USD/JPY News and Analysis

- Japanese gauge of widespread inflation rises at its fastest pace since 2001

- USD/JPY heads lower as the dollar slides further

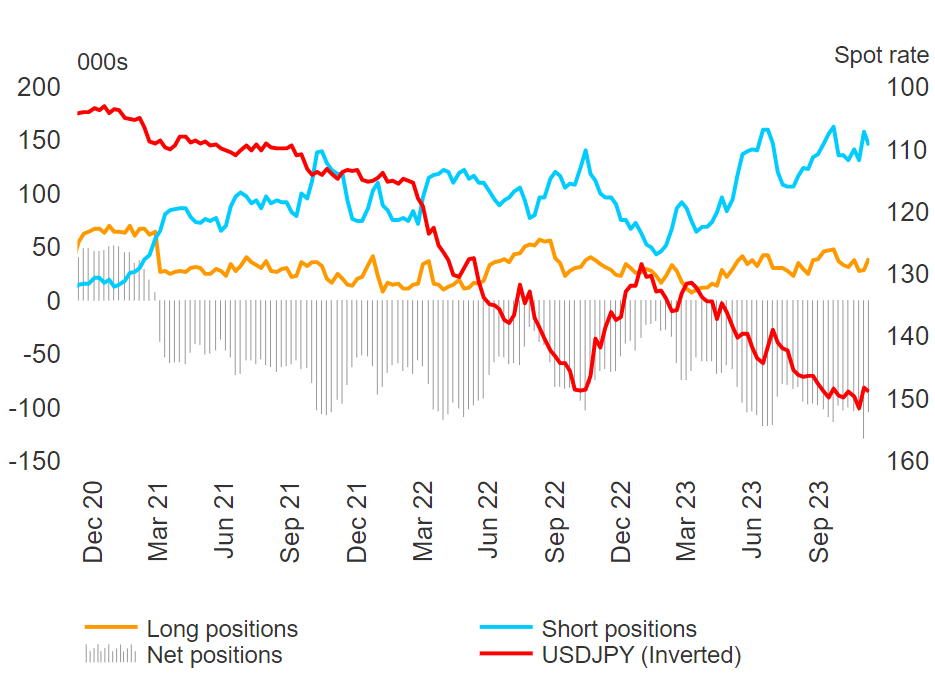

- JPY remains heavily net-short (large speculators) but not as short as last week

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Japanese gauge of widespread inflation rises at its fastest pace since 2001

The weighted median inflation rate is often looked at as a yardstick for widespread price pressures and the data point has build on September’s rise. The rate came in at 2.2% in October, up from 2.0% for September as price pressures appear to becoming more entrenched within the Japanese economy.

Wage growth as well as expectations of higher wages has been on the up since January of this year when firms offered the biggest pay hike in the last 30 years and increases were observed across a broad range of industries too. Higher salary costs and input prices motivate companies to pass on the higher costs to consumers who then negotiate better pay packages and so on.

The cycle is likely to provide the Bank of Japan with a big decision to make regarding stepping back from a prolonged period of ultra-low interest rates. Kazuo Ueda has also recently stated he is not convinced that inflation will sustainably breach the 2% target but there are still more data points to consider before Q1 next year – a time frame revealed during consultations with the bank. Initially it was thought the BoJ would have enough data on hand to make a decision at the end of this year, but the timeframe appears to have been dragged out by three months.

USD/JPY Heads Lower as the Dollar Slides Further

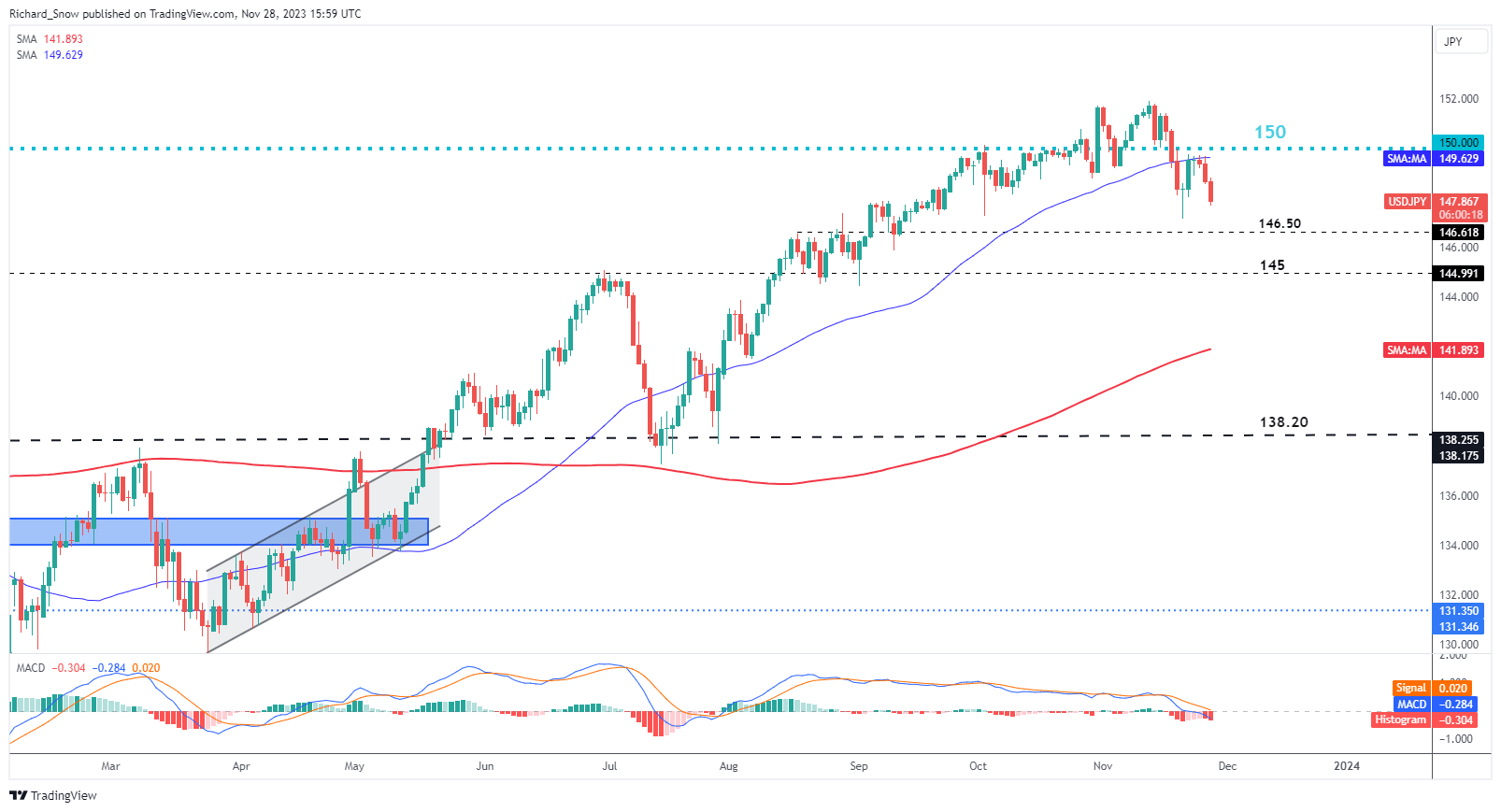

Reversing lower ever since testing the 50-day simple moving average, USD/JPY continues to move to the downside, mainly due to a weaker US dollar. A number of Fed speakers provided their thoughts on policy and inflation with the Fed’s Waller noted cooling in consumer spending as well as manufacturing and services activity. In addition, he acknowledged that policy is well positioned to slow the economy – letting off more steam for the greenback as markets grow in confidence that the Fed has come to the end of the rate hiking cycle.

Support lies at the recent swing low of 147.150 and then 146.50, followed by 145 flat. Resistance remains at the 50 SMA and thereafter the 150 mark. The threat of FX intervention has cooled substantially ever since the pair responded in accordance with a weaker dollar, something that was absent at the start of the dollar decline.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

‘Smart money’ remains heavily net-short on the yen, a position that may lose support if the bearish move extends.

Speculative Positioning from the most recent CoT data

Source: Refinitiv, prepared by Richard Snow

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX