AUD/USD ANALYSIS & TALKING POINTS

- RBA’s Kohler and China new yuan loans beat couple to sustain AUD.

- RBA pricing remains open for future rate hikes.

- AUD/USD cautious ahead of US CPI tomorrow.

Elevate your trading skills and gain a competitive edge. Get your hands on the Australian dollar Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

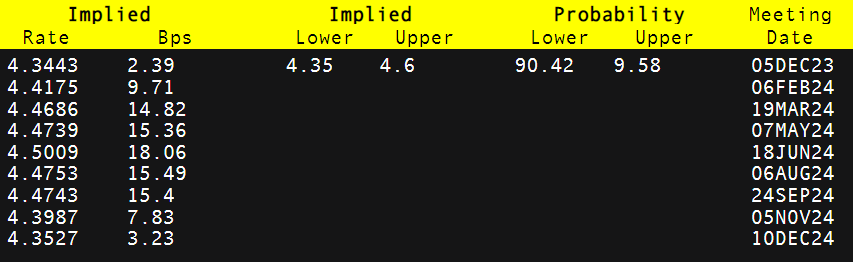

The Australian dollar has benefitted from a hawkish narrative presented by the Reserve Bank of Australia’s (RBA) Kohler earlier this morning. The Assistant Governor highlighted the path to bring down inflationary pressures in Australia may be tougher than expected. As with the United States, a tight labor market has been a key contributor to elevated inflation in Australia. Money markets have therefore kept the door open for an additional interest rate hike in 2024 (refer to table below) as investors await further incoming data.

RBA INTEREST RATE PROBABILITIES

Source: Refinitiv

China’s new yuan loans were released early in the European trading session and although the figure fell sharply from the prior print, new yuan loans exceeded forecasts coming in at CNY738.4B vs CNY665B expected. This comes in an environment where the Chinese government has flooded the local market with cash while easing monetary policy conditions by cutting interest rates. Inflation has been falling and commodity linked pro-growth currencies like the AUD require a strong Chinese economy to gain traction against the USD.

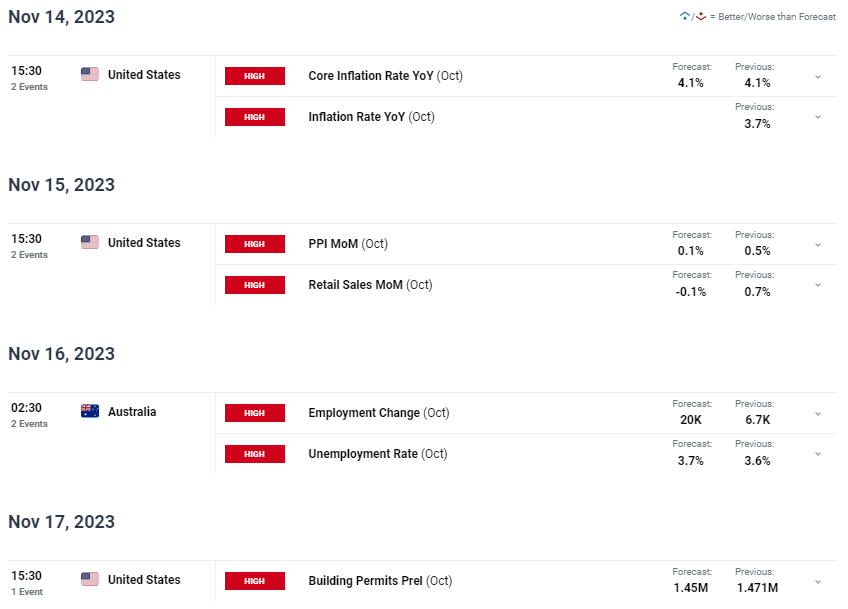

While there is little in the way of economic data today barring some Fed speak, the week ahead (see economic calendar) is scattered with potentially market moving releases including US CPI and Australian labor data. Both sets of reports will help markets evaluate the overall messaging by the respective central banks as per recent commentary from officials.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

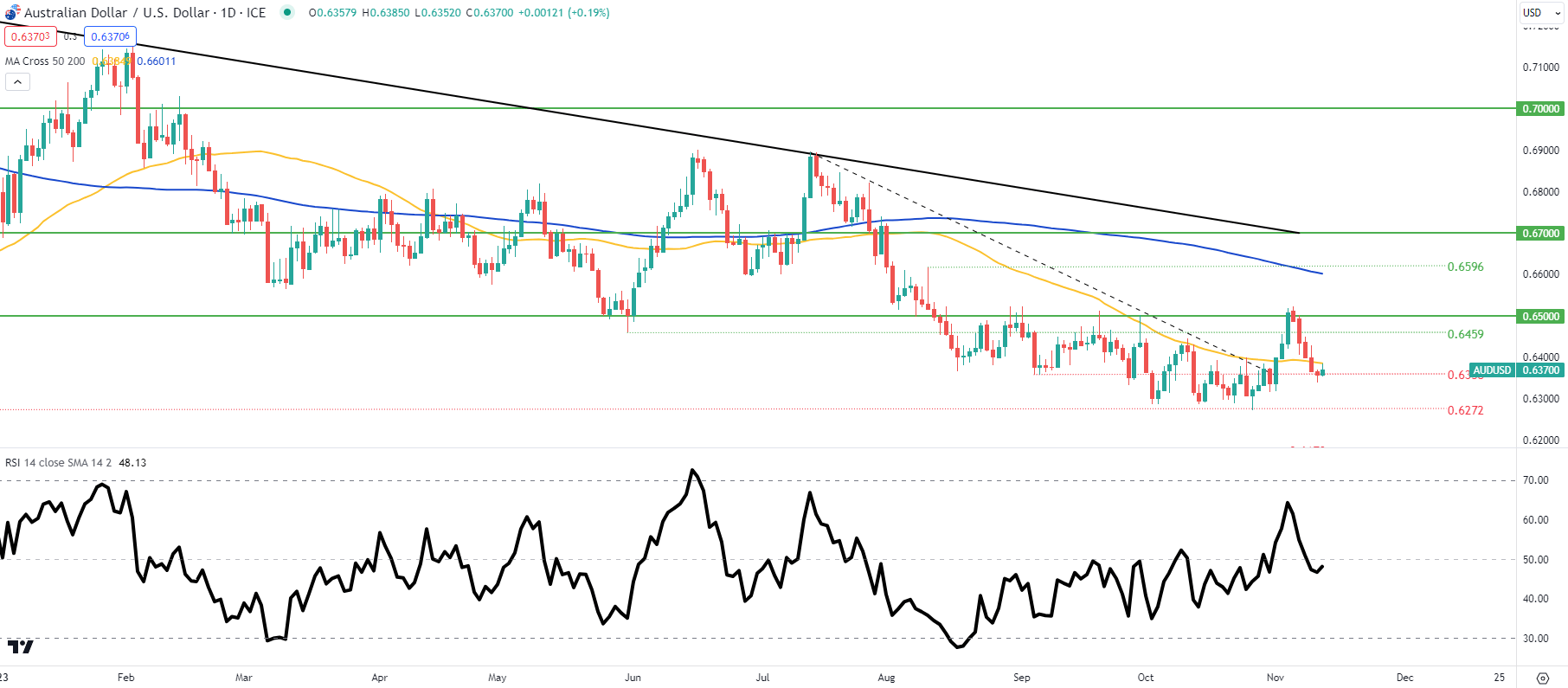

TECHNICAL ANALYSIS

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

Yet another failure by AUD bulls at the 0.6500 psychological resistance level now keeps the pair below the 50-day moving average (yellow) and above the 0.6358 key support zone. The current daily candle looks to be forming a long upper wick and should this candle close in this fashion, further downside may ensure for AUD/USD.

Key resistance levels:

- 0.6500

- 0.6459

- 50-day MA

Key support levels:

- 0.6358

- 0.6272

IG CLIENT SENTIMENT DATA: MIXED (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 82% of traders currently holding long positions.

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas