Gold Price Talking Points

Gold climbs to a fresh monthly-high ($1320) following the Federal Open Market Committee (FOMC) interest rate decision, and the precious metal may exhibit a more bullish behavior over the coming days as the price for bullion reverses course ahead of the 2019-low ($1277).

Gold Gets Bid Following FOMC Meeting Amid Bets for December Rate-Cut

Gold extends the advance from earlier this week as the Federal Reserve keeps the benchmark interest rate in its current threshold of 2.25% to 2.50%, with the central bank largely endorsing a wait-and-see approach for monetary policy ‘in light of global economic and financial developments and muted inflation pressures.’

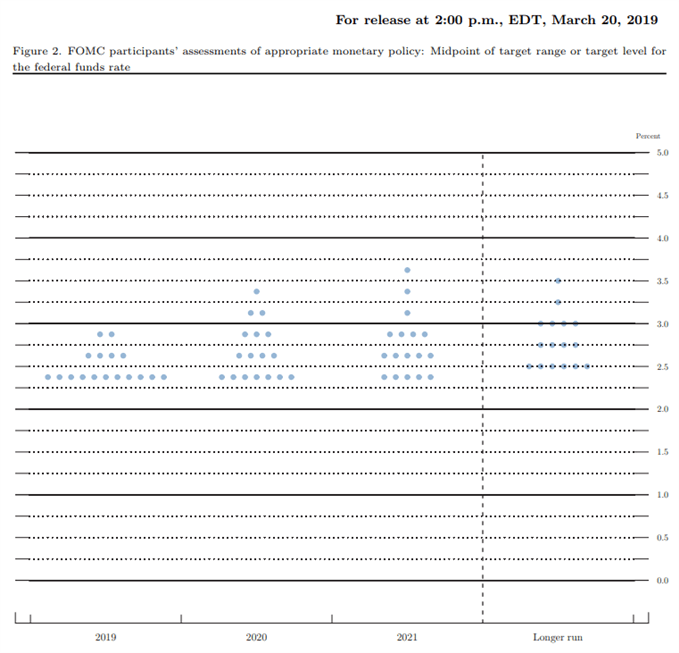

The fresh updates to the Summary of Economic Projections (SEP) suggest the FOMC will continue to change its tune over the coming months as the central bank trims its economic forecast, and Fed officials may show a greater willingness to abandon the hiking-cycle as the committee plans to wind down the $50B/month in quantitative tighten (QT) by the end of September. However, the dot-plot indicates that the FOMC may still implement a rate-hike over the policy horizon as the longer-run interest rate forecast sits between 2.50% to 2.75%, and it remains to be seen if the Fed will keep the door open to further normalize monetary policy as the central bank pledges to be ‘patient as it determines what future adjustments to the target range for the federal funds may be appropriate.’

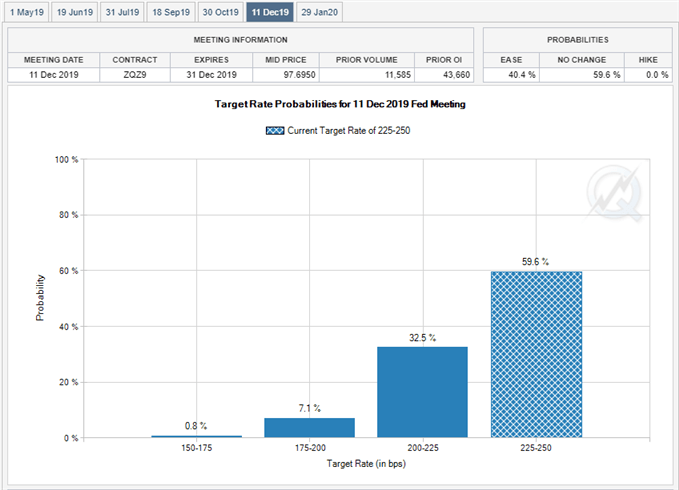

With that said, Fed Fund Futures now shows market participants pricing a 40% probability for a rate-cut in December, and a further shift in the Fed’s forward-guidance may ultimately heighten the appeal of gold as it stokes fears of a policy error. In turn, the current environment may keep gold prices afloat, and the price for bullion may continue to retrace the decline from the yearly-high ($1347) as it initiates a series of higher highs & lows following the FOMC meeting.

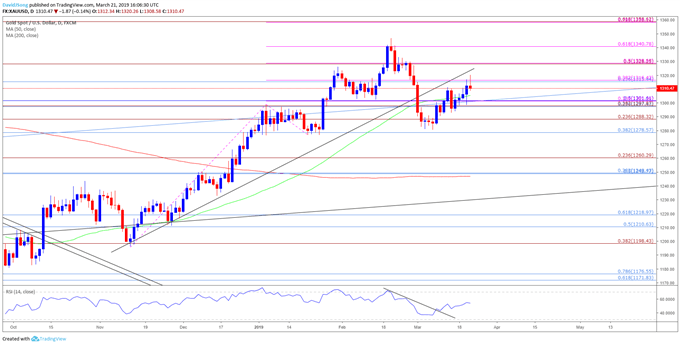

Gold Price Daily Chart

- Keep in mind, failure to snap the yearly opening range instills a constructive outlook for gold, with the price for bullion at risk of retracing the decline from the yearly-high ($1347) as it reverses course ahead of the 2019-low ($1277).

- At the same time, developments in the Relative Strength Index (RSI) suggest the bearish momentum will continue to unravel as the oscillator breaks out of the downward trend carried over from the previous month.

- However, need a close above the Fibonacci overlap around $1315 (23.6% retracement) to $1316 (38.2% expansion) to open up the $1328 (50% expansion) to $1329 (50% expansion) region, with the next area of interest coming in around $1340 (61.8% expansion).

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

For more in-depth analysis, check out the 1Q 2019 Forecast for Gold

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.