Gold Talking Points

Gold trades near the monthly-high ($12330) even as the rout in risk appetite dissipates, and the recent pickup in volatility keeps the topside targets on the radar as bullion snaps the downward trend from earlier this year.

Gold Risks Larger Correction Amid Adjustment in Speculative Position

The near-term outlook for gold remains supportive as bullion breaks out of the range-bound price action carried over from the previous month, and the recent developments appear to be isolated to bullion especially as silver prices continue to track the opening range for October.

Gold prices may stage a larger correction over the coming days as there appears to be a broader shift in market behavior, and traders may pay increased attention to the precious metal as safe-haven currencies like the Swiss franc also show a limited response to the gyrations in risk sentiment. In turn, bullion may continue to move to the beat of its own drum as there appears to be a wave of short-covering, with the most recent CFTC Commitments of Traders (CoT) report showing speculators still selling gold as of last Tuesday as net-short positions sit at the highest since 1999.

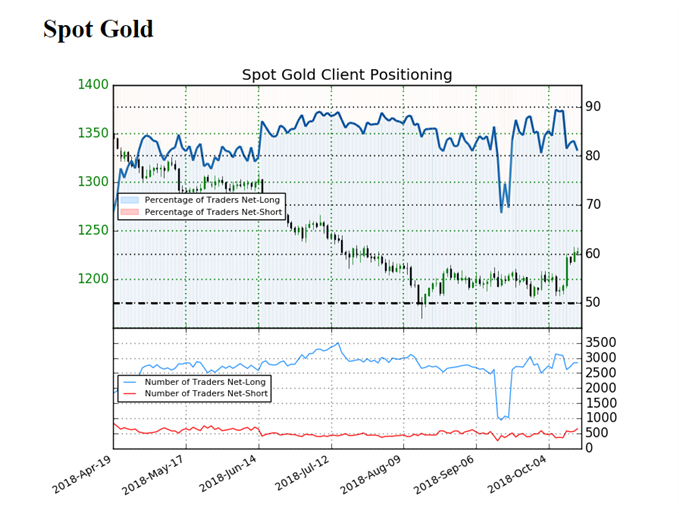

In contrast, the IG Client Sentiment Report still shows retail interest at extremes as 81.1% of traders are net-long with the ratio of traders long to short at 4.29 to 1. However, a deeper look at the report shows the number of traders net-long is 1.0% higher than yesterday and 7.4% lower from last week, while the number of traders net-short is 10.0% higher than yesterday and 45.1% higher from last week.

The ongoing tilt in retail position undermines the recent strength in gold as it offers a contrarian view to crowd sentiment, but a further pickup in net-shorts may generate a potential shift in the IG Client Sentiment index as retail traders appear to be fading the correction in gold. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Gold Daily Chart

- Broader outlook for gold is no longer bearish as it breaks out of the downward trend from earlier this year, with the break above the $1210 (50% retracement) to $1219 (61.8% retracement) hurdle raising the risk for a move towards the Fibonacci overlap around $1249 (50% retracement) to $1250 (38.2% retracement).

- The next topside region of interest comes in around $1260 (23.6% retracement) followed by the $1279 (38.2% retracement) area.

For more in-depth analysis, check out the Q4 Forecast for Gold

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.