GBP/USD Analysis and Chart

- UK data helping to underpin Sterling.

- US dollar nudging lower but bond yields remain near multi-year highs.

Download the Brand New British Pound Q4 Guide Below

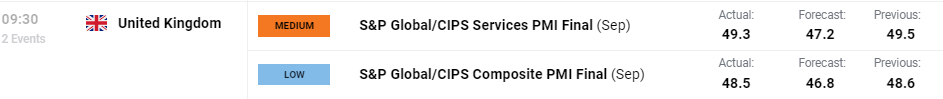

The final UK S&P services and composite readings for September beat original forecasts and came roughly in line with August’s readings. The accompanying report however underlined the weakness of the service sector despite beating original forecasts.

According to Tim Moore, economics director at S&P Global Market Intelligence, ‘"Service sector activity remained on a negative trajectory in September as cutbacks to non-essential business and consumer spending weighed on sales volumes. Although only modest and slower than indicated by the earlier 'flash' PMI reading, the downturn in UK service sector output was the greatest seen since the beginning of this year and stood in contrast to solid growth during the spring months.’

Sticking with data releases, the latest US ADP employment report missed expectations. The September report showed ‘the slowest pace of growth since January 2021, when private employers shed jobs’. Private employers added 89k jobs in September, missing expectations of +153k and August’s outturn of +177k.

The US dollar turned marginally lower after the ADP report but remains at elevated levels. US bond yields are at, or are within touching distance, of multi-year highs with the 10-year benchmark now offered at 4.76%, while the 30-year-long bond is trading with a yield of 4.88%.

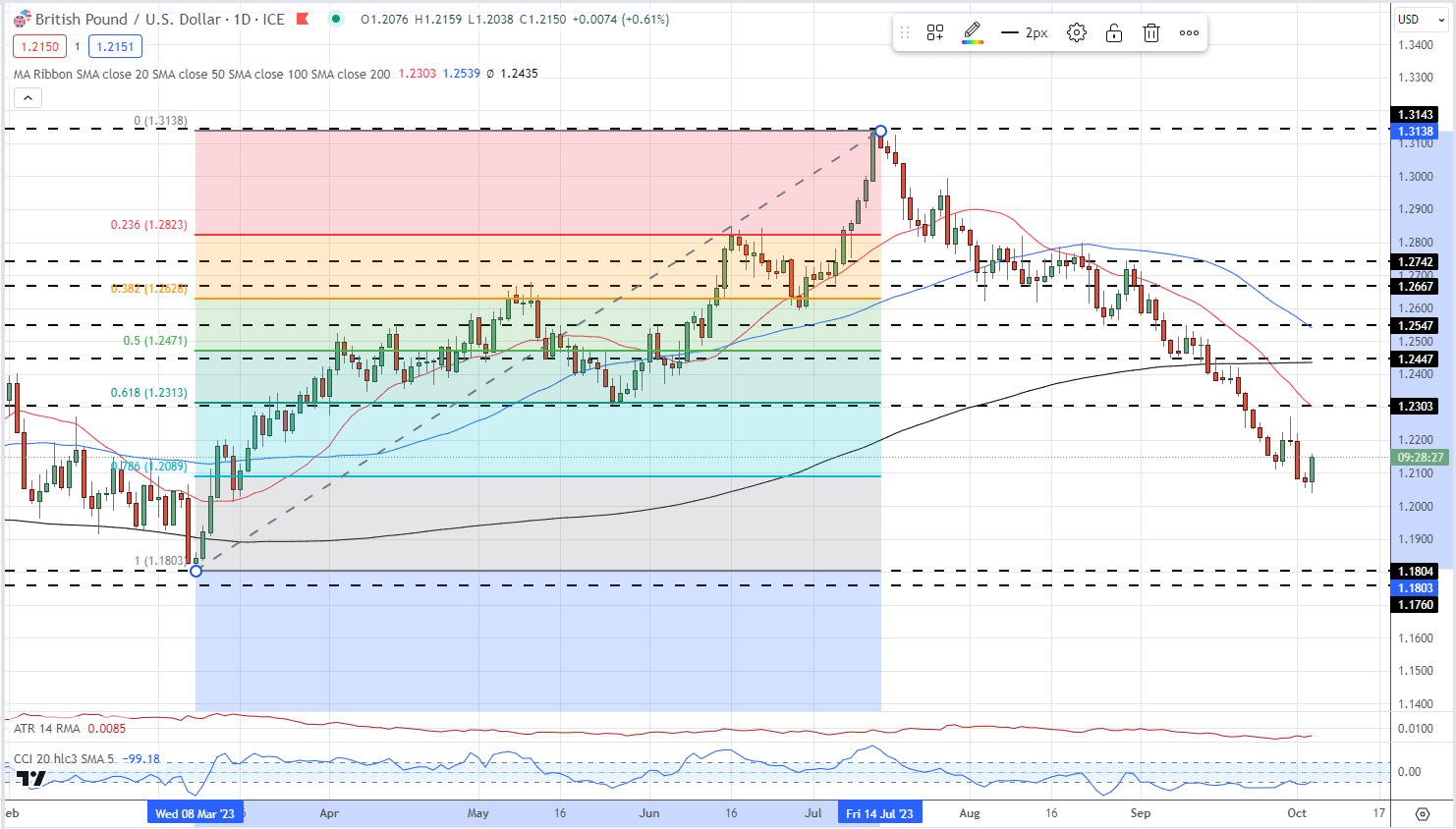

GBP/USD traded as low as 1.2040 earlier but a combination of better-than-expected UK data and weaker-than-expected US data has seen the pair move back to 1.2150. The technical outlook remains weak however with the pair trapped in a strong downtrend. Cable remains below all three moving averages and continues to print lower highs and lower lows. The 78.6% Fibonacci retracement of the mid-March to mid-July move at 1.2089 has not been broken convincingly and so may hold in the coming days. Below here there is an air pocket down to 1.1804.

Friday’s US NFP report (13:30 UK) will be the next driver of the pair going into the weekend.

For all market-moving economic data and events, see the DailyFX Calendar

GBP/USD Daily Price Chart

See How GBP/USD Traders are Currently Positioned

| Change in | Longs | Shorts | OI |

| Daily | 10% | 6% | 7% |

| Weekly | -31% | 38% | 0% |

Charts using TradingView

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.