Talking Points:

- USD/CAD Unfazed by Weak Canada Retail Sales; RSI Divergence Emerges.

- AUD/USD Extends Bearish Series Following Lackluster Australia 1Q CPI.

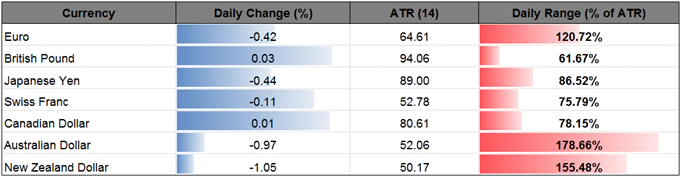

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| USD/CAD | 1.3574 | 1.3606 | 1.3543 | 2 | 63 |

USD/CAD Daily

Chart - Created Using Trading View

- USD/CAD ramped up to a fresh 2017-high of 1.3626 as U.S. President Donald Trump announced plans to implement a tariff on softwood lumber imports from Canada, and the broader outlook remains constructive as the pair largely preserves the bullish trend carried over from the previous year.

- However, the near-term advance in the exchange rate appears to be getting exhausted as the 1.3630 (38.2% retracement) hurdle continues to offer resistance, while the Relative Strength Index (RSI) struggles to push into overbought territory; may see a bearish divergence take shape as the oscillator fails to break above 70.

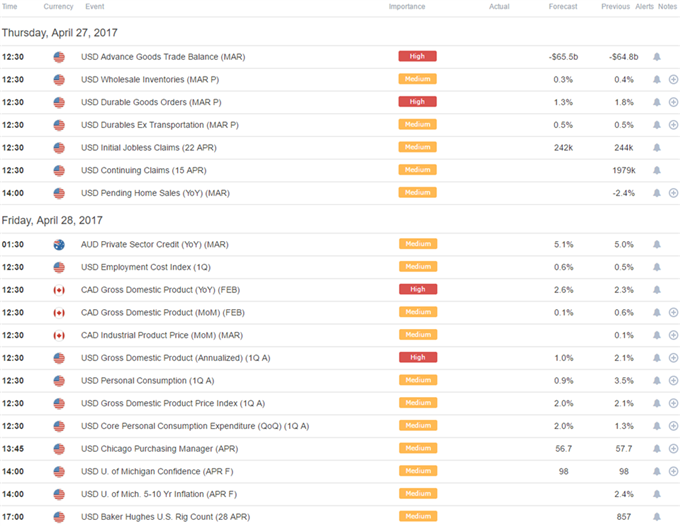

- With that said, the limited reaction to the 0.6% decline in Canada Retail Sales suggests the key developments coming out of the U.S. may have a greater impact on the exchange rate, and the U.S. 1Q Gross Domestic Product (GDP) may stoke a further decline in USD/CAD as the world’s largest economy is projected to grow an annualized 1.0% following the 2.1% expansion during the last three-months of 2016; signs of slower growth may also drag on interest-rate expectations as the Federal Reserve warns ‘participants continued to underscore the considerable uncertainty about the timing and nature of potential changes to fiscal policies as well as the size of the effects of such changes on economic activity.’

- In turn, a closing price below 1.3560 (50% expansion) may spur a move back towards the Fibonacci overlap around 1.3450 (23.6% retracement) to 1.3460 (61.8% retracement), with the next downside region of interest coming in around 1..3360 (38.2% retracement).

Make Sure to Check Out the DailyFX Guides for Additional Trading Ideas.

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| AUD/USD | 0.7462 | 0.7554 | 0.7461 | 73 | 93 |

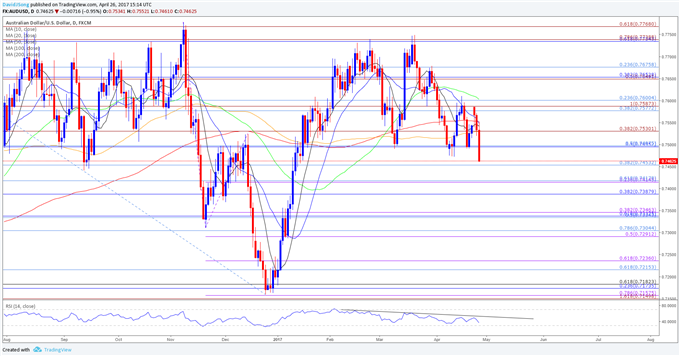

AUD/USD Daily

Chart - Created Using Trading View

- AUD/USD extends the series of lower highs & lows from earlier this week and slips to a fresh monthly low of 0.7461 as Australia’s 1Q Consumer Price Index (CPI) failed to meet market expectations; near-term outlook remains tilted to the downside as the pair searches for support, while the RSI preserve the bearish formation carried over from February.

- The mixed batch of data is likely to keep the Reserve Bank of Australia (RBA) on the sidelines at the May 2 meeting, and the central bank may continue to endorse a wait-and-see approach for monetary policy as officials warn ‘wage growth and broader measures of labour cost pressures remained subdued;’ in turn, more of the same from Governor Philip Lowe and Co. may ultimately dampen the appeal of the aussie as market participants push back bets for a rate-hike.

- In contrast, the Federal Open Market Committee (FOMC) may relay a more hawkish tone at the May 3 interest rate decision as the central bank pledges to further normalize monetary policy over the coming months, with Fed Fund Futures still highlighting a greater than 70% probability for a June rate-hike; however, the central bank may refrain from releasing a more detailed exit strategy amid the uncertainty surrounding the fiscal outlook, and Chair Janet Yellen and Co. may attempt to buy more time as Fed officials argue the ‘recent higher readings on headline inflation had mostly reflected the temporary effect of increases in consumer energy prices.’

- Nevertheless, the downside remains in focus going into the end of April, with a break/close below 0.7450 (38.2% retracement) opening up the next region of interest around 0.7390 (38.2% retracement) to 0.7420 (61.8% retracement) followed by 0.7330 (50% retracement) to 0.7350 (38.2% expansion).

For LIVE Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

Click HERE for the Entire DailyFX Webinar schedule.

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.