Talking Points:

- USD/CAD Rebound to Gather Pace on Dismal Canada Employment Report.

- USDOLLAR Extends Rebound as ISM Non-Manufacturing Beats Expectations.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

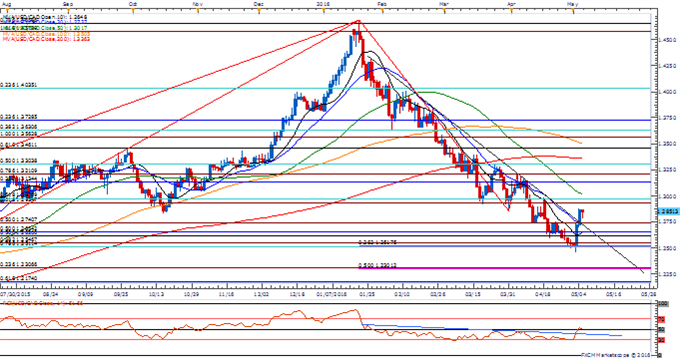

Chart - Created Using FXCM Marketscope 2.0

- USD/CAD may continue to retrace the decline from earlier this year amid the failed attempts to close below 1.2510 (78.6% retracement), while the Relative Strength Index (RSI) breaks out of the bearish formation carried over from January.

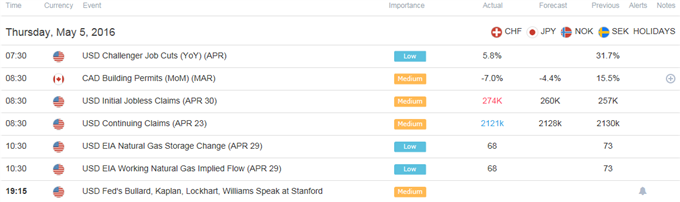

- Even though Canada Employment is anticipated to show another 2.0K expansion in April, an uptick in the jobless rate to an annualized 7.2% from 7.1% may dampen the appeal of the loonie especially if the Participation Rate holds steady at 65.9% for the fifth-consecutive month.

- Will keep a close eye on the topside targets as USD/CAD appears to have made a meaningful low, with the first hurdle coming in around 1.2930 (61.8% expansion) to 1.2980 (61.8% retracement), followed by 1.3130 (38.2% retracement).

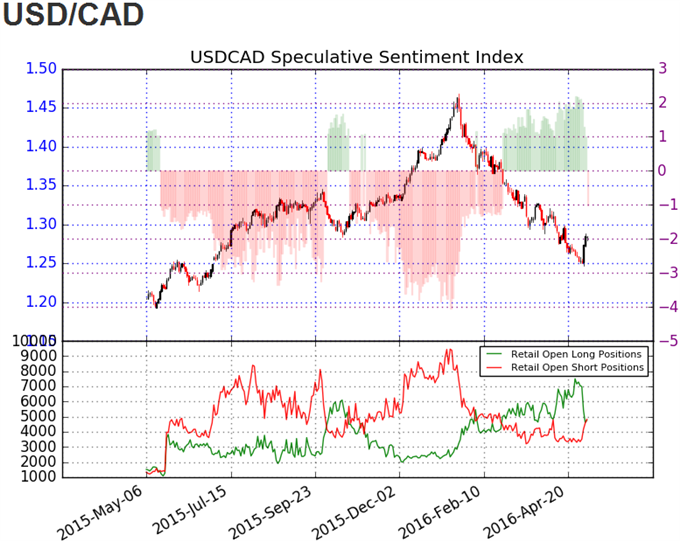

- The DailyFX Speculative Sentiment Index (SSI) shows the FX crowd remains net-long USD/CAD since the first week of April, with the ratio hitting a near-term extreme coming into May as it edged above the +2.00 mark.

- The ratio continues to come off of recent extreme as it currently sits at +1.06, with long positions 34.5% lower from the previous week, while open interest stands 7.3% below the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

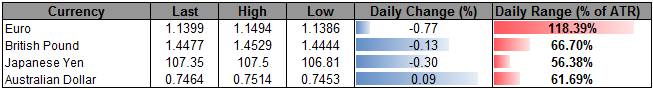

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11830.50 | 11833.84 | 11786.83 | 0.20 | 76.57% |

Chart - Created Using FXCM Marketscope 2.0

- Following the bullish-engulfing, the USDOLLAR may continue to track higher going into the highly anticipated U.S. Non-Farm Payrolls (NFP) report amid the recent series of higher highs & lows, while the RSI appears to be threatening the bearish formation carried over from the end of February.

- A positive development may heighten the appeal of the greenback as the U.S. economy is expected to add another 200K, while Average Hourly Earnings are projected to increase an annualized 2.4% following the 2.3% expansion in March; signs of stronger wage/job growth may boost bets for a Fed rate-hike at the next quarterly meeting in June.

- A break/close above 11,836 (61.8% retracement) to 11,843 (38.2% retracement) may spur a larger recovery in the USDOLLAR, with the next topside region of interest coming in around 11,898 (50% retracement), followed by 11,951 (38.2% expansion) to 11,965 (23.6% retracement).

Click Here for the DailyFX Calendar

Read More:

Emotions Run High in Silver Trade

SPX500 Technical Analysis: Higher-Low Ahead of US Earnings

US DOLLAR Technical Analysis: Who’s Happier? Bears or Central Bankers

AUD/USD – Will the Real Trend Please Stand Up?

Get our top trading opportunities of 2016 HERE

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand