GBP/USD Analysis and Charts

- GBP/USD’s broad range is holding into a busy week

- The Fed is up first, with the BoE to follow

- With no change priced in for both, what they have to say will dominate trade

Learn How to Trade GBP/USD with our Expert Guide

The British Pound has been confined to a clear trading range against the United States Dollar since mid-December and wasn’t about to break it on Wednesday. After all there are only hours to go before the Federal Reserve’s first monetary policy statement of the year.

The Fed is coming up on Wednesday, with the Bank of England’s own interest-rate decision due just a day later. Neither central bank is expected to alter its policy settings but the meat for markets will lie in how ready they seem to do so later this year. The US central bank has so far tamed inflation more successfully than the British, but there are signs everywhere that prices are coming back under control.

This could even be the first policy conclave since 2011 that sees no UK rate-setter voting for tighter credit. Could one (or more) even lean toward a cut? Probably not yet, but it’s possible.

The major risk would seem to be that both central banks disappoint in terms of apparent eagerness to ease rates. They might. The US economy is still expanding at a reasonable clip, according to most recent data. The UK is still weaker, with inflation much further above target. The case that neither is crying out for lower rates now can still be made.

Still, there may not be much movement for GBP/USD unless this disappointment is skewed toward one of the central banks. The decision to hold rates is now well in the price. All the market can do is wait.

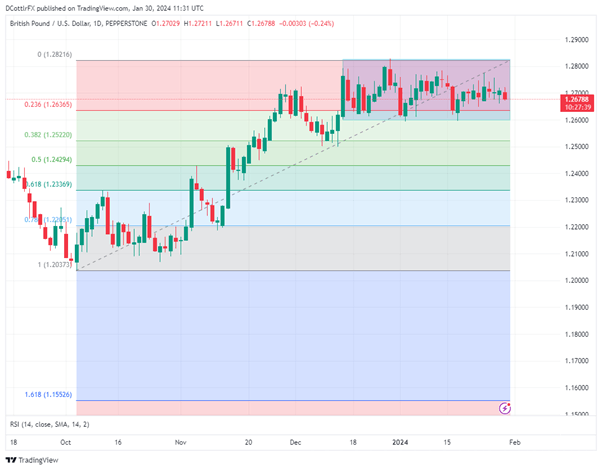

GBP/USD Technical Analysis

GBP/USD Daily Chart Compiled Using TradingView

The Pound is stuck in a range effectively between late December’s 1.28247 top and the first Fibonacci retracement of the rise to that four-month peak from the lows of early October. That comes in at 1.26365.

There also appears to be quite strong support below that at the 1.26 psychological level. The market has bounced there twice in the past month. If Sterling bulls are going to make another attempt at the range top, they’ll need to retake January 24’s intraday top of 1.27764, a level which hasn’t been approached since.

While it doesn’t look as through they have the momentum to try that just yet, it’s notable that GBP/USD is range trading at a relatively high level by recent standards. This makes fundamental sense, of course, as the Fed is expected to cut rates earlier and deeper than the BoE.

If the market comes out of this week’s meetings with the same impression, the Pound could rise sharply.

| Change in | Longs | Shorts | OI |

| Daily | -5% | -15% | -10% |

| Weekly | -10% | 3% | -5% |

--By David Cottle for DailyFX