US Dollar, EUR/USD, USD/JPY, COT Report –Analysis

The Analytical Abilities of the COT Report

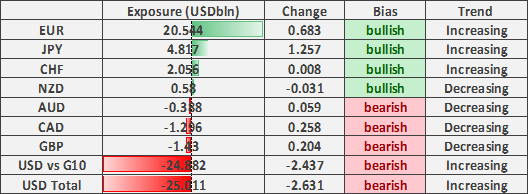

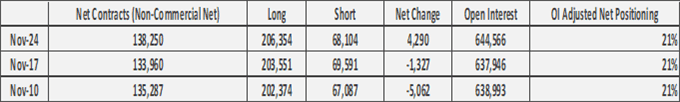

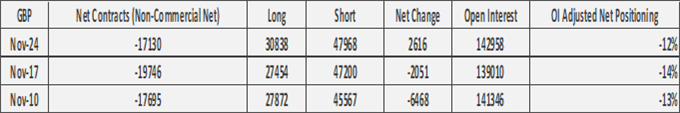

Source: CFTC, DailyFX (Covers up to November 24th, released November 30th)

US Dollar Selling Renewed, GBP/USD Shorts Unwinding- COT Report

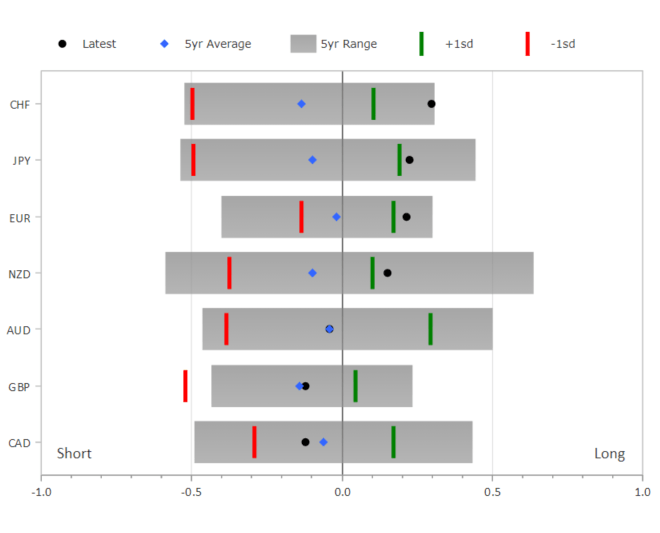

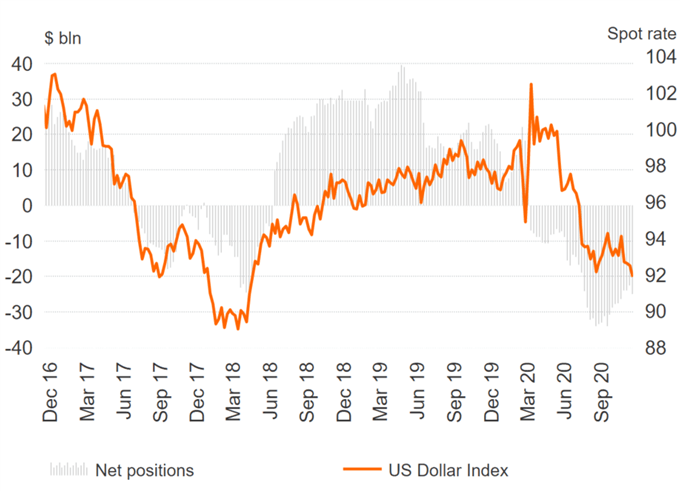

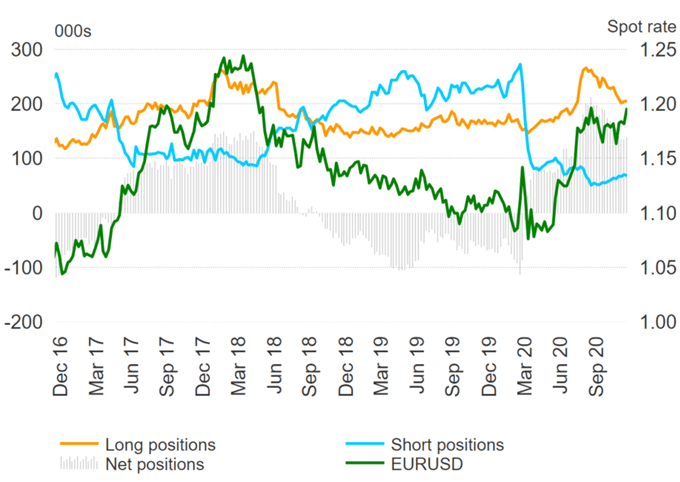

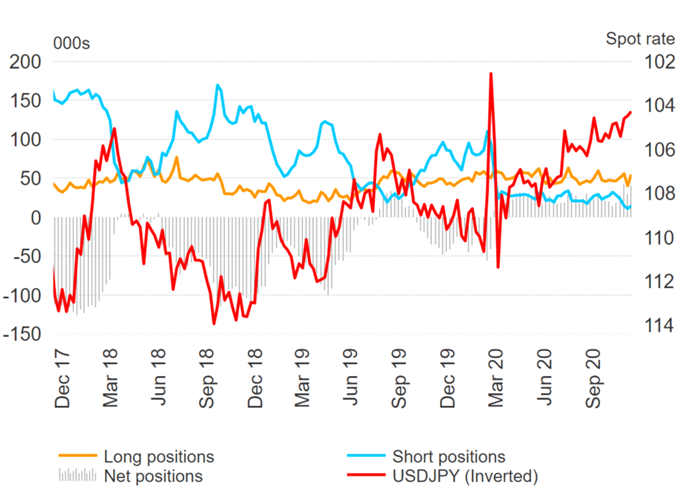

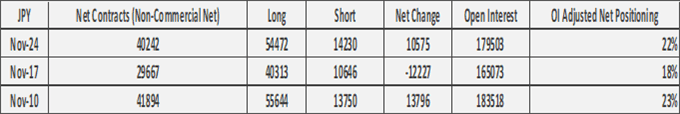

In the latest CFTC reporting week to November 24th, speculators had increased their USD short exposure for the first time since September by $2.4bln with USD selling rather broad-based. This, however, should come as little surprise given that the US Dollar is hovering around its lowest level since April 2018. That said, while investors remain heavily short on the greenback, this does not mean that positioning cannot get shorter, particularly as markets begin to look to 2021 with recent vaccine optimism raising hopes of a faster global rebound than previously expected. Much of the USD selling had been against the Japanese Yen which saw net longs rising $1.2bln to total $4.8bln.

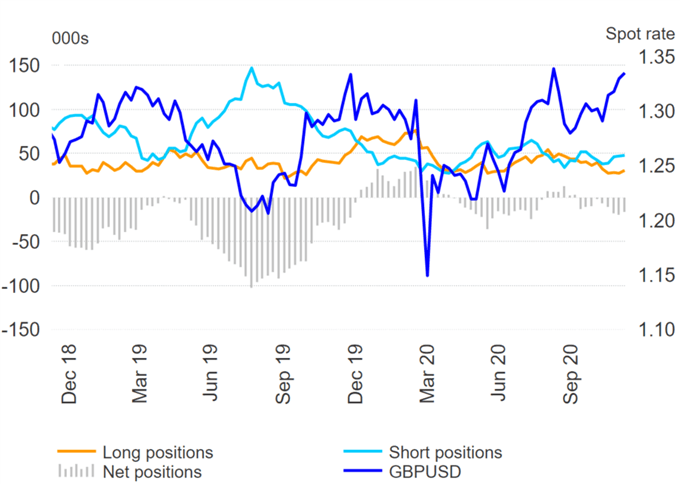

GBP has seen a reduction in bearish bets for the first time in over a month. Although, positioning remains at odds with spot GBP, which continues to trade at elevated levels, despite a trade agreement between the EU and UK yet to be announced. Alongside this, with the reduction in net shorts, GBP/USD could potentially struggle to see a meaningful bounce on the back of an agreement with less shorts being unwound.

| Change in | Longs | Shorts | OI |

| Daily | -5% | -15% | -10% |

| Weekly | -10% | 3% | -5% |

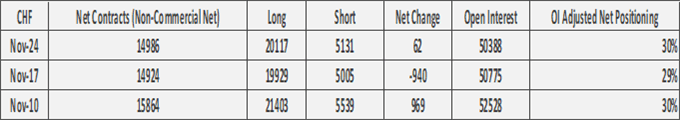

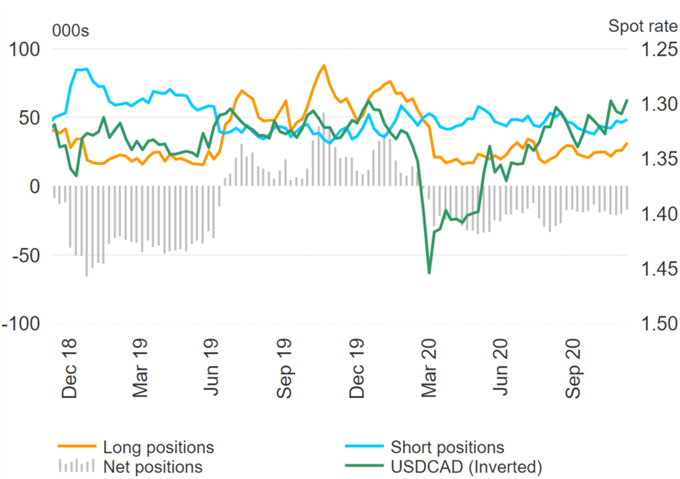

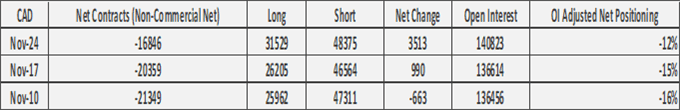

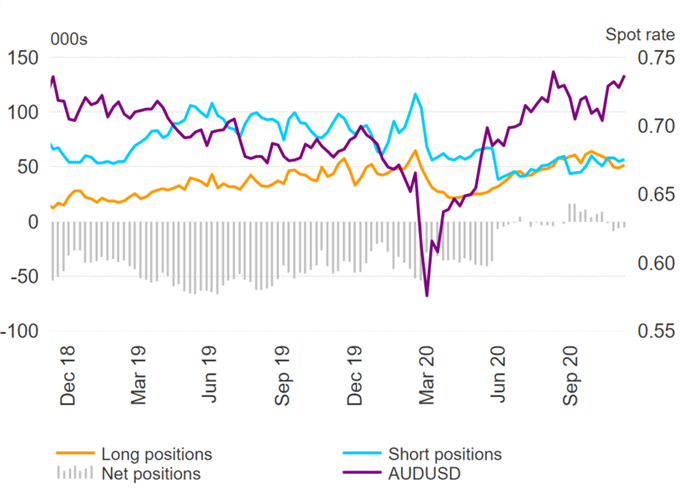

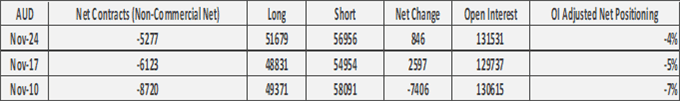

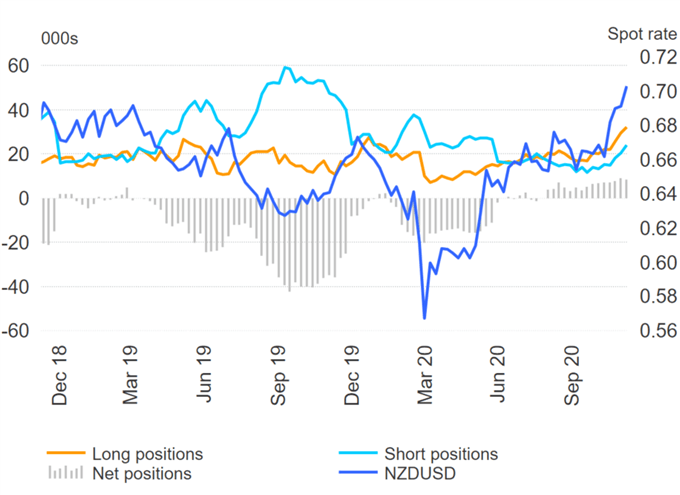

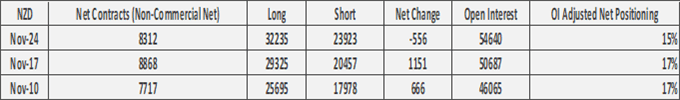

Across the commodity currencies, short exposure in CAD and AUD had eased slightly with CAD tracking oil prices higher. NZD however, saw net longs pull back slightly, which is to be expected after recent surge following the pricing out of a negative OCR in NZ front end rates. That said, with a dovish RBNZ now fully priced out, the Kiwi may begin to underperform against the CAD and AUD.

US Dollar |

EUR/USD |

GBP/USD |

USD/JPY |

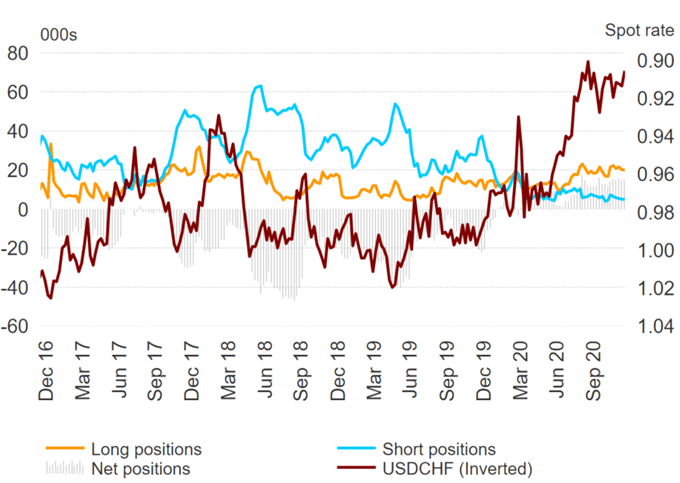

USD/CHF |

USD/CAD |

AUD/USD |

NZD/USD |

For a more in-depth analysis on FX, check out the FX Forecast