Australian Dollar Talking Points

AUD/USD trades below the 0.7000 handle for the first time since 2016 as data prints coming out of China, Australia’s largest trading partner, highlight a slowing economy, and the exchange rate may continue to depreciate over the remainder of the week as it snaps the range-bound price action from the end of December.

AUD/USD Rate Trades Below 0.7000 for First Time Since 2016

The contraction in China’s Purchasing Managers Index (PMI) appears to be weighing on AUD/USD as the dismal development rattles the economic outlook for the Asia/Pacific region, and the lingering threat of a U.S.-China trade war may continue to produce headwinds for the Australian dollar as the Reserve Bank of Australia (RBA) shows little to no interest in raising the official cash rate (OCR) off of the record-low.

It seems as though the RBA will stick to the sidelines throughout the first-quarter of 2019 as ‘there had been some signs of a slowing in global trade,’ and Governor Philip Lowe & Co. may merely attempt to buy more time at the next meeting on February 5 as ‘growth in household income remains low, debt levels are high and some asset prices have declined.’

With that said, the opening range for 2019 instills a bearish outlook for AUD/USD as the exchange rate initiates a fresh series of lower highs & lows, and the ongoing skew in retail interest warns of further losses as recent pickup in volatility fuels market participation.

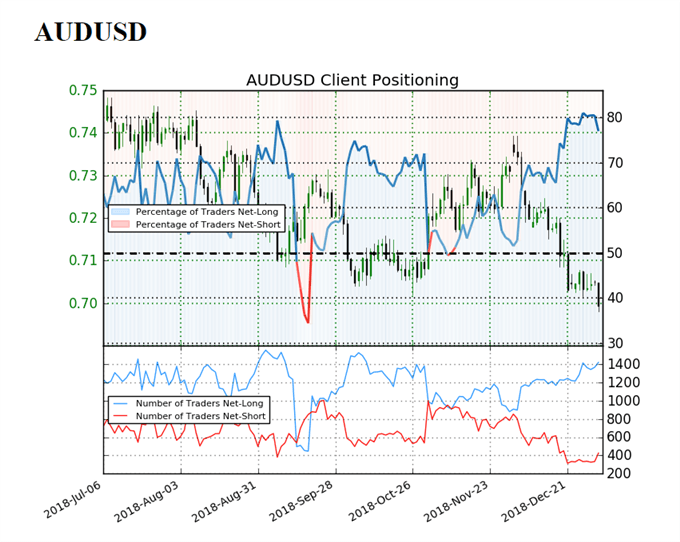

The IG Client Sentiment Report shows 77.0% of traders are now net-long AUD/USD compared to 72.7% on December 20, with the ratio of traders long to short at 3.34 to 1.In fact, traders have been net-long since December 4 when AUD/USD traded near 0.7350 even though price has moved 4.3% lower since then.The number of traders net-long is 5.2% higher than yesterday and 10.9% higher from last week, while the number of traders net-short is 30.8% higher than yesterday and 10.4% higher from last week.

Despite the recent surge in net-short position, the persistent tilt in retail interest offers a contrarian view to crowd sentiment especially as the RBA seems to be bracing for a weaker exchange rate. In turn, the broader outlook for AUD/USD remains tilted to the downside, with the exchange rate at risk of extending the recent series of lower highs & lows as it continues to track the downward trend from December. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

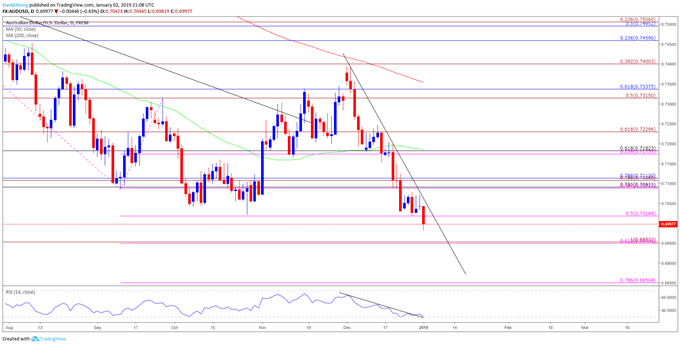

AUD/USD Daily Chart

- Downside targets remain on the radar for AUD/USD as it clears the October-low (0.7021), with a close below 0.7020 (50% expansion) raising the risk for a move towards the 0.6950 (61.8% expansion) region.

- Next downside area of interest comes in around 0.6850 (78.6% expansion), but need to keep a close eye on the Relative Strength Index (RSI) as it fails the preserve the bearish formation from earlier this month.

- May see the bearish momentum gather pace if the RSI slips back below 30 and pushes into oversold territory.

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.