Australian Dollar Talking Points

AUD/USD slips to a fresh monthly-low (0.7178) at the start of the week as data prints coming China, Australia’s largest trading partner, dampen the outlook for the Asia/Pacific region, and the advance from the 2018-low (0.7021) may continue to unravel as the exchange rate extends the series of lower highs from the beginning of December.

AUD/USD Rate Outlook Mired by Series of Lower Highs

AUD/USD extends the decline from the previous week as updates to China’s Balance of Payments (BoP) show exports to all major partners slowing in November, with the Consumer Price Index (CPI) narrowing more-than-expected during the same period as the headline reading slipped to 2.2% from 2.5% per annum in October.

The persistent threat of a U.S.-China trade war may continue to drag on AUD/USD as the Reserve Bank of Australia (RBA) sees ‘signs of a slowdown in global trade, partly stemming from ongoing trade tensions,’ and it seems as though the central bank remains in no rush to lift the official cash rate (OCR) off of the record-low as ‘growth in household income remains low, debt levels are high and some asset prices have declined.’

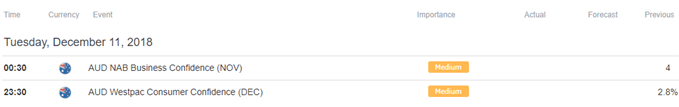

In turn, the RBA Minutes due out on December 18 may do little to heighten the appeal of the Australian dollar as the central bank endorses a wait-and-see approach for monetary policy, and Governor Philip Lowe & Co. may merely attempt to buy more time at the next meeting on February 5 as ‘the low level of interest rates is continuing to support the Australian economy.’

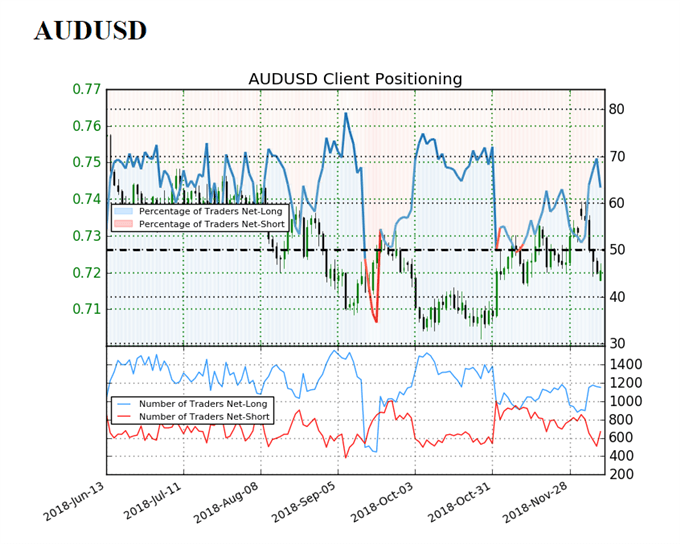

With said, AUD/USD remains at risk of giving back the advance from the 2018-low (0.7021) especially as the Federal Reserve is still expected to deliver a 25bp rate-hike later this month, but retail traders continue to fade the weakness in the exchange rate as the pickup in volatility fuels a pickup in net-long interest.

The IG Client Sentiment Report shows 63.3% of traders are net-long AUD/USD compared to 67.2% on Friday, with the ratio of traders long to short at 1.72 to 1.The number of traders net-long is 4.1% lower than yesterday and 29.8% higher from last week, while the number of traders net-short is 21.5% higher than yesterday and 28.3% lower from last week.

The drop in net-short position points to profit-taking behavior as AUD/USD slips to a fresh monthly-low (0.7178), but the buildup in net-long interest offers a contrarian view to crowd sentiment as both price and the Relative Strength Index (RSI) snap the bullish formations carried over from October. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

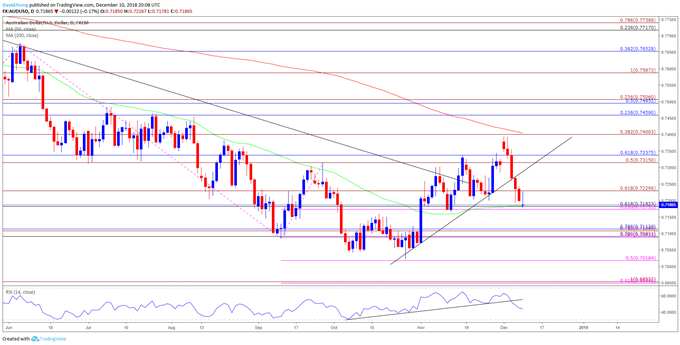

AUD/USD Daily Chart

- The opening range for December keeps the downside targets on the radar as AUD/USD carves a series of lower highs, but need a break/close below 0.7170 (23.6% expansion) to 0.7180 (61.8% retracement) to open up the next downside hurdle around 0.7090 (78.6% retracement) to 0.7110 (78.6% retracement).

- The 0.7020 (50% expansion) area comes up next, which lines up with the 2018-low (0.7021), with the next region of interest coming in around 0.6950 (61.8% expansion).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.