Dow Jones, Nasdaq 100, DAX 30 Outlooks:

- The Dow Jones saw earnings season kick off last week with earnings from JP Morgan, Wells Fargo and Citi

- This week, the Nasdaq 100 will look to FAANG member Netflix for insight

- Capped by technical resistance, the DAX 30 may require a fundamental spark to continue higher

Dow Jones Fundamental Forecast

Outlook: Mixed

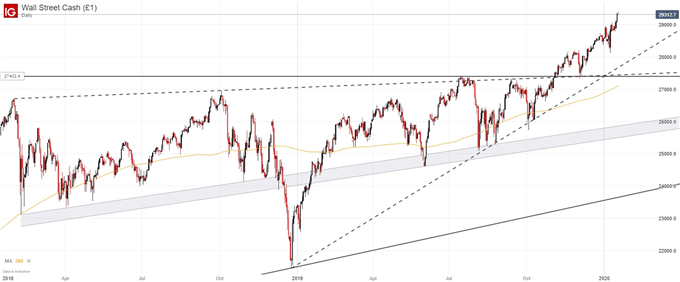

The Dow Jones enjoyed a boost last week from the US-China phase one trade deal which was officially signed on Wednesday. While the deal delayed another round of tariffs, some analysts are skeptical China will move to meet the new requirements which could see the US impose punitive measures – effectively escalating the conflict once more.

For the time being, however, the deal resulted in a sense of optimism and has paved the way for a second phase which President Trump has said may only be signed after the 2020 election. While talks of progress in the interim are to be expected, the Dow Jones may have to look to other themes for direction in the meantime.

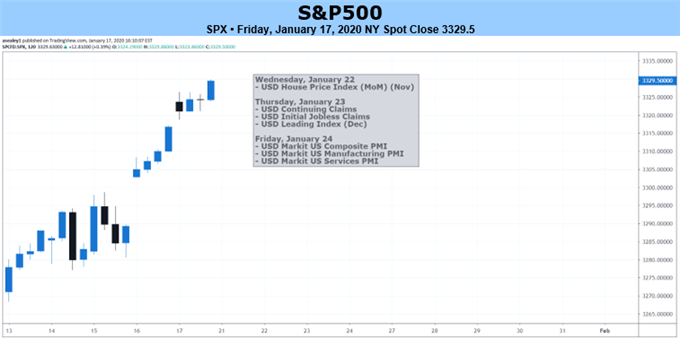

Dow Jones Price Chart: Daily Time Frame (March 2018 – January 2020) (Chart 1)

Day Trading the Dow Jones: Strategies, Tips & Trading Signals

Nasdaq 100 Fundamental Forecast

Outlook: Neutral

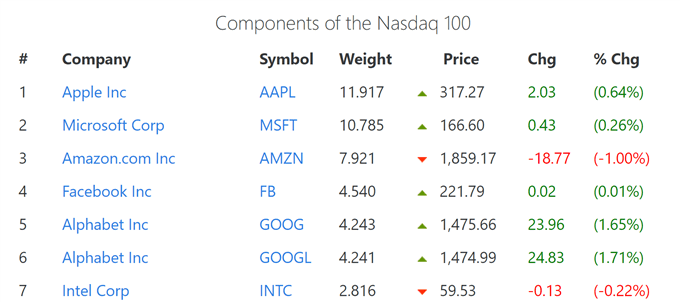

One such theme will be the continuation of earnings season. Average earnings from Citi, Bank of America and Wells Fargo were offset by JP Morgan which posted the best quarter on record for a bank. Together, the earnings worked to boost the financials sector. Now, the tech-heavy Nasdaq 100 will shift focus to Netflix earnings on Tuesday. Previously a member of the high-flying FAANG group, Netflix has been exchanged for Microsoft (FAAMG) after a few disappointing quarters. Should the streaming service disappoint again on Tuesday, tech sentiment could take a hit and drag the entire Nasdaq and Dow Jones with it.

Source: SlickCharts Weightings as of January 17

Since Apple and Microsoft account for more than 20% of the index alone, sentiment regarding the industry is critically important for keeping recent bullishness intact. With that in mind, Netflix has the odds stacked against it with new entrants into the space from Disney and Peacock, while Apple and Amazon have continued to expand offerings on their own platforms.

Therefore, equity traders should keep a close eye on earnings from Netflix, followed by reports from Intel and Texas Instruments. Follow @PeterHanksFX for updates and insights on the reports as they are released.

DAX 30 Fundamental Forecast

Outlook: Neutral

While the Dow Jones and Nasdaq 100 await insights from single companies, the DAX 30 will likely derive its influence from the European Central Bank rate decision on Thursday. With Christine Lagarde now at the helm, the ECB has shown greater interest in pressuring countries to reform their fiscal policy. Should Mrs. Lagarde continue this pursuit, any indication that Germany may look to ease its fiscal guidelines would amount to a seismic shift in the underlying fundamental landscape for the DAX 30.

DAX 30 Price Chart: 4 – Hour Time Frame (October 2019 – January 2020) (Chart 2)

How to Trade Dax 30: Trading Strategies and Tips

In turn, such a spark would likely be able to drive the German equity index above the resistance at which it is currently ensnared. Similarly, commentary regarding monetary policy may also result in DAX volatility which makes the event the headline concern for the DAX next week.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Read more: 3 Things to Know When Trading Earnings Announcements