RAND ANALYSIS & TALKING POINTS

- Risk sentiment improves on China stimulus pledge.

- Fed likely to hike but where to next?

- ZAR bulls look to expose R17.50/$.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

USD/ZAR FUNDAMENTAL BACKDROP

The South African rand broke yet another key support level today as it sets its sights on the R17.50/$ handle. Buoyed by Chinese optimism after the global superpower pledged to provide stimulus for the flailing economy, bolstering the traditional positive relationship it maintains with the ZAR. That being said, attention now shifts towards the FOMC announcement tomorrow where the Federal Reserve is expected to hike by 25bps (of which I do not expect any change); however, forward guidance will be closely monitored to gain any clues to possible changes to the current predicted hiking cycle.

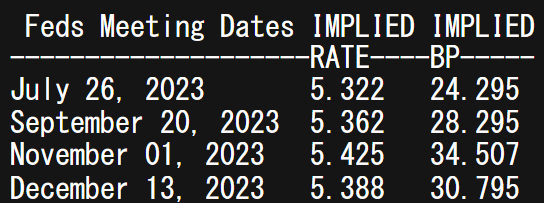

Money markets (refer to table below) are currently pointing to a ‘one and done’ scenario where this could potentially be the last interest rate hike with the first cut anticipated around June/July 2023. Considering the SARB has held an aggressive monetary policy stance up until now, the carry trade appeal should the Fed decide to adopt a more dovish approach could be beneficial for the rand.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

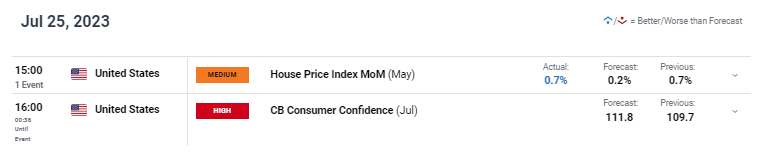

The economic calendar (see below) is US dominated today as will be the case throughout the rest of the trading week and today’s data has kicked off in favor of USD upside via the house price index that did not fall as forecasted but rather maintained a growth level of 0.7%. CB consumer confidence is up next and if actual figures print in line with estimates, the greenback may claw back some of its lost gains thus far.

USD/ZAR ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

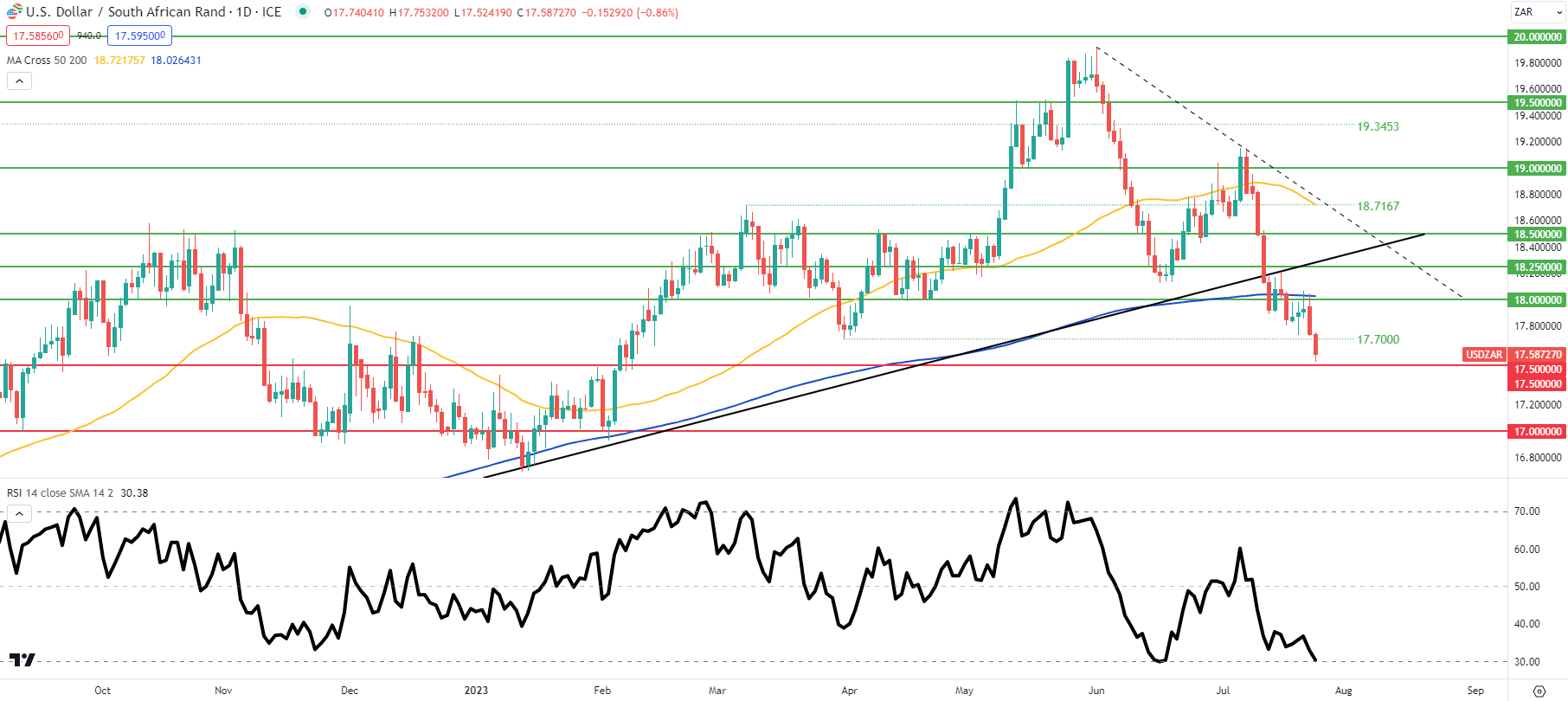

TECHNICAL ANALYSIS

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

Daily USD/ZAR price action is on the edge of oversold territory as measured by the Relative Strength Index (RSI) but remains higher than the previous RSI low. In contrast, USD/ZAR levels are printing lower lows thus indicative of bullish divergence that could point to impending upside to come for the pair. There is already some reluctance by traders around the 17.5000 psychological handle which could be a sign of fatigue from bears. Should we see a confirmation close below 17.5000 there could be a significant drop towards 17.0000.

Resistance levels:

- 18.0000/200-day moving average

- 17.7000

Support levels:

- 17.5000

- 17.0000

Contact and followWarrenon Twitter:@WVenketas