EUR/USD Forecast - Prices, Charts, and Analysis

Learn how to trade the most active fx-pair with our complimentary guide

Most Read: US Dollar (DXY) Latest: Markets Ignore Fed Rate Pushback, GBP/USD and EUR/USD

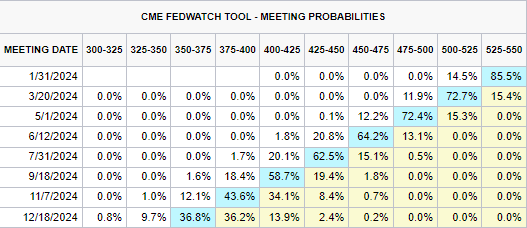

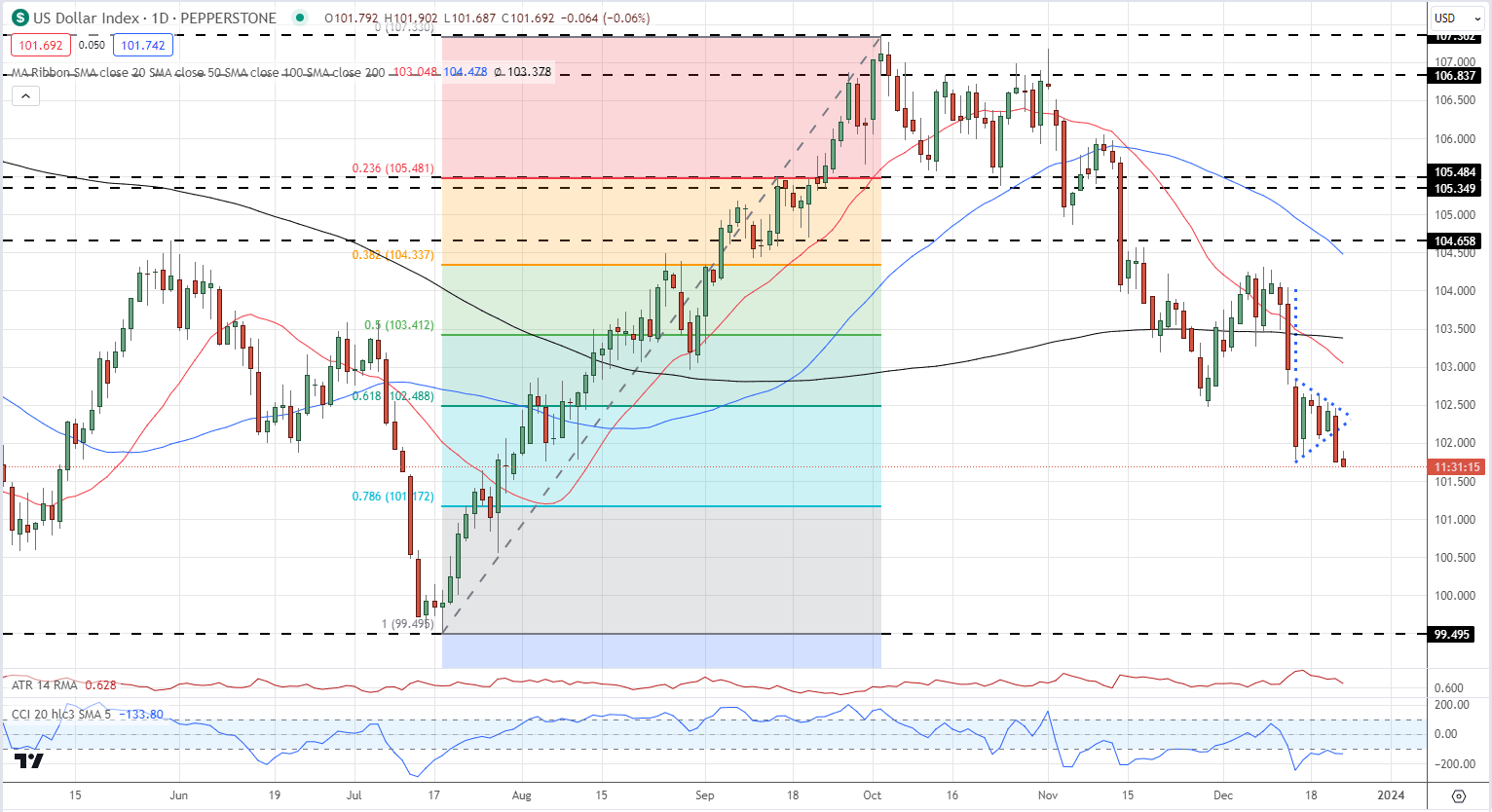

The Euro continues this week’s move higher against a weakening US dollar and is touching levels last seen over four months ago. The single currency is higher against a range of currencies this week as markets pare back elevated rate cut expectations. In comparison, the US dollar keeps moving lower with the US dollar index back at levels last seen at the end of July. US Treasury yields are also pressing against multi-month lows as traders front-run a series of US rate cuts next year. According to the latest CME predictions, the Fed is set to cut rates by 25 basis points at seven FOMC meetings next year.

US Dollar Index Daily Chart with Bearish Pennant Breakout

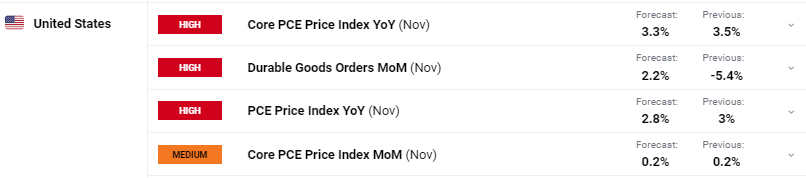

Later today the November US core PCE data will be released, the last heavyweight data event before the market closes down for the festive break. Core PCE y/y is seen falling from 3.5% to 3.3%. A reading below forecast could see the US dollar tumble further.

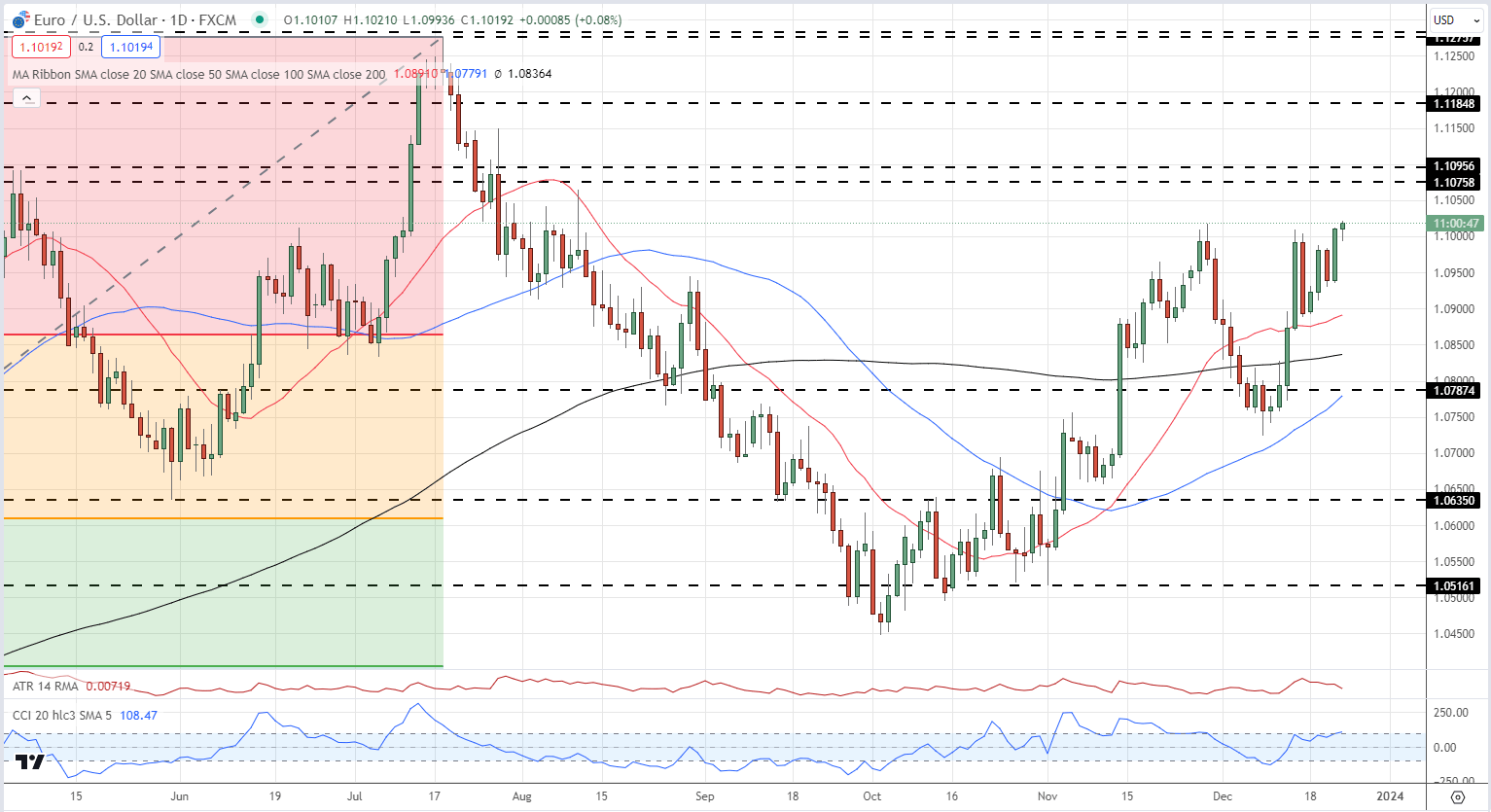

The daily EUR/USD chart retains a positive outlook and may test the 1.1075-1.1095 area when the markets return back to normal at the start of next year. All three simple moving averages are supportive and while the CCI indicator suggests the pair are overbought, the reading is not in extreme territory yet. A continuation of the recent multi-week series of higher lows and higher highs looks likely.

EUR/USD Daily Chart

Chart Using TradingView

IG retail trader data shows 34.53% of traders are net-long with the ratio of traders short to long at 1.90 to 1.The number of traders net-long is 16.38% lower than yesterday and 0.80% lower from last week, while the number of traders net-short is 18.51% higher than yesterday and 10.53% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

To See What This Means for EUR/USD, Download the Full Report Below

| Change in | Longs | Shorts | OI |

| Daily | -9% | 1% | -5% |

| Weekly | 1% | 4% | 2% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.