USD/JPY ANALYSIS

- BoJ monetary policy meeting minutes

- Dollar strength nets off with Yen safe-haven appeal

- IG Client Sentiment (IGCS) remains bearish

USD/JPY FUNDAMENTAL BACKDROP

Minutes from the Bank of Japan (BoJ) meeting yesterday saw policymakers appealing for greater adaptability around the purchasing of Exchange-Traded Funds (ETFs) and risky assets. This comes after the persisting COVID-19 pandemic which has and will likely continue to cause a slowdown in Japans stimulus initiative.

Yesterday the Dollar gained significantly on the U.S. Dollar Index (DXY) due to concerns over the size speed of the U.S. stimulus package as well as the global COVID-19 pandemic. This resulted in traders flocking under the protection of the greenback though this had minimal effect on the USD/JPY pair as the Yen serves as a safe-haven currency as well; which ultimately limited upside.

Markets around the world are reacting to U.S. stimulus and COVID-19 recovery optimism which has recently been halted. The prolonging nature of these two factors are now reflecting in markets as financial assets brace for one of the two to give way for some directional bias. It is likely that large price swings will be follow across different financial assets classes including the USD/JPY pair.

USD/JPY TECHNICAL ANALYSIS

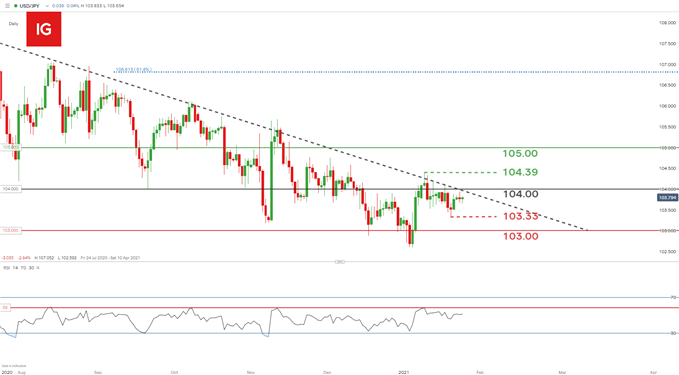

USD/JPY Daily Chart:

Chart prepared by Warren Venketas, IG

Despite yesterdays Dollar strength, price action on USD/JPY still conforms to the overall downtrend and remains below diagonal resistance (dashed black line). Since December 2020, the pair has waded between the 103.00 and 104.00 psychological levels while respective of the aforementioned trendline resistance. This is expected to continue in the medium-term but is highly dependent on fundamental factors.

The Relative Strength Index (RSI) 59 level endures as synchronized resistance with the downtrend and should be monitored as price approaches resistance. A confirmed break above will see the 104.00 level as initial resistance, succeeded by the 104.39 2021 swing high.

The more probable downward outlook may entail further upside in the short-term followed by a push down off trendline resistance toward last week’s support swing low at 103.33 followed by 103.00.

Key technical points to consider:

- USD/JPY: Long-term trendline resistance

- RSI 59 level

- U.S. Dollar price fluctuations around U.S. stimulus doubts

ATTENTION ON U.S. ECONOMIC DATA THIS WEEK

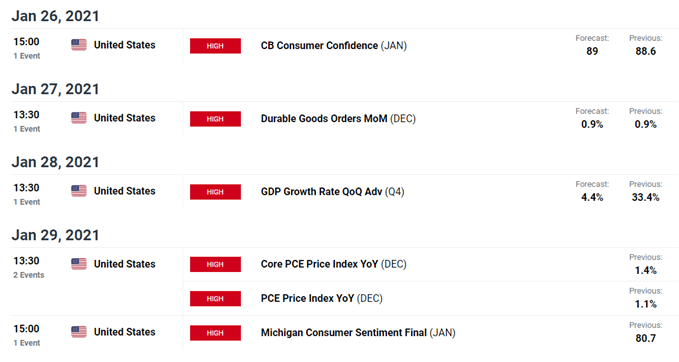

U.S. announcements will provide most of the potential USD/JPY price volatility for next week. Several key economic indicator statistics will be revealed which could lead to large price swings depending on estimate deviations.

Source: DailyFX Economic Calendar

IG CLIENT SENTIMENT SUPPORTIVE OF YEN BULLS

| Change in | Longs | Shorts | OI |

| Daily | 4% | -7% | -4% |

| Weekly | 93% | -36% | -19% |

IGCS shows retail traders are currently net long on USD/JPY, with 59% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment, and the fact traders are net-long is suggestive of a bearish bias on the pair.

--- Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter: @WVenketas