Receive the DailyFX Morning Digest in your inbox every day before US equity markets open - signup here

The US Dollar’s rally has run into its first major roadblock, the trendline from the highs back in April and May earlier this year. The greenback had been gaining consistently over the past week, since the Federal Reserve’s September policy meeting. With both the US Treasury 2-year and 10-year yields continuing to push higher, however, any US Dollar pullbacks may be brief.

Elsewhere, constructive talks between the EU and the UK have paved the way for a recovery in the British Pound this morning. The tone of the press conferences for the EU’s Michel Barnier and the UK’s David Davis were varying in their degrees of optimism, but the consensus was that things are moving – albeit slowly – in the right direction. Any signs that the probability of a ‘hard Brexit’ outcome are low relieves pressure on the British Pound.

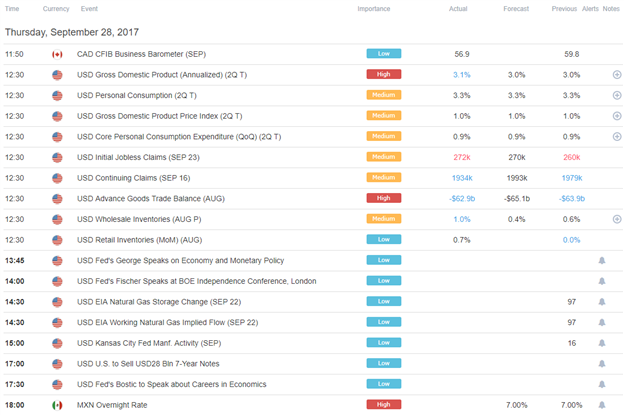

DailyFX Economic Calendar: Thursday, September 28, 2017 - North American Data Releases

With the bulk of US economic data already having been released for today, and in aggregate it having very little impact on the US Dollar at the time of their releases at 8:30 EDT/12:30 GMT, attention turns to the three Fed speakers due up. Federal Reserve officials have echoed the hawkish rhetoric deployed by Fed Chair Janet Yellen this week and last, suggesting that another rate hike is coming by December. Fed funds are currently pricing in a 70% chance of a 25-bps hike in December, up from 45% last Wednesday ahead of the September FOMC meeting. Later in the session, Banxico is meeting, though with no rate hike expected, attention will be on any details released thereafter.

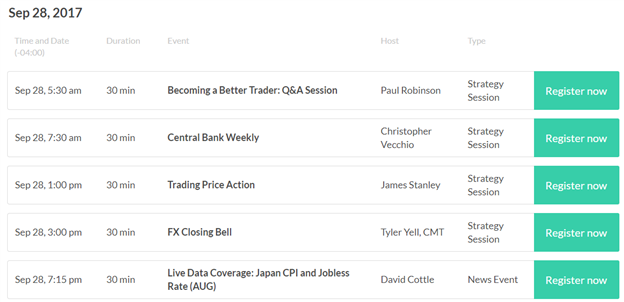

DailyFX Webinar Calendar: Thursday, September 28, 2017

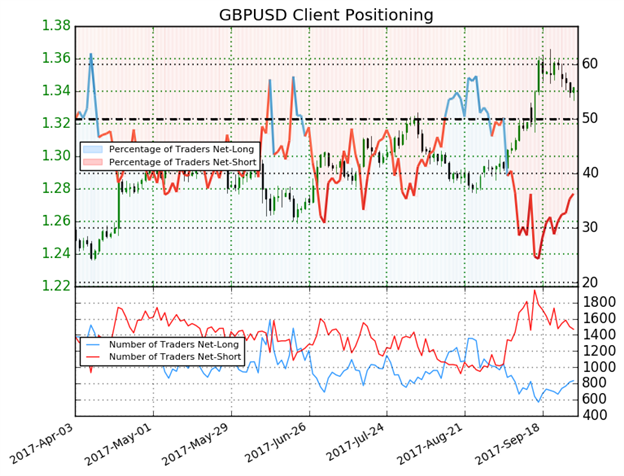

IG Client Sentiment Index Chart of the Day: GBPUSD

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

GBPUSD: Retail trader data shows 36.3% of traders are net-long with the ratio of traders short to long at 1.76 to 1. In fact, traders have remained net-short since Sep 05 when GBPUSD traded near 1.29615; price has moved 3.6% higher since then. The number of traders net-long is 1.8% higher than yesterday and 10.6% higher from last week, while the number of traders net-short is 3.9% lower than yesterday and 10.0% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBPUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBPUSD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading

- “DXY Index at Resistance as Key USD-pairs Pause” by Christopher Vecchio, CFA, Senior Currency Strategist

- “S&P 500 Remains Constructive, Nasdaq 100 Attempting to Build Bullish Pattern” by Paul Robinson, Market Analyst

- “Buoyant Euro-Zone Confidence Keeps Tighter Monetary Policy in Focus” by Martin Essex, MSTA, Analyst and Editor

- “Bank of England’s Carney: Brexit to Hit UK Incomes, GBP/USD Slides” by Martin Essex, MSTA, Analyst and Editor

- “EURUSD Options-implied Levels Ahead of German CPI, U.S. GDP” by Paul Robinson, Market Analyst

The DailyFX Morning Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Evening Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.