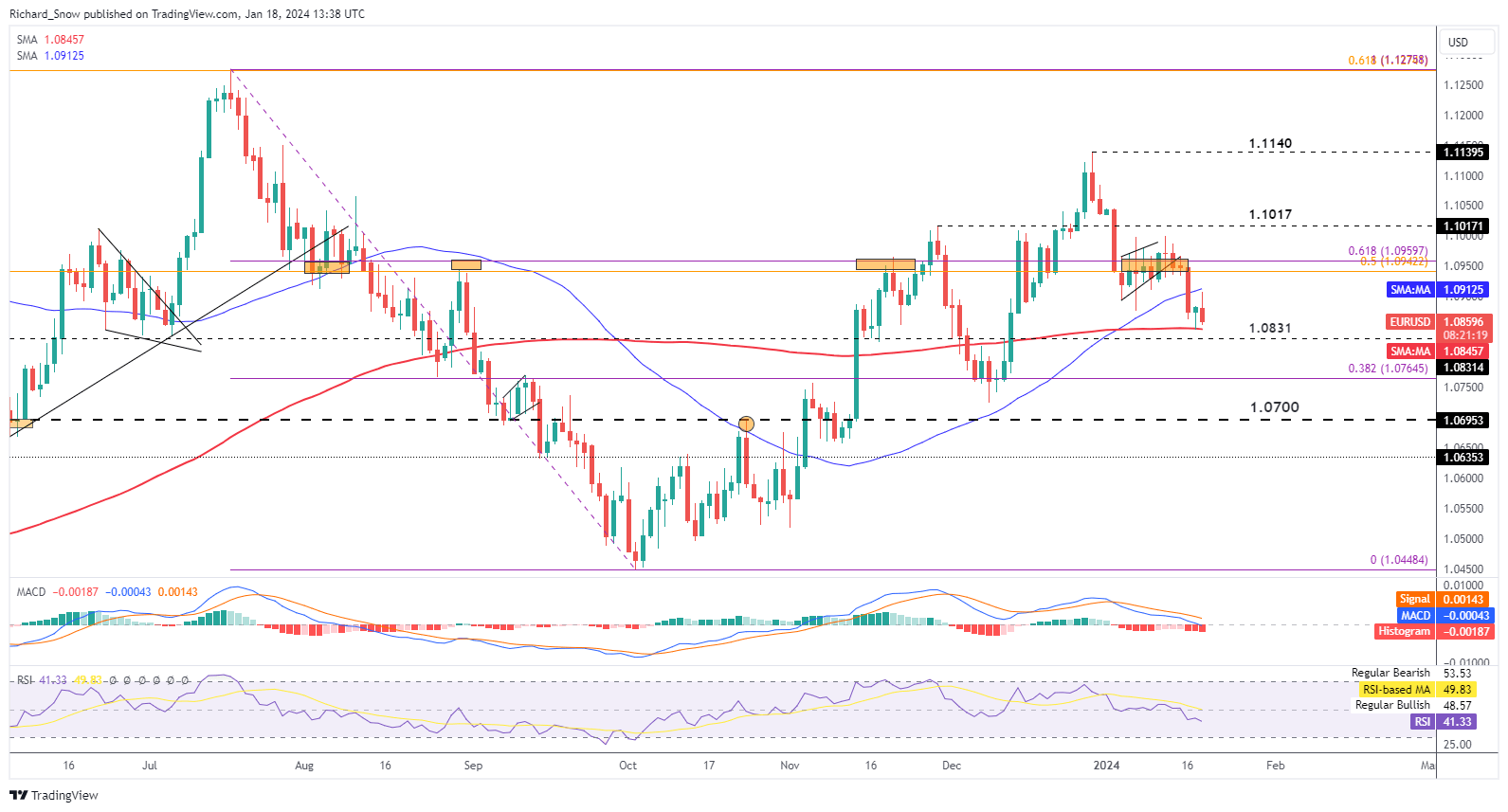

Better-than-expected US retail sales and the global uptick in inflation has necessitated adjustments to the timing and magnitude of expected interest rate cuts this year. With markets having tapered aggressive rate cut expectations, the dollar emerged as one of the standout beneficiaries, weighing on EUR/USD.

On Tuesday, the pair broke out of what was a frustrating period of consolidation, trading below the 50-day SMA. Today, the pair now tests the 200-day simple moving average (SMA), followed closely by 1.0831. Momentum appears to favour the downside when observing the MACD indicator. Stagnant growth in Europe continues to weigh on the Euro while the US economy remains relatively well positioned in this regard but growth is expected to ease further.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

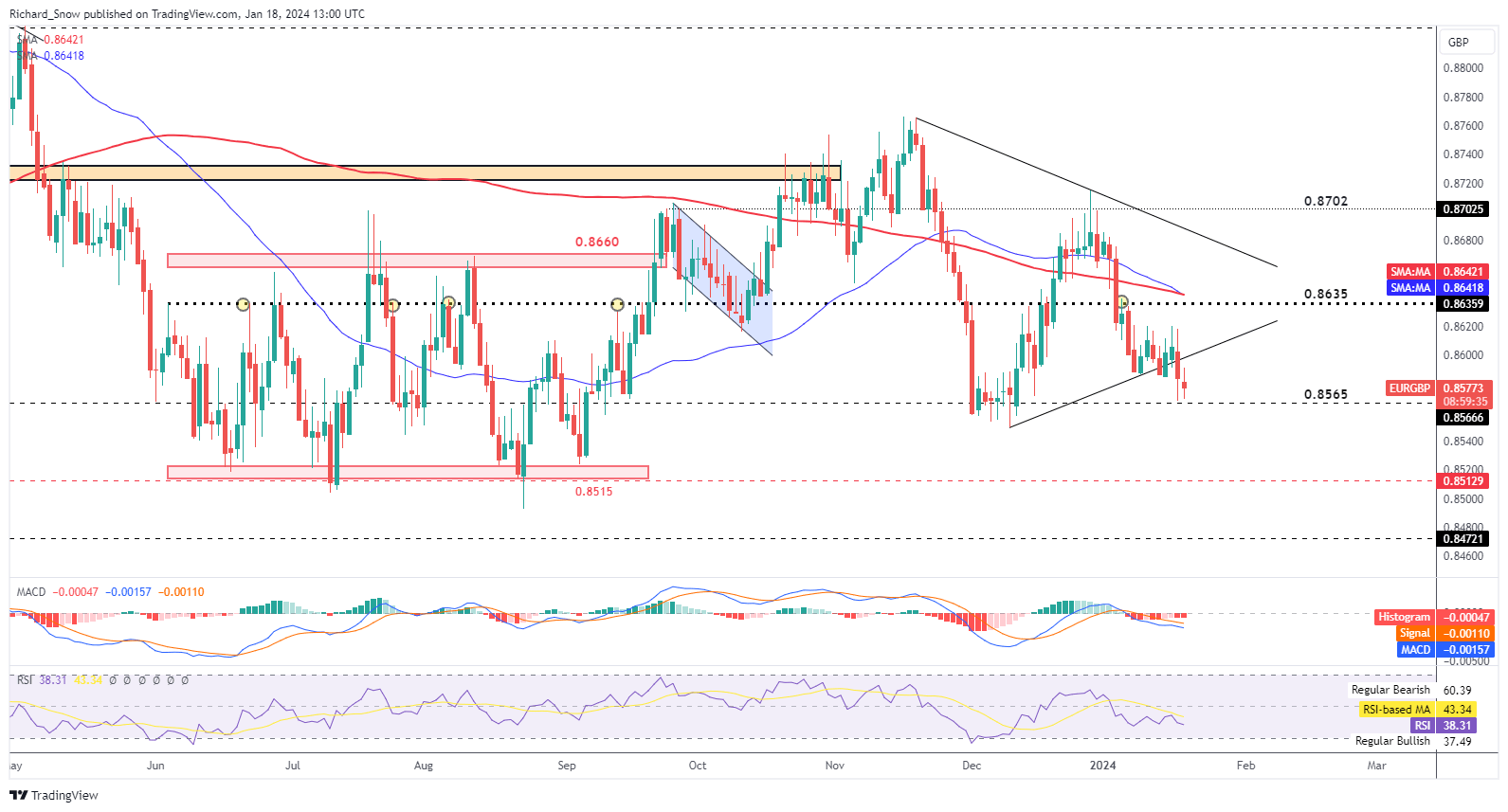

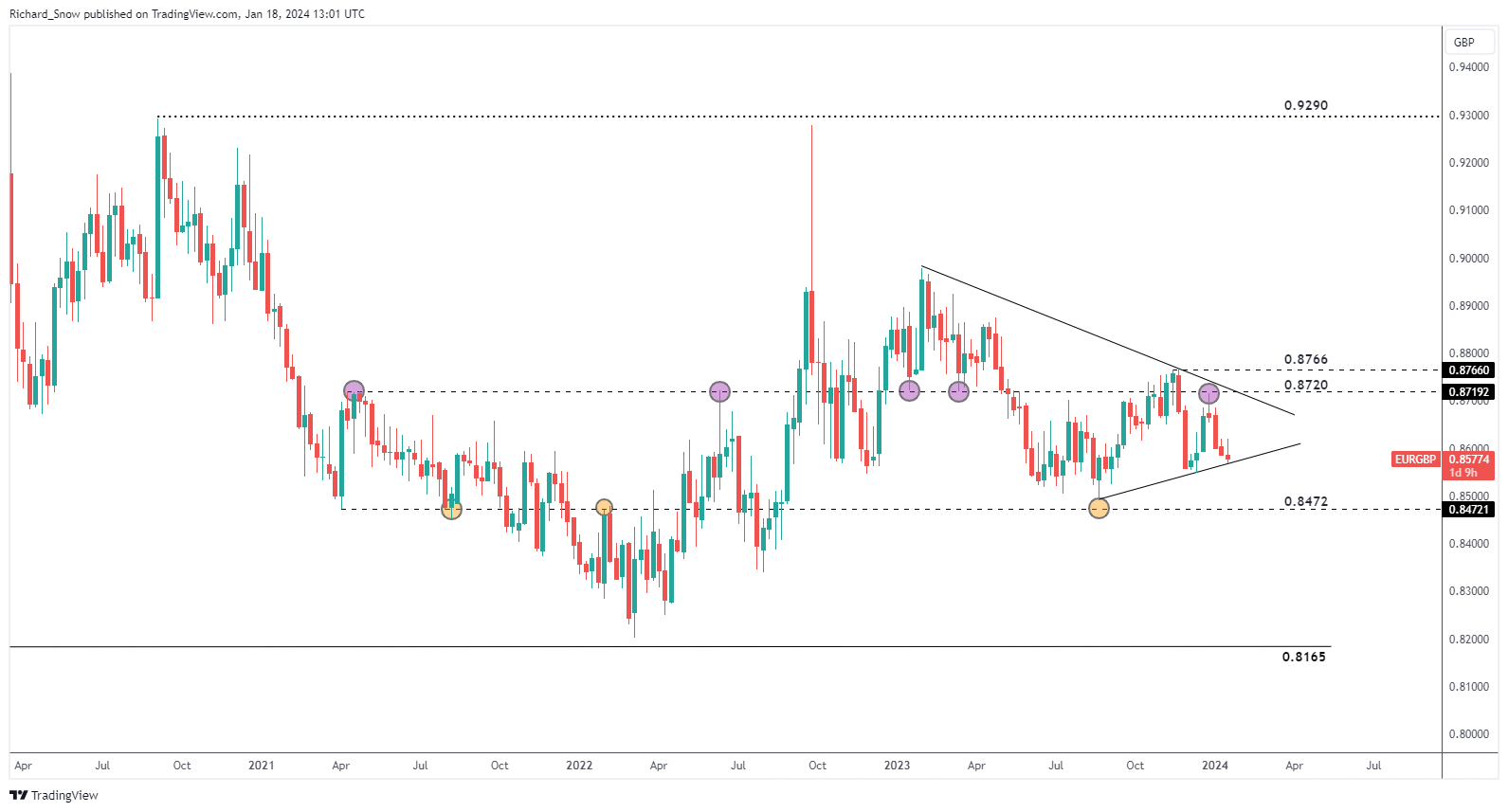

EUR/GBP Shows Early Signs of Longer-Term Bearish Continuation

EUR/GBP on the daily chart reveals a desire to trade lower after breaking out of the narrowing triangle pattern, currently testing 0.8565, with 0.8515 the next significant level of support. Previous guidance looked to the more prominent dotted line at 0.8635 for signs of bullish intent – something that has not been confirmed and in fact, prices are notably lower since.

Recent, elevated UK inflation data has helped prop up the value of sterling which provided the main catalyst for the move to the downside in EUR/GBP. Prices continue to trade below the 50 and 200-day SMA, something that is typically observed in down trending markets.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

The weekly EUR/GBP chart currently holds its triangle pattern but trendline support has come under pressure this week. Taking a zoomed out look at the pair, the 0.8472 marker provides a possible level of interest if a bearish move were to extend over the medium-term.

EUR/GBP Weekly Chart

Source: TradingView, prepared by Richard Snow

Elevate your trading skills and gain a competitive edge. Get your hands on the Euro Q1 forecast today for exclusive insights into key market catalysts that should be on every trader's radar:

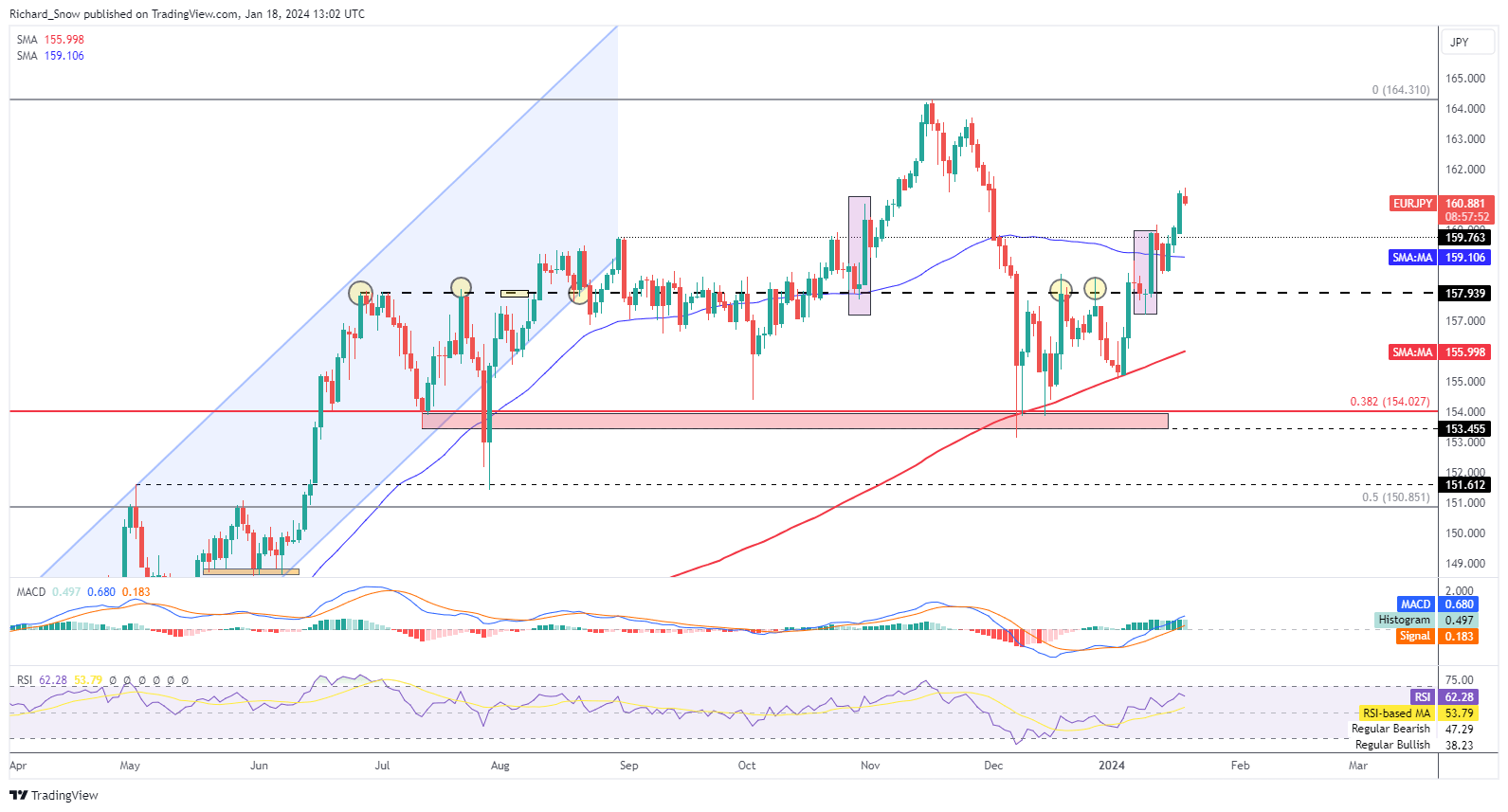

EUR/JPY Takes Advantage of a Depreciating Yen

EUR/JPY unlike the prior two chart setups, reveals bullish momentum. The pair trades slightly lower today but price action in the first month of the year has revealed great bullish potential.

While prices are lower today thus far, prior pullbacks in 2024 had proven to be short-lived, setting up the potential for a move towards 164.31 – the prior swing high in November of last year. The RSI is getting close to breaching overbought territory meaning it may be prudent to wait for a pullback followed by more upward momentum before considering bullish EUR/JPY plays

GBP/JPY Weekly Chart

Source: TradingView, prepared by Richard Snow

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX