Gold and Crude Oil Talking Points:

- Crude oil prices slipped back from the two-month highs of Thursday

- Reports that production cuts may be extended could not overcome trade war fears

- Gold prices inched up but still show signs of topping out

Join our analysts for live, interactive coverage of all major economic data at the DailyFX Webinars. We’d love to have you along.

Crude oil prices retreated from near two-month highs on Friday as US-China trade uncertainty continued to dog all major markets.

The Wall Street Journal had reported on Thursday that Chinese Vice Premier Liu He had invited US Treasury Secretary Steven Mnuchin and Trade Representative Robert Lighthizer to Beijing for further talks. It was not clear whether the invitation had been accepted but the paper cited government sources saying that Washington was keen for a meeting and that the two sides were on the doorstep of deal.

However, this ostensibly quite encouraging story hardly matches with rhetoric from Chinese President Xi Jinping. He said on Friday that China was not afraid of a trade war and will not flinch from such a fight.

Oil prices had risen quite sharply on a Reuters report saying that production cuts by the Organization of Petroleum Exporting Countries were likely to be extended into mid-2020 when the group meets on December 5.

Will Lagarde Break Her Monetary Policy Silence?

Still, trade worries are clearly still driving and will likely do so for the remainder of the global day. The one main overall market risk event in store is a speech from new European Central Bank President Christine Lagarde. Little has been heard from her at all since she took over from Mario Draghi earlier this month, and nothing at all on monetary policy.

She may of course shy away from the subject again, leaving investors to wait until the aftermath of the next ECB policy decision on December 12. However, should she broach it markets will expect a high degree of dovishness.

Gold prices edged up in Asian hours, Of course trade uncertainties gave haven assets their customary boost, but the situation in Hong Kong is also in play. The US Congress has this week past bills in support of human rights in the territory which China has urged President Donald Trump to veto, knowing that he all-but certain to pass them.

If Hong Kong becomes more unstable, China’s response will be crucial, with an increase in suppression likely to make any trade agreement that much harder. The gold market would likely see very considerable inflows in that event.

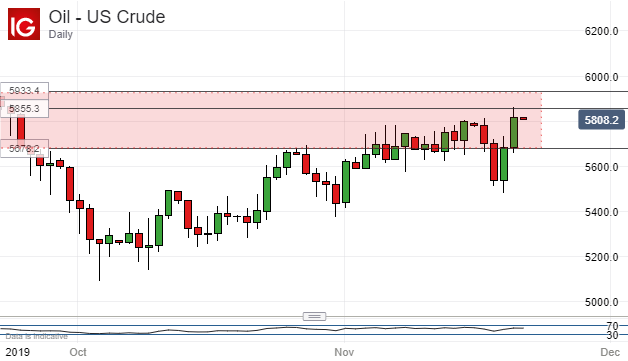

Crude Oil Technical Analysis

Despite Friday’s weakness crude oil prices remain well within an important trading band which the bulls managed to regain this week.

Immediate support lies around the $57.51/barrel area where the market coalesced just after its last push up into this range between November 5 and 19. Below that the range base of $56.78 would be eyed once again but the prognosis that production cuts will be extended may place a near-term floor under this market around that level.

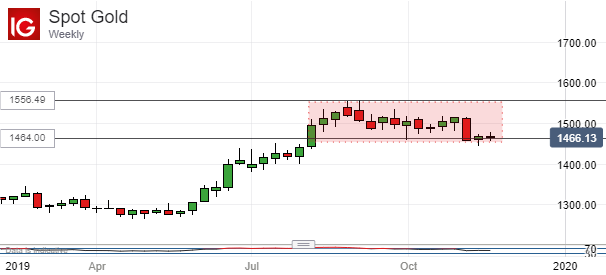

Gold Technical Analysis

Gold prices are in a sort of opposite situation to oil, which makes sense given their differing responses to changes in risk appetite.

The yellow metal is creeping along the bottom of its recent trading range and a break below it on a daily closing basis wouldn’t be a surprise at this point.

However, even if spot prices look to be forming a near-term top at August 26’s intraday peak of $1556.49/ounce, it seems unlikely that the underlying haven demand for gold is going to dissipate anytime soon in these markets.

Commodity Trading Resources

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!