Market sentiment analysis:

- Trader confidence remains high, with strong corporate earnings among the factors helping stocks at the expense of safe-haven assets like the US Dollar.

- These trends look set to continue near-term over a week dominated by central bank meetings.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Trader confidence high

Trader confidence remains at elevated levels thanks to strong corporate earnings and a variety of other factors such as US/China economic and trade talks, and Iran/EU discussions on reviving the nuclear deal previously in place.

Those trends will likely remain in place near term over a week dominated by central bank meetings in the EU, Japan and Canada, with the S&P 500, for example, looking strong after the recent consolidation.

S&P 500 Price Chart, Daily Timeframe (May 18 – October 26, 2021)

Chart by IG (You can click on it for a larger image)

Bearish signal for AUD/JPY

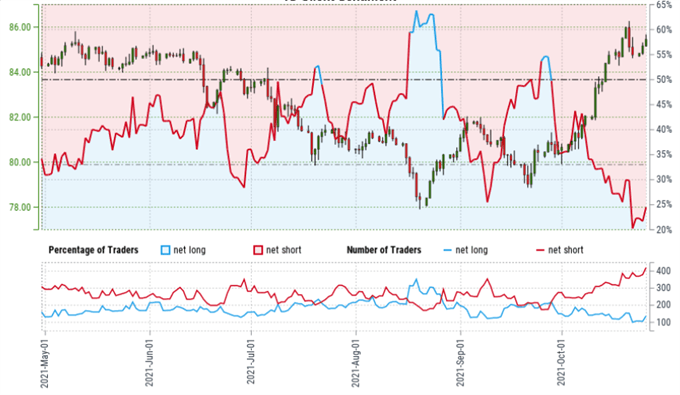

In the meantime, IG client positioning data are sending out a bearish signal for AUD/JPY. The retail trader numbers show 30.25% of traders are net-long, with the ratio of traders short to long at 2.31 to 1. The number of traders net-long is 61.90% higher than yesterday and 17.24% higher than last week, while the number of traders net-short is 4.39% lower than yesterday and 10.73% higher than last week.

Here at DailyFX, we typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/JPY prices may continue to rise.Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current AUD/JPY price trend may soon move lower despite the fact traders remain net-short.

AUD/JPY Client Positioning – IG Client Sentiment

Source: IG/DailyFX

In this webinar, I looked at the trends in the major currency, commodity and stock markets, at the forward-looking data on the economic calendar this week, at the IG Client Sentiment page on the DailyFX website, and at the IG Client Sentiment reports that accompany it.

--- Written by Martin Essex, Analyst

Feel free to contact me on Twitter @MartinSEssex