Euro (EUR/USD, EUR/GBP) Analysis

- Minutes suggest the ECB is content with rates, focused on the economy

- US CPI threatens recent EUR/USD pullback

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Minutes Suggest the ECB is Content with Rates, Focused on the Economy

ECB minutes revealed it was a close call to raise interest rates for the tenth and possibly last time, the last time the Governing Council met. The majority of officials anticipate that record high interest rates (4%) will play a huge role in forcing inflation back to the 2% target.

Now the focus turns to the European economy which has had to endure the effects of elevated prices during a global growth slowdown that has heavily impacted its major trading partner, China. The German manufacturing sector has been particularly hard hit, leading the rest of Europe lower. No doubt the ECB will be watching government bond yields after higher US borrowing costs led the way for other developed markets. Italian bond yields will be top of the list as they have traditionally been vulnerable to expanding yields due to the large budget deficit, elevated debt and lack if fiscal discipline. ECB officials remain hopeful to avoid a recession this year. With anemic growth witnessed thus far in Europe, a soft landing remains a massive challenge.

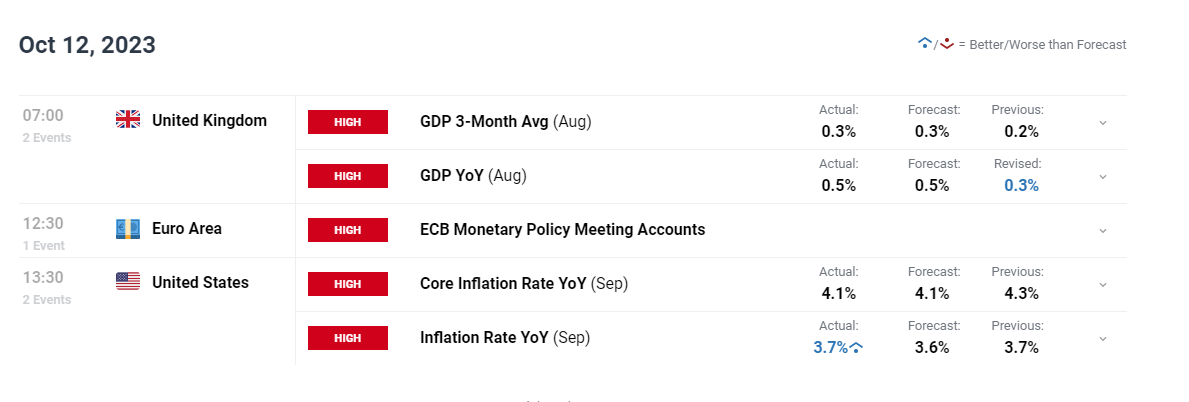

However, US CPI data provided the largest catalyst of the day, prompting a rise in the weaker USD as headline inflation rose slightly above forecast, coming in at 3.7% vs 3.6% forecasted. Rising oil prices pose a potential challenge to recent progress on inflation.

Customize and filter live economic data via our DailyFX economic calendar

With central banks favouring an end to the tightening cycle, how will the Euro fare in Q4? Read our Euro Q4 Forecast below:

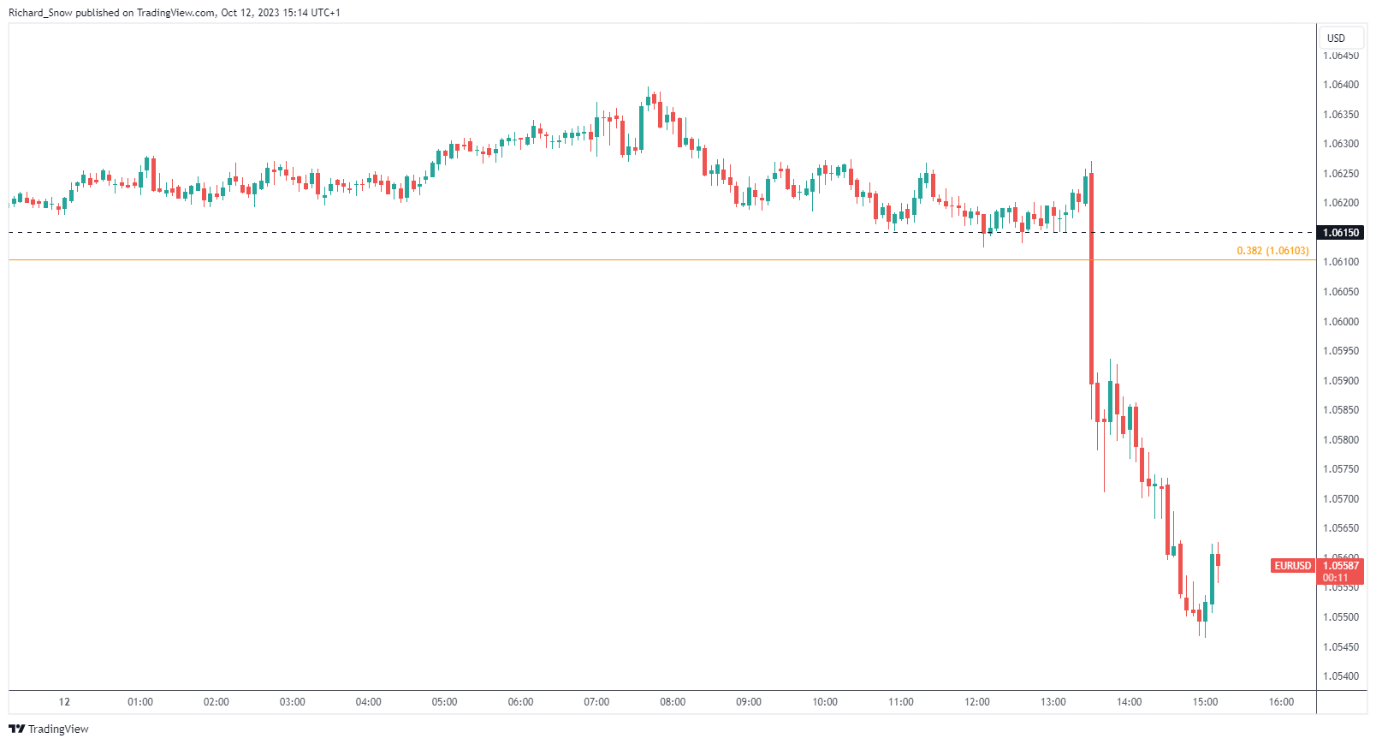

The immediate reaction in EUR/USD saw a move to the downside, as the surprise to the upside reignited concerns around sticky inflation after numerous Fed officials communicated a cautious approach to future tightening with many stating a satisfaction with the current level of interest rates.

EUR/USD 5-Minute Chart

Source: TradingView, prepared by Richard Snow

US CPI Threatens Recent EUR/USD Pullback

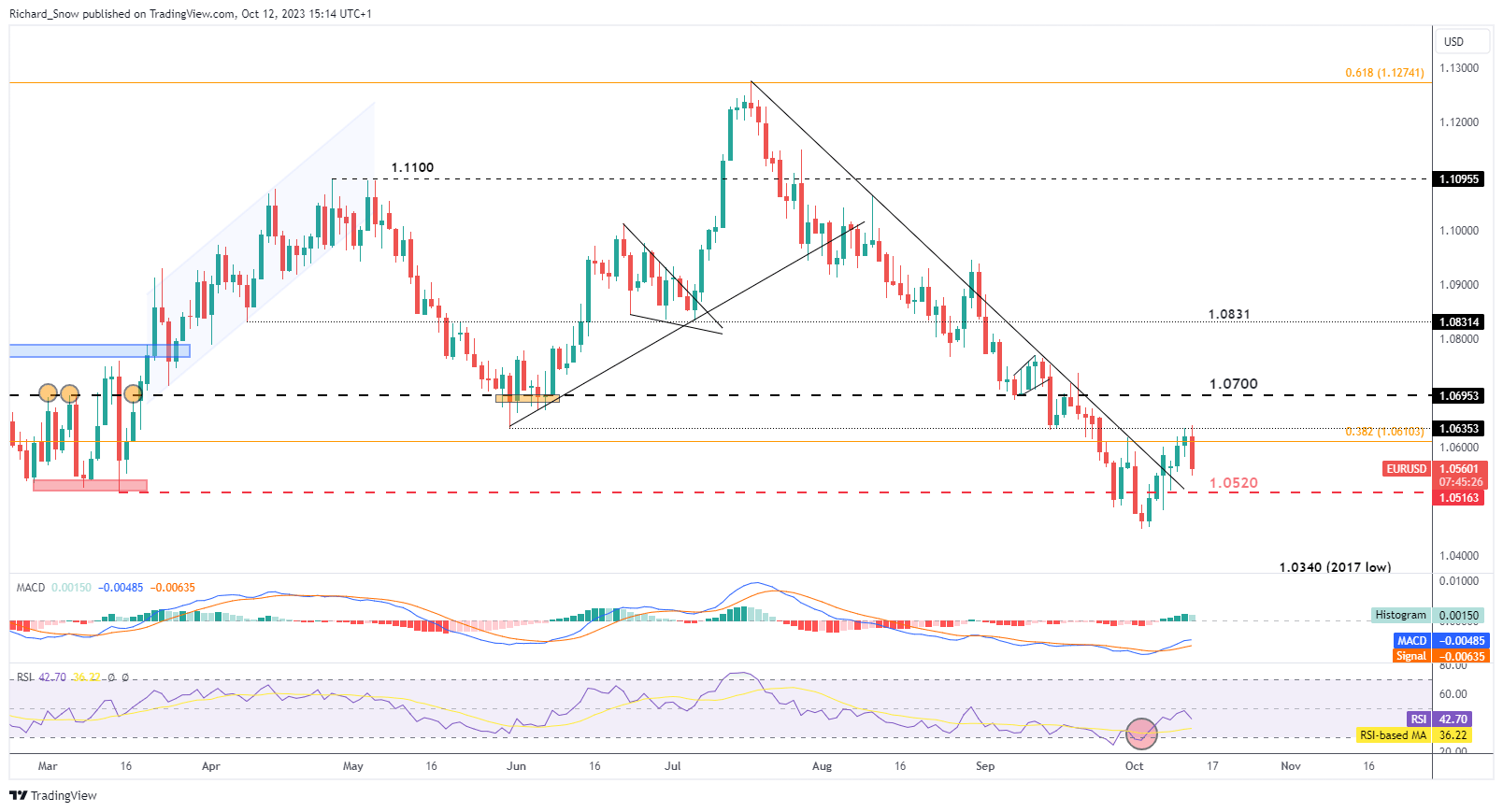

The higher inflation print sees EUR/USD resume the longer-term downtrend after turning around 1.0635 – the 31st of May swing low. 1.0520 is the next level of support which may coincide with trendline support.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | 14% | -3% | 3% |

| Weekly | -14% | 11% | 0% |

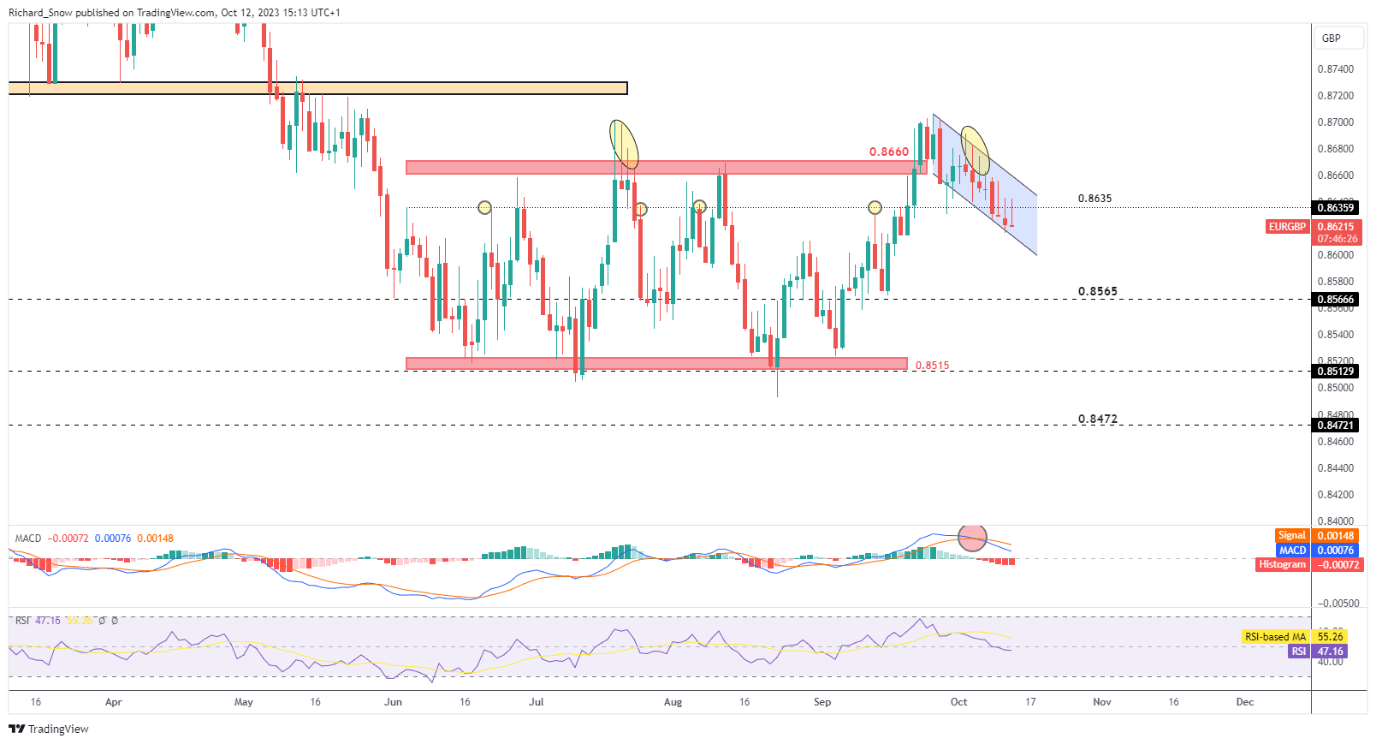

The EUR/GBP pair resumes the shorter-term move lower as the daily chart reflects higher upper wicks on the daily chart – a rejection of higher prices. Prices now approach the underside of the descending channel after crossing below 0.8635 – a prior key level of resistance. Momentum, according to the MACD, favours further downside with the RSI nowhere near oversold conditions. Resistance appears at 0.8635.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX