EUR/USD OUTLOOK:

- The euro falls sharply against the U.S. dollar, failing to sustain Monday’s breakout

- Weak economic data in Europe weighs on the common currency

- The ECB’s policy decision may set the tone for the euro later this week

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Most Read: Canadian Dollar’s Outlook Hinges on Bank of Canada. What to Expect for USD/CAD?

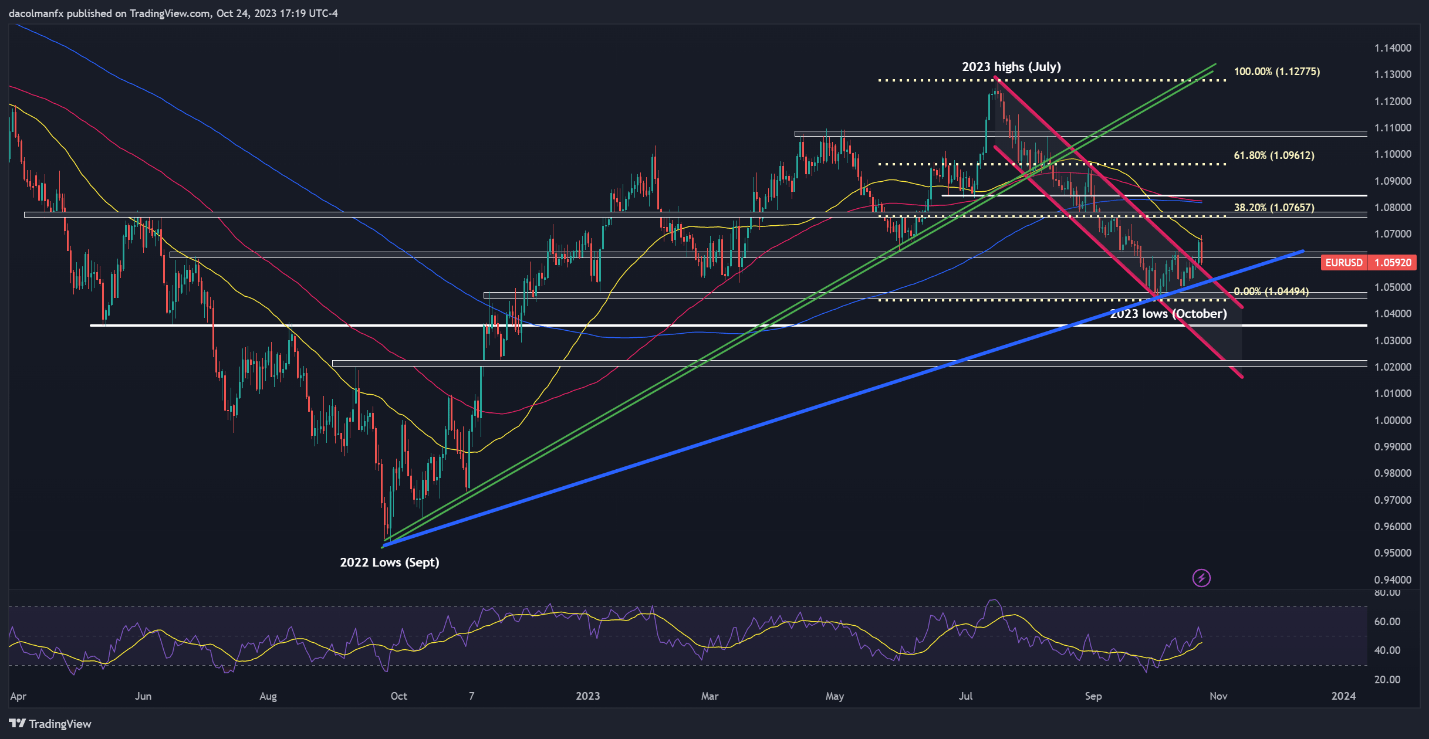

EUR/USD dropped sharply on Tuesday (-0.72% to 1.0590), relinquishing the gains it had garnered at the beginning of the week, and failing to maintain its bullish breakout, a sign that sellers have reasserted themselves after a short period of indecision.

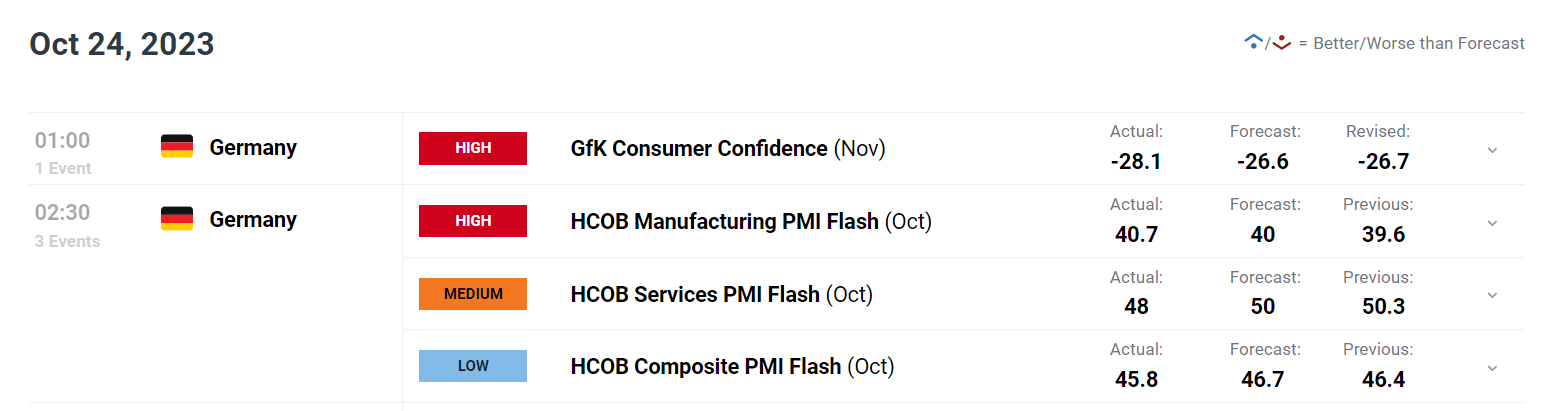

In terms of price action catalysts, the common currency’s pullback was driven by disappointing eurozone data. By way of context, October German business activity, as reflected by the S&P Global composite PMI, fell further into contraction territory, raising concerns that a recession is underway in Europe's largest economy.

GERMAN DATA

Source: DailyFX Economic Calendar

Curious to know the likely trajectory for EUR/USD and the market catalysts that should be on your radar? Find all the information you need in our Q4 euro trading forecast. Download it now!

Economic fragility could challenge market expectations that interest rates will remain at elevated levels for an extended period despite the European Central Bank’s rhetoric, creating the right conditions for regional bond yields to come under pressure.

We'll gain more insights into policymakers’ thinking later this week when the European Central Bank announces its monetary policy decision. That said, the institution led by Christine Lagarde is seen hitting the pause button after having delivered 450 basis points of tightening over the past ten meetings.

Traders have already factored in this anticipated pause, so it is important to closely monitor guidance, placing a particular focus on President Lagarde's communication. If the central bank chief signals that this isn’t just a short hiatus to gather more data to better assess the outlook but rather the conclusion of the hiking cycle, the euro could suffer large losses against the U.S. dollar.

On the other hand, should the guidance indicate the possibility of another rate increase in the future, perhaps in December, EUR/USD could find itself in a favorable position for a cautious rebound. However, any potential gains would likely be limited due to the prevailing interest rate differentials between the U.S. and Europe.

Want to find out how retail positioning can shape the short-term trajectory of EUR/USD? Our sentiment guide has all the relevant information you may be looking for. Grab a free copy now!

| Change in | Longs | Shorts | OI |

| Daily | -19% | -10% | -14% |

| Weekly | -24% | 26% | -3% |

EUR/USD TECHNICAL ANALYSIS

EUR/USD breached channel resistance early in the week, but the lack of follow-through on the upside and the subsequent reversal on Tuesday strongly implies that the initial breakout was, in fact, a fakeout.

We’ll have more clues about market dynamics in the coming days, but if prices extend lower following the bearish fakeout, the first floor to keep an eye on rests at 1.0575. Below that threshold, the focus is on trendline support at 1.0515, followed by this year’s lows just a touch below the 1.0500 handle.

Conversely, if buyers stage a comeback and drive the exchange rate higher, initial resistance appears at 1.0625, and 1.0675 thereafter, which corresponds to the 50-day simple moving average. On further strength, attention transitions to 1.0765, the 38.2% Fibonacci retracement of the July/October slump.

If trading losses have dampened your spirits, consider taking a proactive approach to enhance your skills. Download our guide, "Traits of Successful Traders," to access invaluable insights that may help you sidestep typical trading pitfalls.

EUR/USD TECHNICAL CHART