Talking Points

- Silver Prices remain very choppy, hence I am waiting for a breakout

- I expect prices to trade lower as I’m bullish the U.S. Dollar

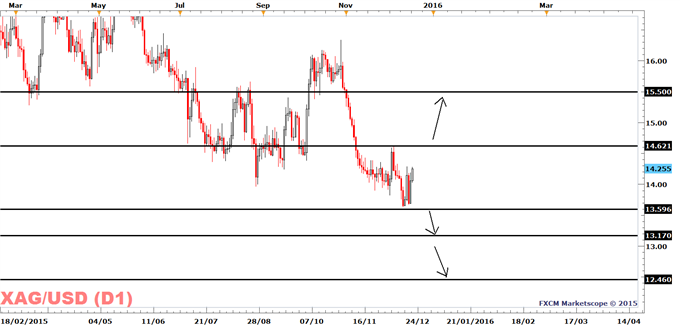

Silver Prices remain very choppy for the past month, which complicates trading. However, when price finally breaches its $13.61 to $14.62 range we can probably enjoy a healthy trend.

In the case of a break to $14.62 silver prices may reach $15 and $15.50 with the latter level acting as support during October. In the case price breaches the December low of $13.61 prices may reach the July 29, 2009 low at $13.17 and then the July 13 low at $12.46.

Until a break occurs, I see the price continuing to trade sideways.

Most traders are correct about the market direction. Yet, they still don’t generate positive returns. This Traits of Successful Traders Guide explains why this is the case

Will It Break Higher or Lower?

My base scenario is for silver to a break lower. This is because the primary driver at this stage is the USD, and I see it gaining further in the months ahead.

Already today, U.S. interest rates suggest that the Dollar should be stronger vs. its major peers. I also lean towards the Fed’s view of 4 rate hikes in 2016 vs. the markets expectations of two rate hikes (according to overnight-index-swaps). This should will lift short-term rates further and give the dollar a boost.

Will the U.S. economy be able to cope with further rate hikes? At this stage I think it will as U.S. inflation is rising, which leaves inflation-adjusted interest rates relativity unchanged.

What may hinder further rate hikes?

Today, we are seeing a contraction of U.S. industrial production (-1.17% YoY) on the back of soft energy markets and a very strong dollar. The leading indicator, ISM manufacturing, is also not showing any signs of bouncing. This implies industrial production should remain soft. This could become a bigger problem in the weeks and months ahead if the Dollar keeps on gaining. And could eventually trigger losses in other sectors of the economy and the Fed may be forced to give up their plans to hike rates.

Get ahead in 2016 – Read The Traits of Successful Traders Guide

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Learn more about trading and join a London Seminar

To be added to Alejandro’s e-mail distribution list, please fill out this form