A forex economic calendar is useful for traders to learn about upcoming news events that can shape their fundamental analysis. This piece will explore the DailyFX economic calendar in depth, offering tips on how to read a forex economic calendar to plan ahead, manage risk, and support strategic trading decisions.

What is an economic calendar?

An economic calendar is a resource that allows traders to learn about important economic information scheduled to be released in major economies. Such events might include familiar indicators such as GDP, the consumer price index (CPI), and the Non-Farm Payroll (NFPs) report. Further, in today’s environment of fiscal cliffs and central bank intervention, it can be very helpful to know the date of the next central bank meeting or major news announcement.

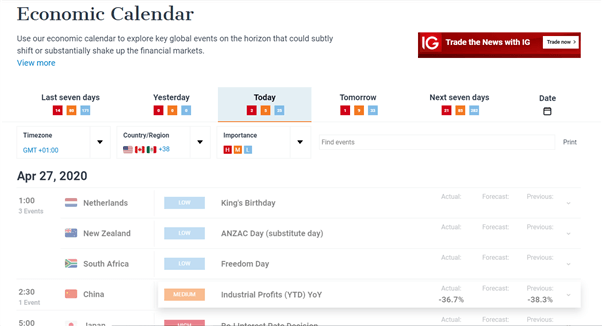

For organization, the events on the DailyFX economic calendar are grouped by country/region and timezone, and graded low, medium or high importance, depending on their likely degree of market impact. This is what the economic calendar looks like.

How to read the forex economic calendar

Knowing how to read the forex economic calendar properly is important to maximize your analysis and trading strategy prior to and following the most important releases. Checking the calendar every morning will allow you to familiarize yourself with the upcoming events that matter. Take stock of the economists’ forecasts associated to events (those that carry them) as that can help set the market’s expectations as well as the impact the outcome has when the ‘actual’ posts relative to forecasts.

In default mode, the calendar will show you every piece of economic news coming out of the major economies. For many, that will be information overload, so you may want to customize the look.

Customizing your forex economic calendar view

Customizing the forex economic calendar means refining the available information to the markets most relevant to you. Some of the unique customizations to the economic calendar you can make include:

- Look at events in the past, ‘today’ and in the future by clicking on buttons such as 'Today' 'Tomorrow' and 'Next Seven Days'.

- Change the timezone to what you’re most comfortable with; this is done by clicking 'Timezone'. For example, US traders on the East Coast may choose Eastern Standard Time or GMT-4/GMT-5.

- Click the ‘Country/Region’ button to select the areas with the events most relevant to you or currency crosses you intend to analyze.

- Filter events for their level of importance in the ‘Importance’ tab.

Using the economic calendar: An example

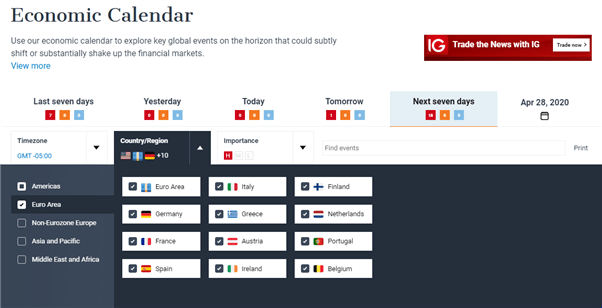

Let’s say you’re trading EUR/USD and want to focus on news coming out of the Eurozone and the US over the coming week that is of high importance. Here’s a simple step-by-step guide to getting the right results:

- Click ‘Next seven days’ in the timeframe options at the top.

- Below that, click the ‘Timezone’ option and select your timezone of choice.

- Next, click ‘Country/Region’, select the ‘Euro Area’ tab, and select your preferred Euro Area country options. In the ‘Americas’ tab, select the ‘United States’ option.

- Click ‘High’ in the ‘Importance’ tab.

After that, your filter may look like this:

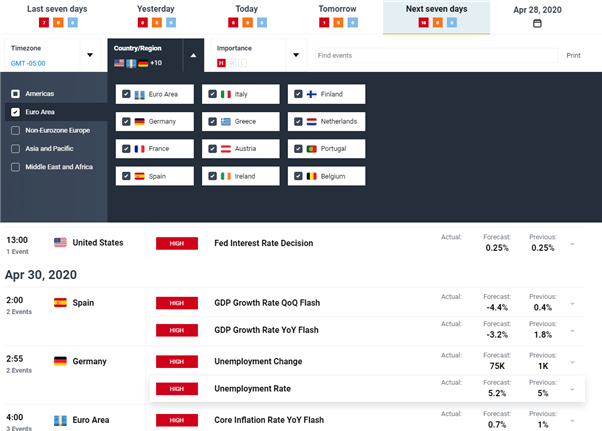

Once you select the 'Euro Area' and ‘Americas’ buttons, you should only see the Eurozone and US news announcements that have a high propensity to move the market should the news surprise traders, economists and other market participants.

In the example in the image below, the search has revealed the upcoming Fed interest rate decision from the US, as well as key economic events from the Eurozone.

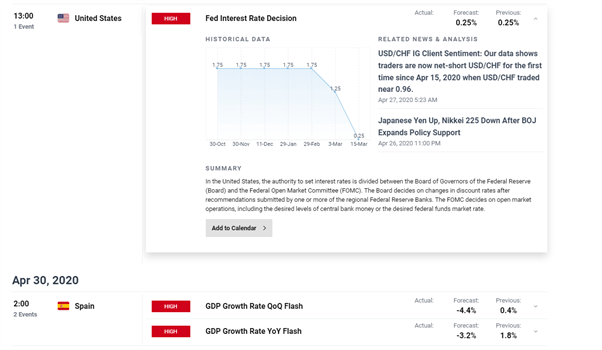

You can select each event of interest to learn more information about it, the surrounding news and analysis, and also to add it to your email calendar, which can be done by clicking the ‘Add to Calendar’ button. Below, we click on the Fed Interest Rate Decision event to find out about its relevance.

Top benefits of using a forex economic calendar

The top benefits of using the DailyFX forex economic calendar include:

- Being able to manage risk effectively

- Being in a position to plan ahead

- Having access to extra, helpful features for customisation

1. Risk Management

Being able to plan your trades around key economic calendar events means you can ready yourself for potential turbulence in price. When an event listed on the calendar approaches, there may be expected a period of volatility if data is released well above, below or in line with expectations.

Understand the principle of risk management in regard to these trades. Risk is the difference between your entry price and stop loss price, multiplied by the position size.

2. Planning Ahead

The forex economic calendar allows for planning ahead. For example, if a Nonfarm Payroll report is set to be released, traders will know that this indicator has the potential to move FX markets substantially as indicated by the ‘high’ importance. As such, awareness of the events’ timing means trader can plan their forex trades accordingly.

3. Benefiting From Features on the DailyFX Forex Economic Calendar

The forex economic calendar provided by DailyFX offers the added benefit of special features such as the customization option mentioned above, offering the facility to select specific timeframes, set alerts and apply filters to make it more relevant to your specific trading strategy. DailyFX also offers free trading webinars to help you plan around major news releases.

Key features on the DailyFX economic calendar

As you will see, the DailyFX economic calendar includes a range of features to improve your experience – making it easier to plan and prioritize. These include close to real-time updates, customized settings for each user, and a more comprehensive view of individual economic data releases. Here’s more about the main perks.

- Find key releases from the world’s leading countries and regions. DailyFX has increased the number of regions covered from ten to 41, giving you broader access to the global fundamental drivers that matter.

- Stay informed with new super-fast updates. Traders now have no excuse to miss out on the latest releases with our new faster updates, delivered in near-real-time.

- Customize your calendar for relevance.The DailyFX economic calendar will remember the individual user’s settings, allowing them to see only the most relevant data to their interests.

- Analyze deeper with better data. Our individual economic data releases now have historical data plots. This allows users to put current results into context in a far more comprehensive way – as well as giving a full explanation of the data in context and why it matters.

Other resources to help you trade the markets

Learn more about using news and events to trade forex and improve your knowledge of how fundamentals move currency prices.

It can also be helpful to understand the differences between Fundamental and Technical Analysis in forex trading, and how to apply them to your trades.