BREXIT LATEST – TALKING POINTS

- GBPUSD is down more than 1 percent so far today as the latest Brexit drama puts pressure on the Pound

- The European Council will commit to a Brexit extension, but more than a month shorter than what the UK hoped for and is contingent on passing a deal

- For more information on Brexit’s impact on the GBP, read more on How the Pound Might Move After Parliamentary Vote

The Pound has suffered steep losses against the US Dollar throughout today as the latest Brexit developments pushes GBPUSD lower. The cable is off over 1 percent as the likelihood of the UK landing a ‘soft’ departure from the EU by the March 29 deadline continues to dwindle.

Prime Minister Theresa May’s request yesterday to delay the fast-approaching Brexit deadline until June 30 was met with vast criticism and appears to be rejected by the European Council. News has just recently crossed the wires that the European Council will commit to a Brexit extension, but more than a month shorter than what the UK hoped for.

Check out this Brexit Timeline for a chronological list of key events

The current draft Brexit conclusions from the ongoing EU Summit in Brussels stated that the European Council will agree to extend Brexit until May 22. The delay is contingent on British MPs setting aside their differences and approving PM May’s negotiated Withdrawal Agreement by the end of next week.

Furthermore, the European Council added that an extension beyond May 22 will not be possible seeing that the UK does not intend on holding European Parliamentary elections that begin on May 23.

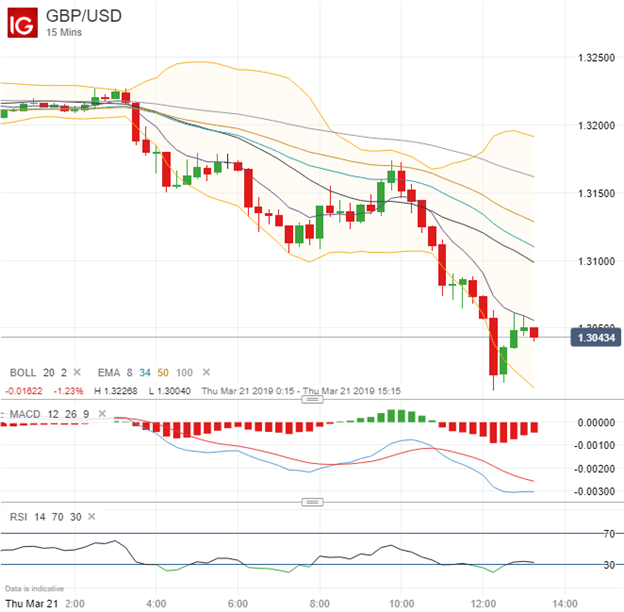

GBPUSD CURRENCY PRICE CHART: 15-MINUTE TIME FRAME (MARCH 21, 2019 INTRADAY)

Although today’s GBPUSD selloff could be exacerbated by a rebounding US Dollar following yesterday’s post-FOMC carnage, spot prices have extended to the downside throughout the session as speculation mounts that the UK might still crash out of the EU without a deal on March 29.

This is still a possibility considering all EU27 members must vote on the extension which is contingent on the House of Commons approving the Withdrawal Agreement by next week. Despite MPs voting against a no-deal Brexit last week, the legal default as things stand is for the UK to sever itself from the EU with no deal on the current March 29 Brexit date.

As such, the most recent Brexit uncertainty has pushed GBPUSD implied volatility to 32-month highs. Markets will likely turn to European Council President Donald Tusk next who will provide a press statement at 1900 CET with PM Theresa May also said to hold a press conference in Brussels later this evening.

Read More: Brexit Latest Puts UK and British Pound at EU’s Mercy

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter