Fundamental Forecast for Dollar:Neutral

- The US Dollar has advanced for seven consecutive months through January – a record back to the Gold Standard

- NFPs and the PCE inflation indicator will further stir hawkish Fed expectations, but the theme may be mature

- Want to develop a more in-depth knowledge on the market and strategies? Check out the DailyFX Trading Guides

When is ‘in-line’ a source of fundamental strength – when the economy/market/asset is already positioned as a leader. That was the case with the Dollar this past week. Both the FOMC rate decision and US 4Q GDP resulted in status quo outcomes that cemented positions of strength. In turn, the reaffirmation would secure the US Dollar’s seventh consecutive month of advance. That is a record run for the currency going back to the true end of the Gold Standard in the 1970s. An advantage for growth, yields and safety will offer strong support for the Greenback over the medium term. However, this is far from an infallible fundamental backdrop. Should data rein rate hike speculation in or risk aversion undermine speculative interest in dollar-assets, the currency could face a healthy correction.

Amongst the fundamental themes that have leveraged the most strength from the Greenback over the past six months, the relatively hawkish bearing for the Fed has arguably proven the most productive driver. These past weeks have furthered that view. Following the introduction of QE in the Eurozone and a tangible dovish shift from the BoJ, BoE, RBNZ and BoC; the US data reinforced the Fed’s contrast. The FOMC rate decision refused to offer the dovish tone stimulus dependents were hoping for. Meanwhile, the GDP figures cooled while keeping a pace of healthy expansion and a range of Fed officials shaped support for a timely hike.

Moving forward, monetary policy speculation will remain a rudder for the Dollar. However, given the Fed is already sporting a significant premium over its major counterparts – swaps are pricing in 41 bps worth of hikes over the next 12 months and its closest peer in the BoE is looking at 6 bps – this theme may require significantly more fuel to generate gains. That is not to say that there isn’t untapped potential on this theme. Considering Fed Fund futures are still projecting a rate hike towards the very end of the year and a pace thereafter much slower than the FOMC itself expect, there is still potential in this current. It is just requires a stronger jolt to convince the skeptics.

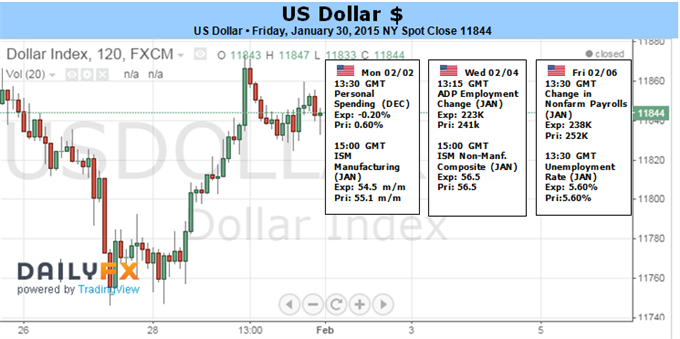

We will confront a few high-profile event risk items that may try their hand at moving the market in the week ahead. On Monday, the Fed’s preferred inflation indicator (the PCE) for January is due. The headline, year-over-year figure is expected to slow to a five-year low 0.8 percent on the back of energy prices; but the FOMC has already tempered the impact a short-term slowdown could have had on the market with a focus on core and ‘medium-term’ time line. Subsequently, the data could carry a greater impact from an upside surprise rather than a downside. Through the week, Fed speak will help build a consensus of where the Committee stands on timing. Bullard, Mester, Rosengren, Lockhart and Kocherlakota are on tap.

Top event risk is the week-ended January NFPs. The net change in payrolls isn’t nearly as important as the ‘qualitative’ figures. The jobless rate has already touched past year milestones for rate hikes – a few years ago, then Chairman Ben Bernanke tied a first rate hike to an unemployment rate of under 6.5 percent. It is currently 5.6 percent. Perhaps the inflation aspect of the labor data is the lynchpin. Wage growth has struggled to catch traction. A particularly weak showing here, on the other hand, could reinforce the more distant timeline the market has on hikes and instead lead to a downgrade in FOMC forecasts at the March meeting.

Monetary policy is the engaged fundamental driver at the moment, but it is important for Forex traders not to take their eyes off of systemic investor sentiment. In the ‘risk on’ position, progress is slow and struggles to draw in the entire market. However, should full scale ‘risk aversion’ strike, conviction will span the financial system. As momentum picks up, the Dollar will see its haven appeal swell. Yet, in the early stages of such a dynamic shift, the same yield curve appeal the currency cultivated these past months could lead to capital outflow. Should sentiment turn, the Greenback’s bearing will depend on how hot the fire is.