USD/JPY OUTLOOK:

- USD/JPY has retreated in recent days, weighed down by a moderate pullback in US Treasury rates

- If yields continue to fall, the US dollar could come under further pressure against the Japanese yen.

- This article looks at USD/JPY key technical levels to keep an eye on in the near term

Most Read: EUR/USD Latest – Ranging Ahead of Next Week’s US Data and FOMC Minutes

USD/JPY has a strong positive correlation with U.S. interest rates, especially the 10-year yield. For most of the year, the 10-year yield has been in a solid uptrend, driven by the FOMC's hawkish monetary policy in response to soaring inflation. Rising long-term rates have been a major bullish catalyst for the U.S. dollar in recent months, driving it to multi-year highs against the Japanese yen during the first half of May.

However, USD/JPY has begun to descend from its recent peak of 131.35, tracking the moderate reversal in the US 10-year yield. For reference, the key benchmark rate topped out at over 3.20% early last week, but it has since retraced its advance and now trades near 2.83%, a pullback of nearly 40 basis points in less than 10 days.

USDJPY VS US 10-YEAR YIELD

Source: TradingView

With fears growing that the US central bank will not be able to engineer a soft landing and that the economy is headed for a recession, haven demand may boost Treasury prices further, a scenario that will weigh on rates given the inverse relationship between bond prices and yields. This dynamic could accelerate the greenback's downward correction against the yen in the near term, although any decline should be moderate in light of the monetary policy divergence between the Fed and the Bank of Japan.

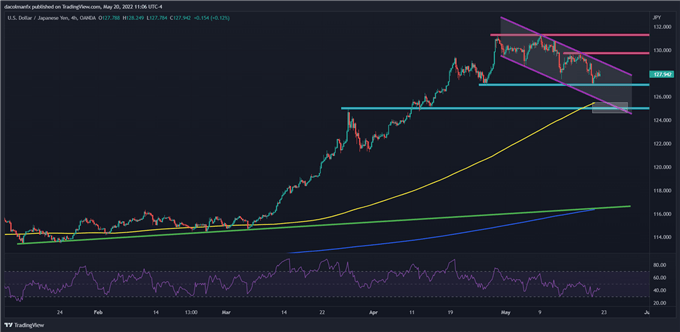

In terms of technical analysis, following the recent weakness, USD/JPY has fallen over 300 pips from its 2022 high, but has managed to bounce modestly off support near the psychological 127.00 level. If the bulls can extend the push higher in the coming sessions, initial resistance lies at 128.80, an area defined by the upper boundary of a short-term descending channel. If this hurdle is cleared decisively, buyers could launch an attack on 129.75, and then 131.35.

On the flip side, if sellers return and drive the exchange rate below 127.00, downside momentum could pick up pace in the days ahead, setting the stage for a possible move towards cluster support, ranging from 125.50 to 125.00.

| Change in | Longs | Shorts | OI |

| Daily | -10% | -13% | -12% |

| Weekly | 12% | -24% | -18% |

USD/JPY TECHNICAL CHART

USD/JPY chart prepared using TradingView

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG's client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

---Written by Diego Colman, Market Strategist for DailyFX