Can CAD strength continue? See our forecast to find out what is driving market trends!

Talking Points:

- USD/CAD technical strategy: remaining short below 1.3545 on closing basis

- 3-Wave move higher to 200-DMA favors medium-term focus lower

- Canadian Dollar Adds To Gains Ahead of Central Bank Filled Week

The Canadian Dollar strength had caught a lot of people by surprise given the drop in Oil to the lowest levels since August this week. The jolt higher in CAD (lower USD/CAD) was brought about by a double-punch of hawkishness from Bank of Canada members Wilkins that was stamped by Governor Poloz who said that prior rate cuts had “done their job,” to support the economy in terms of an Oil breakdown. On Thursday, traders got confirmation of a stable and growing Canadian economy with retail shows showing the sector is off to the strongest start since 1991 per Bloomberg. Given the recent Bear Market in Crude Oil from 2017 highs, the timing of the comment was appropriate. Poloz would go on to say, “The economy is gathering momentum, and not just in certain spots but across a much wider array.” To get a sense of whether or not Poloz’s confidence is well-placed, traders will be keeping an eye on Friday’s CPI print in Canada, which could put pressure on the Bank of Canada to raise rates should we see an upside surprise.

The technical question is whether we’re seeing a retracement in the works or whether we recently saw a base in USD/CAD on the move to 1.3165 ahead of the Federal Reserve rate hike on June 14. I favor the former as a base would likely be confirmed much higher given that we’re still below 1.616% extension in a third-wave move higher and the spread between US2/CA2 yr yields are condensing.

The defining resistance levels that would favor the idea of a base being formed, and my trade being wrong would be on a move above 1.3434, which is the opening range low for June followed by a break above the Opening Range high at 1.3547. Lower resistance can be found at 1.3340, which is the 200-DMA and 100% extension of the first leg off the June 13 low.

If the price remains below 1.3434, the market remains ready to see if the aggressive move lower from the May 5 high of 1.3793 is a sign of things to come. If so, we could be working on an extension of the January-May move lower from 1.46-1.2460 that could take the price of USD/CAD well-below 1.3000.

Join Tyler at his Daily Closing Bell webinars at 3 pm ET to discuss key market developments.

Chart Created by Tyler Yell, CMT

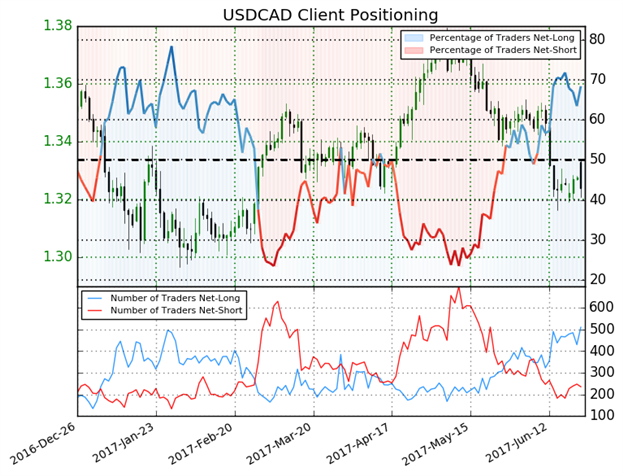

USD/CAD Insight from IG Client Positioning: Rise in Bulls could precede breakdown

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

USDCAD: Retail trader data shows 68.4% of traders are net-long with the ratio of traders long to short at 2.16 to 1. In fact, traders have remained net-long since Jun 07 when USDCAD traded near 1.34474; price has moved 1.5% lower since then. The number of traders net-long is 7.6% higher than yesterday and 0.8% lower from last week, while the number of traders net-short is 15.7% lower than yesterday and 22.3% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDCAD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USDCAD trading bias.(Emphasis mine)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell