EUR/USD Main Talking Points:

- EUR/USD’s Fed-inspired slide didn’t break its downtrend or trading range

- The Single currency is creeping back up within that range

- There are still plenty of European Central Bank speakers on tap this week

The Euro continues its modest recovery against a United States Dollar still well-underpinned by the prospect of interest rates staying higher for longer.

Last week’s commentary from Federal Reserve Chair Jerome Powell to the effect that the Fed will lack a complete-enough picture of the inflationary environment to contemplate a March rate cut sent the greenback soaring against just about everything else in the major-currency space. Other Fed speakers have backed Powell in the days since, with Cleveland Fed President Loretta Mester and Minneapolis’ Neel Kashkari singing broadly from the Chair’s hymn-sheet The message is clear enough; the next move, when it comes, will probably be a cut. But it’s not coming yet.

On the ‘Euro’ side of EUR/USD, the European Central Bank is for its part offering a very similar message. Croatia’s central bank governor Boris Vujcic told Reuters that there’s no rush to bring record-high borrowing costs down and that it would be better to wait and see that inflation has been decisively beaten. Plenty more ECB leaders will be getting before a microphone in the coming days. If they repeat this message, the Euro can likely expect a little more support of its own.

On the data front, German inflation is the week’s probable last gasp out of the Eurozone in terms of trading cues. The bloc’s powerhouse economy is reeling, with industrial production down for seven months straight. Inflation is predicted to have relaxed with economists looking for a final annualized rate of 2.9% in January.

EUR/USD Technical Analysis

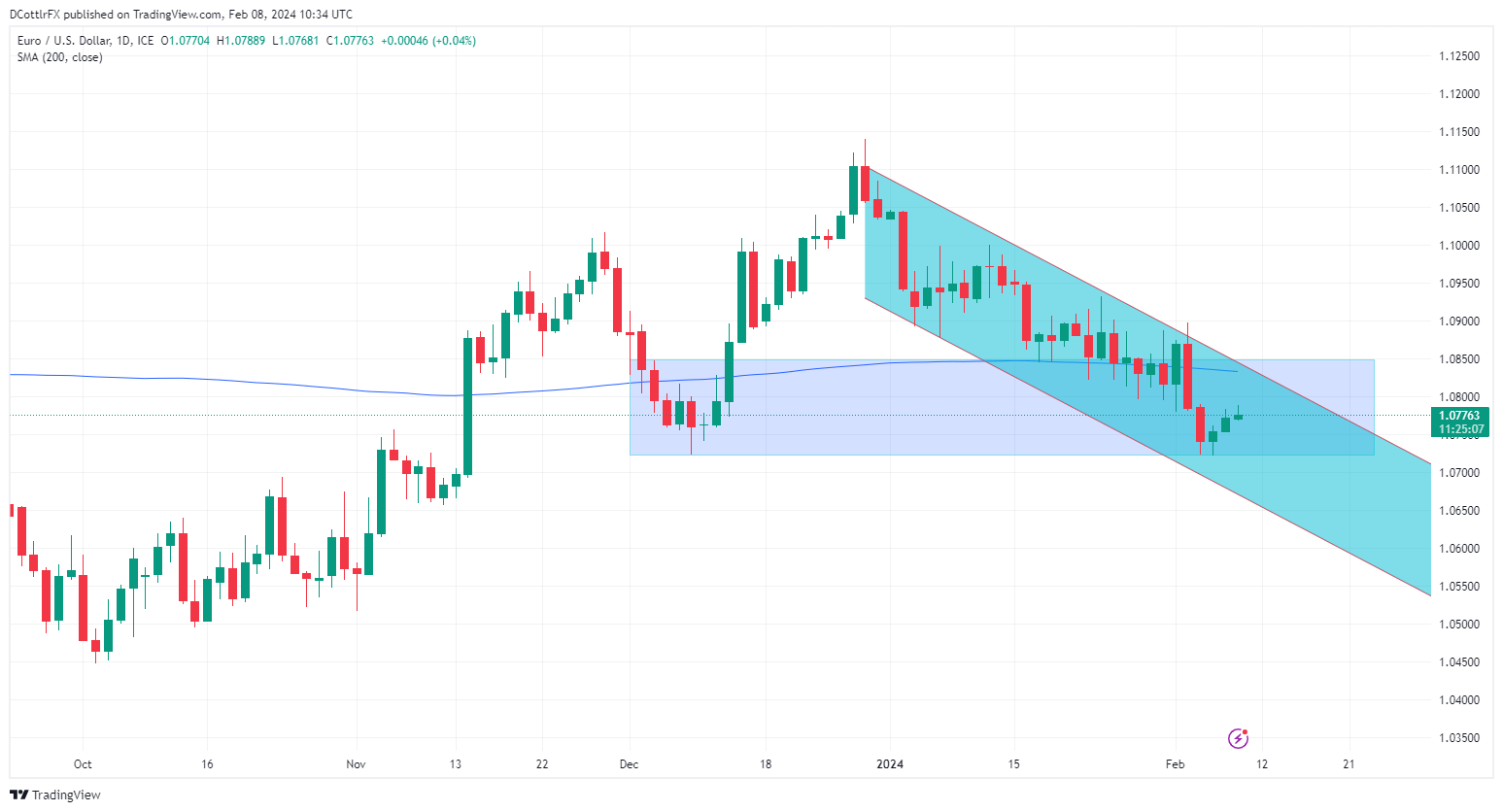

EUR/USD Daily Chart Compiled Using TradingView

The Dollar’s burst of strength between February 2 and 6 has been impressive but, perhaps surprisingly, has neither intensified EUR/USD’s dominant downtrend nor shifted it out of its medium-term trading range.

That range remains valid, with its base at December 8’s intraday low of 1.07427 limiting declines on both February 5 and 6. The pair has spent the past three sessions climbing away from that base, but has yet to put in enough distance from it to make an immediate re-test unlikely. Should it give way, focus will be on psychological support at 1.07 ahead of the area around November 10’s intraday low of 1.06581.

The current downtrend channel probably offers support at 1.06568, but that seems unlikely to face a near-term test. Bulls will have their eyes set on the 200-day moving average which has been above the market all this week so far. It comes in at 1.08298. A break above that would put the range top of 1.08478 back in upside focus.

--By David Cottle for DailyFX