- U.S . Dollar strength may have been short lived

- Global economic rebound may benefit Yen going forward

- IG Client Sentiment (IGCS) remains bullish

USD/JPY FUNDAMENTAL BACKDROP

Yesterday Federal Chair Jerome Powell maintained their accommodative outlook in an interview with Princeton University, which has since put a dampener on recent greenback strength. Simply put, the sustained weakening of the U.S. Dollar throughout 2020 may well continue further into 2021 due to additional currency supply. This ultimately weighs negatively on the U.S Dollar and will likely favor the safe-haven Yen. As mentioned in my previous article, rising US Treasury yields may soften the Dollar downside however, the combination of a global recovery and further stimulus may suppress any sort of Dollar recovery.

Japan has witnessed mass inflows (foreign and domestic) in both stocks and bonds. Local investors are also favoring local investments as opposed to foreign portfolios which has had a positive impact on the Nikkei 225 index as well as mixed backing of the USD/JPY pair as hedging supports further upside while the influx into Japanese bonds should theoretically drive demand for the local currency.

USD/JPY TECHNICAL ANALYSIS

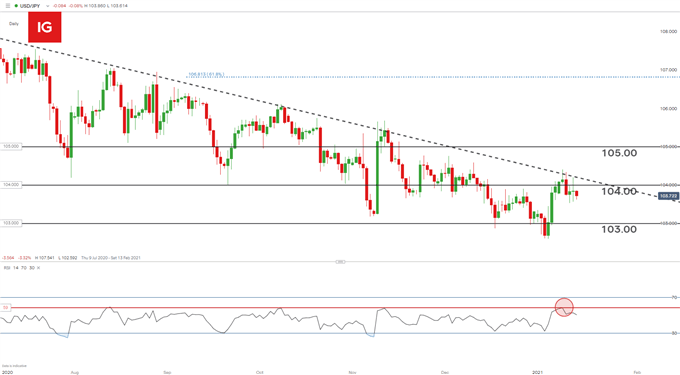

USD/JPY Daily Chart:

Chart prepared by Warren Venketas, IG

The USD/JPY daily chart shows a clear price rejection at diagonal resistance (dashed black line), indicated by long upper wicks. Yesterday’s Doji candlestick pattern is suggestive of uncertainty by the market which is representative of current global conditions. The Relative Strength Index (RSI) has once again used the long-term 59 resistance level (red) as a benchmark for a cap on further upside. The 103.00 psychological level will be the next area of support for bears which may take some time to get to but with the Dollar under pressure once more, the medium-term outlook for USD/JPY may be leaning toward further downside.

KEY JAPANESE ECONOMIC DATA SCHEDULED NEXT WEEK

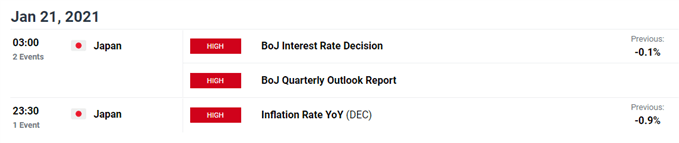

The Bank of Japan (BoJ) is set to announce their interest rate decision next week (see calendar below) which may provide significant price fluctuations. A policy alteration could surprise markets but consensus is that the BoJ will remain under its current easy monetary policy.

Source: DailyFX Economic Calendar

Key points to consider:

IG CLIENT SENTIMENT SUPPORTIVE OF ADDITIONAL DOLLAR STRENGTH

| Change in | Longs | Shorts | OI |

| Daily | -14% | 1% | -3% |

| Weekly | -12% | -7% | -9% |

IGCS shows retail traders are currently net long on USD/JPY, with 55% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment, and the fact traders are net-long is suggestive of a bearish bias on the pair however, due to a higher net change in short positions relative to long positions we settle at a bullish signal.

--- Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter: @WVenketas