US Dollar Euro, FOMC, German ZEW – TALKING POINTS

- US Dollar, Euro may wobble after German ZEW Survey, US industrial data is published

- Volatility may be tamed as traders wait to commit capital before the FOMC rate decision

- Traders will also be closely watching for commentary from ECB officials in Luxembourg

Learn how to use political-risk analysis in your trading strategy !

Asia-Pacific Market Recap

Asia markets had a relatively quiet day with most of the focus being on the Saudi Aramco drone strike and disruption to the global oil supply. There were initial concerns about how it may impact developing Asian economies, though this fears appeared to be tempered – for now at least. RBA meeting minutes were published but failed to stoke significantly volatility possibly because it reiterated a message markets were expecting.

European Session: US Industrial Production, German ZEW Survey Data

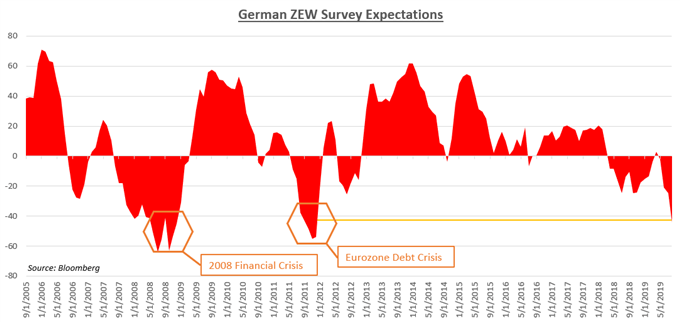

The US Dollar and Euro will be watching the release of German ZEW Survey data that is hovering around levels not reached since the Eurozone debt crisis and before that the 2008 financial collapse. This comes as the European economy continues to show weakness and pressure the local currency as 5Y5Y Euro inflation forward swaps hovers at record lows. This indicator is typically used as a tool for future inflation expectations.

Last week, the ECB cut rates deeper into negative territory and reintroduced QE. However, this was not sufficiently dovish enough for markets participants who were hoping for more easing. After the rate decision, the Euro – rather counterintuitively – closed higher for the day. This suggests that the ECB had failed to meet the market’s lofty expectations for ultra-dovish policy measures and showed desperation for liquidity.

Up next, ECB Chief Economist Philip Lane and Executive Board Member Benoît Cœuré will both be speaking in Luxembourg. Though their commentary may not stoke notable volatility, the nuance of their comments could provide greater insight into policymakers’ views. To get more in-depth analysis of ECB commentary, be sure to follow me on Twitter @ZabelinDimitri.

In the US, traders will be eyeing local industrial production data, though volatility from these events may be curbed due to the upcoming FOMC decision this week. Rate cut bets have already been priced in, so at most what they could do is either amplify or slightly temper future rate cut bets at upcoming meetings. However, this by no means suggests the upcoming data is irrelevant, especially in light of a slowing global economy.

Chart of the Day: German ZEW Data at Lowest Point Since Eurozone Debt Crisis, Financial Crash

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter