Japanese Yen Technical Analysis Talking Points:

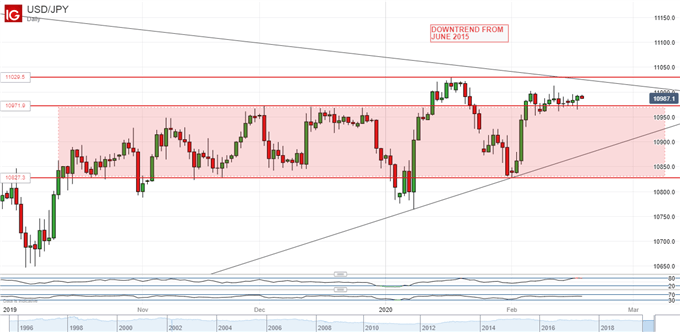

- USD/JPY gains have stalled just below an important long-term downtrend line

- Given its confluence with a near-term range top, disinclination to push on may be understandable

- EUR/JPY is much more clearly on the slide

The Japanese Yen remains clearly on the back foot against the US Dollar, but USD/JPY’s rise has stalled somewhat in the last two weeks.

The pair is currently stuck around the top of a broad trading band which the market has been reluctant to abandon for very long in either direction since mid-October 2019.

Market action around that level has been maddeningly inconclusive and characterized by quite narrow daily ranges since February 9.

Clearly there’s no great profit-taking impulse on the part of Dollar buyers. However, by the same token there also appears to be no great appetite to push on even as far as the previous significant peak. That’s January 17’s intraday top of 110.30.

The proximity of an important longer-term trendline may well be capping Dollar bulls’ exuberance now. A challenge to that January peak would take the Dollar above that line which has capped the market since June 2015.

Still, USD/JPY still looks quite well supported, its current uptrend line is a very long way south of the market and support within that broad trading band looks solid. At present that longer term trend line does look set for a challenge within the next coupe of weeks and it will be fascinating to see whether or not Dollar bulls can make it stick.

| Change in | Longs | Shorts | OI |

| Daily | 4% | -7% | -4% |

| Weekly | 93% | -36% | -19% |

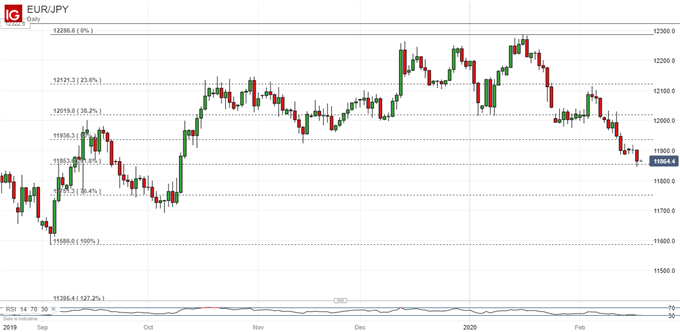

EUR/JPY Heads Still Lower

Fundamentally speaking both the Japanese Yen and US Dollar are locked in a ‘battle of the havens,’ Both have gained as investors have moved into what they hope will be safer assets in the face of the coronavirus spread out of China. Meanwhile the Euro finds itself on the other side of that trade, still shunned as a growth-correlated currency,

EUR/JPY is in consequence down to lows not seen since early October. The cross has slipped below the third, 50% Fibonacci retracement of the rise from last September’s lows to this year’s peaks.

The 61.8% retracement is now close to the market at 118.53, with full retracement now a real possibility. That would imply a slide back down to 115.86. While that may well come unless global risk appetite gets a sustainable lift, the Euro does look unsurprisingly oversold and some consolidation is very likely. Whrther it takes place above or below that 61.8% retracement line could be instructive.

Japanese Yen Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!

https://www.dailyfx.com/free_guide-tg.html?ref-author=Cottle.