S&P 500 PRICE OUTLOOK – STOCK MARKET RECOVERY STYMIED BY DISMAL JOBS REPORT, VIX INDEX DOWN BUT EXTREME FEAR LINGERS

- S&P 500 dropped by 2% this past week on the back of accelerating jobless claims and rising unemployment

- Investors overlooked recent FOMC liquidity and fiscal stimulus efforts as deepening coronavirus recession risk steered the stock market lower

- The VIX Index edged lower four out of the last five trading sessions alongside a broad-based pullback in cross-asset volatility benchmarks

The S&P 500 whipsawed last week to end about 2% lower on net following the 4% rise by Tuesday that quickly flipped to a 4% decline by Thursday’s low point. Perhaps month-end and quarter-end rebalancing partly contributed to S&P 500 price action.

| Change in | Longs | Shorts | OI |

| Daily | -11% | 8% | -1% |

| Weekly | -6% | 8% | 2% |

Investor optimism that continued from the prior week’s massive 11% rebound – primarily a reaction to trillions of dollars in stimulus from the Fed and US congress – helped the stock market extend higher initially. After another alarming jobless claims report was echoed by dismal NFP data, however, the S&P 500 resumed its broader bearish trend.

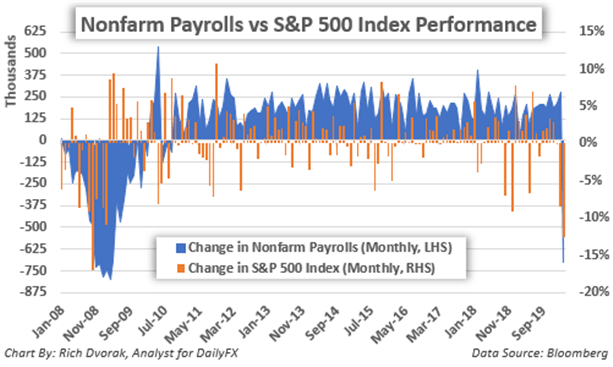

S&P 500 PRESSURED BY SURGING UNEMPLOYMENT, PLUNGING NONFARM PAYROLLS

That said, while economic chaos caused by the coronavirus accumulates, the S&P 500 Index and broader stock market might face more downside ahead. This is considering a recession is likely unavoidable with nonfarm payrolls falling off a cliff, and the unemployment rate spiking higher, as the coronavirus lockdown endures.

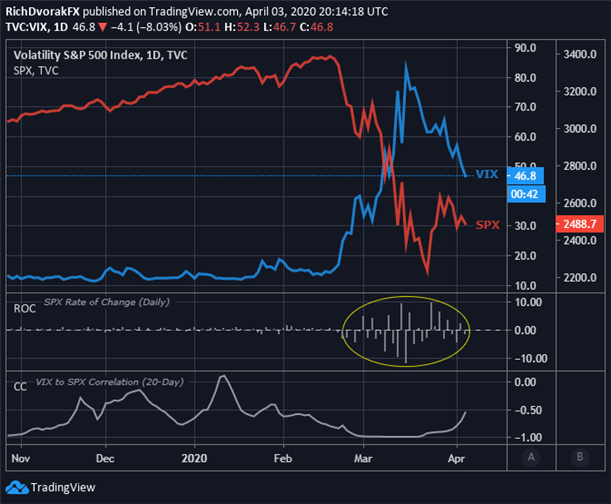

VIX INDEX SLIDES DESPITE STOCK MARKET DECLINES AS S&P 500 PRICE VOLATILITY SIMMERS

Chart created by @RichDvorakFX with TradingView

Despite the slide in stocks last week, the VIX Index, sometimes referred to as an investor fear-gauge, shed nearly 20 percentage points. Correspondingly, the VIX to S&P 500 correlation has turned less negative as the typically strong inverse relationship wanes. The drop in the VIX Index over the last few trading sessions might be explained by a decrease in magnitude of price swings in the S&P 500.

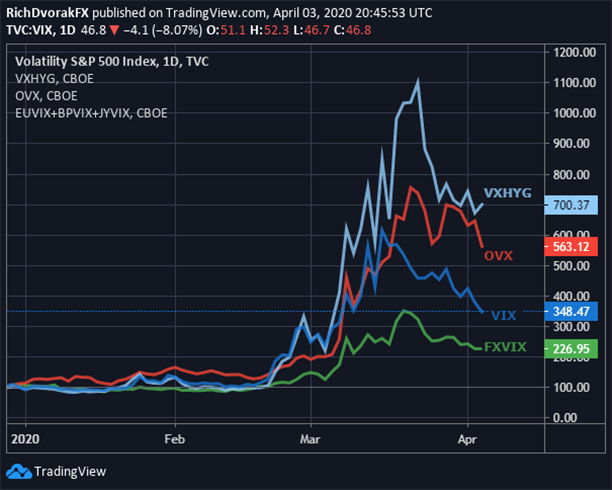

CROSS-ASSET VOLATILITY GRAVITATES LOWER, LED BY VIX INDEX & OIL PRICE RECOVERY

Chart created by @RichDvorakFX with TradingView

Moreover, cross-asset volatility benchmarks, such as currency volatility (FXVIX), oil volatility (OVX) and high yield corporate debt volatility (VXHYG), have gravitated lower alongside expected S&P 500 volatility gauged by the VIX Index. This could be broadly due to the gusher of FOMC liquidity and fiscal stimulus that has calmed market angst.

In addition to cross-asset volatility benchmarks edging lower, rebounding oil price action is probably a positive development for risk appetite, but the moves may prove short-lived. Volatility measures nevertheless remain at extreme highs last seen during the global financial crisis.

On that note, perhaps the dominant theme of investor demand for safe-haven currencies is lingering with the US Dollar ripping back toward multi-year highs. This could correspond with another rise in FX volatility as the S&P 500 Index, Dow Jones and Nasdaq bleed.

Read More: S&P 500 Index Trading Strategies, Tips & More

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight