Pound Sterling (GBP/USD) Talking Points:

- GBP/USD has slipped back after two days of gains

- The prospect of higher US interest rates for longer continues to dominate

- Some as-expected US jobless claim data saw Sterling losses deepen

The British Pound made initial gains against the United States Dollar in Thursday’s European session, but it pared them through the morning and was in the red as US markets wound up.

Sterling was perhaps still boosted early by Wednesday’s news that UK house prices rose at the fastest pace since January last year in December, and also by a general improvement in risk appetite which has seen the Dollar pare gains against many major rivals.

However, news that US initial and continuing jobless claims data had come in more or less as expected saw the greenback extend its lead. Initial claims totaled 218,000 in the week to February 3, just below the 220,000 economists expected. Continuing claims in the week of January 27 were 1,871,000, just below the 1,878,000 predicted. There was nothing here to suggest that US interest rates will be coming down any sooner than the May Federal Reserve policy meeting markets tentatively have in mind.

There’s no first-tier economic data from either the US or UK left this week, which will probably leave GBP/USD at the mercy of the various central bank speakers remaining on the calendar. Richmond Fed President Tom Barkin will speak after the European close on Thursday. He has already said this week that it ‘makes sense’ to be patient in cutting interest rates, and to wait and be sure that inflation is tamed. In this he echoed Chair Jerome Powell’s comments of last week, which so supported the Dollar.

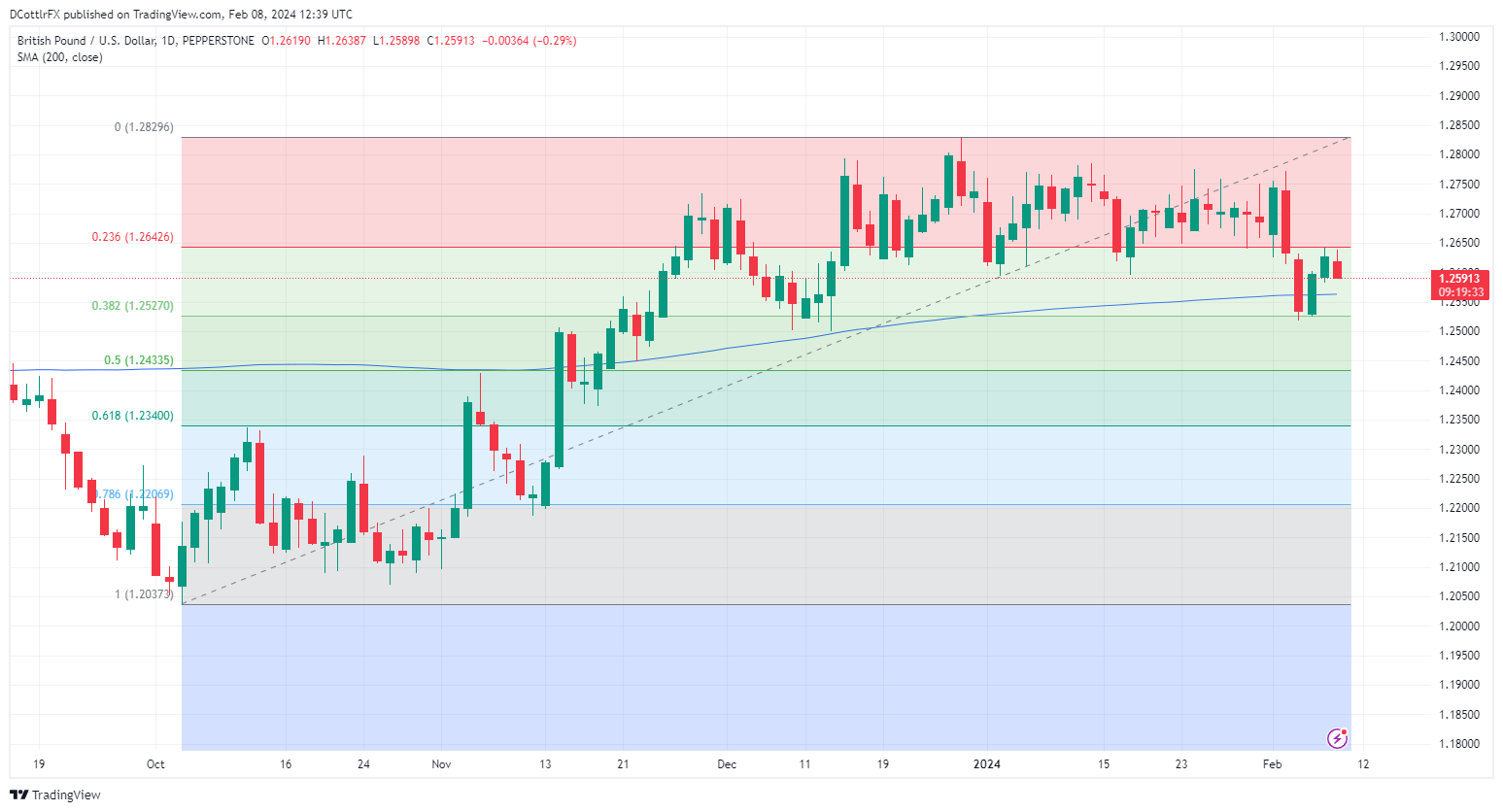

GBP/USD Technical Analysis

GBP/USD Daily Chart Compiled Using TradingView

Trading is a discipline fraught with challenges that can take its toll after a while. Sometimes a bit of perspective and self-reflection is needed in order to regain your confidence:

GBP/USD was hammered down into a lower trading range by last week’s Fed-inspired bout of wide Dollar strength.

It’s now stuck between the first and second Fibonacci retracements of the rise from October’s low to the four-month peak of December 29. They are 1.284246 and 1.2570, respectively.

A fall though that lower bound could presage deeper falls as Sterling would then be back to levels not seen since late November last year, and with November 14’s low of 1.21851 in focus.

GBP/USD did fall briefly below its important 200-day moving average last week, the first time it’s been below there since November 21. However, it has recovered some composure above that level in the last couple of sessions. The average now offers support at 1.2557.

IG’s own sentiment data finds traders very bearish on the Pound’s chances, with fully 75% coming at GBP/USD from the short side. This is quite extreme and might argue for a contrarian, bullish play.

The uncommitted may want to wait and see whether the pair can remain within its current trading range into the week’s end, with the direction of any break likely instructive.

--By David Cottle For DailyFX