EUR/USD Rate Talking Points

EUR/USD struggles to retain the rebound from earlier this week as European officials fail to deliver a comprehensive stimulus package that would cover the monetary union, but the exchange rate may face range bound conditions through the Easter holiday as it fails to extend the series of lower highs and lows carried over from the previous week.

EUR/USD Susceptible to Range Bound Conditions Through Easter Holiday

EUR/USD pulls back from the weekly high (1.0927) as finance ministers representing the European Union (EU) struggle to draw up a joint response to COVID-19, and the nationwide lockdowns across Europe may push the ECB to deploy more non-standard measures as the central bank pledges to “explore all options and all contingencies to support the economy through this shock.”

In a recent interview, ECB President Christine Lagarde warned that “according to the consensus of economists, each month of confinement will result in a loss of annual growth of 2% to 3% in 2020,” with the central bank head going onto say that “this would imply a decline in GDP from 3.5% to 4%, in the scenario of confinement lasting a few weeks and from -9% to -10% in a longer confinement scenario.”

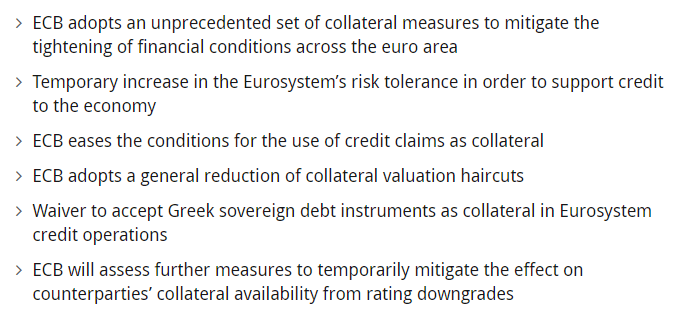

The comments come a day after the ECB unveiled “a package of temporary collateral easing measures to facilitate the availability of eligible collateral for Eurosystem counterparties to participate in liquidity providing operations,” and the Governing Council may continue to push monetary policy into uncharted territory as the central bank insists that it could revise “some self-imposed limits” in order to ensure the “smooth transmission of its monetary policy in all jurisdictions of the euro area.”

Source: ECB

As a result, the account of the March meetings may highlight a dovish forward guidance as President Lagarde emphasizes that “there is no limit to our commitment to serving the euro area,” but the statement may also reveal a rift within the ECB amid the mixed views surrounding Outright Monetary Transactions (OMT).

In turn, the ECB may attempt to buy time at its next meeting on April 30, but the outlook for monetary policy may continue drag on the Euro as the Governing Council is “fully prepared to increase the size of our asset purchase programmes and adjust their composition, by as much as necessary and for as long as needed.”

With that said, the current environment may keep EUR/USD under pressure especially as the US Dollar benefits from the flight to safety, but the exchange rate may consolidate going into the Easter holiday as it snaps the series of lower highs and lows carried over from the previous week.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

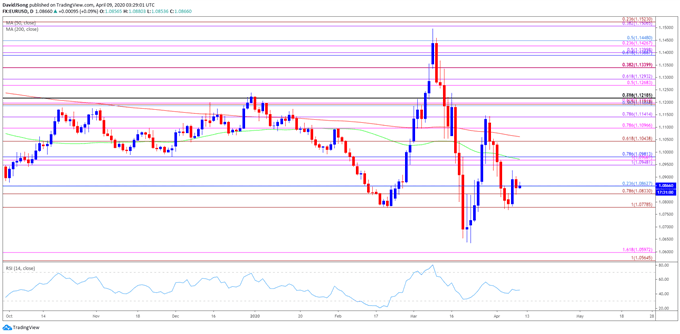

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range has been a key dynamic for EUR/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 1, with the high for November occurring during the first full week of the month, while the low for December happened on the first day of the month.

- The opening range for 2020 showed a similar scenario as EUR/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first trading day of the month.

- However, the opening range for March was less relevant amid the pickup in volatility, with the pullback from the yearly high (1.1495) producing a break of the February low (1.0778) as the exchange rate slipped to a fresh 2020 low (1.0636).

- Nevertheless, the recent recovery in EUR/USD unravels following the string of failed attempt to close above the 1.1140 (78.6% expansion) region, but the exchange rate appears to have marked a failed attempt to test the yearly low (1.0636) amid the lack of momentum to break/close below the 1.0780 (100% expansion) region.

- In turn, EUR/USD may face range bound conditions over the coming days, with the move above the Fibonacci overlap around 1.0830 (78.6% expansion) to 1.0860 (23.6% retracement) opening up the 1.0950 (100% expansion) to 1.0980 (78.6% retracement) region.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong