EUR Analysis and Talking Points

- Euro Dismisses Ongoing Italian and EU Showdown

- ECB Minutes May Signal Downside Risks

Euro Dismisses Ongoing Italian and EU Showdown

The Euro has remained firm, despite yesterday seeing the European Commission rejecting Italy’s revised budget. As such, the showdown between the EU and Italy is showing no signs of abating. After rejecting the budget, the EU will now press ahead with the “excessive deficit procedure”, which may end up with a sanction on Italy.

Currently, Italy’s case is at a point where the Commission will look to propose a set of measures that must be implemented and set a timeframe for by which the Italian government must deliver by. If Italy fails to make progress in implementing the proposed measures, the European Commission can impose a sanction, that may involve a fine of 0.2-0.5% of GDP.

However, given that yesterday’s decision by the European Commission was widely expected and with Deputy PM Salvini providing a somewhat conciliatory tone towards the EU, BTP yields in fact dipped, while the Euro also found a bid.

ECB Minutes May Signal Downside Risks

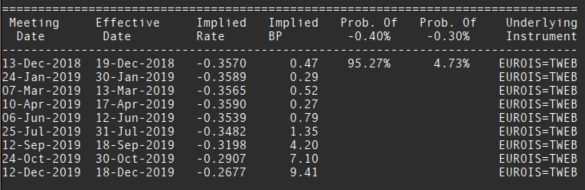

At 1230GMT, the market will digest the latest ECB monetary policy meeting minutes. While the ECB look undeterred by the current backdrop to end QE purchases by the year-end, the focus is shifting towards forward guidance on rate hikes. In light of the increased uncertainty which has sparked a sell off in equity markets, rate hike expectations have receded, with a September rate hike now seen at a 30% likelihood (Prev. 70%). Heading into the monetary policy decision, investors had been looking out for whether the ECB would alter its forward guidance to state that risks to growth are tilting to the downside, however, this was left unchanged (risks broadly balanced). As such, focus in the minutes will be on whether several members indeed see that the outlook is deteriorating, particularly given the slowing in the European powerhouse, Germany, which last week showed GDP contracting for the first time in 3yrs amid the knock on effect from trade wars.

Source: Refinitiv. ECB rate hike projections, showing odds of a 10bps hike to deposit rate via overnight index swaps.

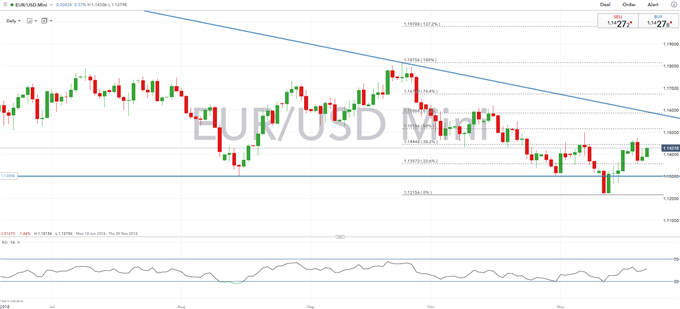

EURUSD Price Chart: Daily Time Frame (June-November 2018)

Topside resistance at 1.1430-40 is holding, where a $1.1bln vanilla option hovers. A break above could see a retest of the 1.1500 handle. However, there is still some way to go to change the bearish sentiment in the pair, whereby a breach of the descending trendline is needed. Support is sitting at 1.13.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX