Crude Oil Price Talking Points

The price of oil holds above the weekly low ($81.73) after showing a limited reaction to the smaller-than-expected rise in US inventories, but failure to defend the monthly range may push crude towards the January low ($74.27) as it appears to be tracking the negative slope in the 50-Day SMA ($91.27).

Crude Oil Price to Eye January Low on Failure to Defend Monthly Low

The price of oil appears to have reversed course ahead of the moving average as it struggles to retain the rebound from the monthly low ($81.20), and it remains to be seen if the Organization of Petroleum Exporting Countries (OPEC) will respond to falling crude prices as the group reverts to its prior production schedule.

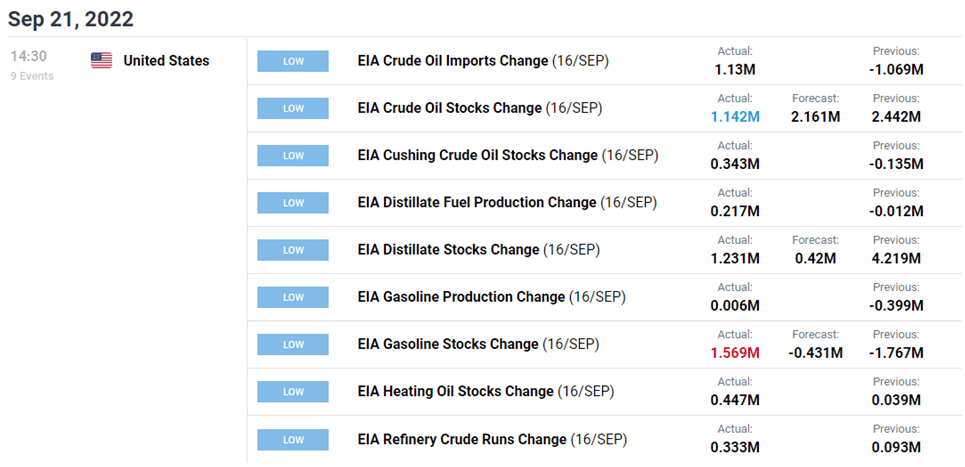

Data prints coming out of the US may encourage OPEC to no longer boost production as oil inventories increase for the third consecutive week, with stockpiles climbing 1.142M in the week ending September 16 versus forecasts for a 2.161M rise.

The development may reinforce OPEC’s expectations for robust demand as the most recent Monthly Oil Market Report (MOMR) states that “in 2023, expectations for healthy global economic growth, combined with anticipated improvements in the containment of COVID-19 in China, are expected to boost oil consumption,” and the group may endorse a wait-and-see approach at the next Ministerial Meeting on October 5 as the rising interest rate environment across advanced economies dampens the outlook for global growth.

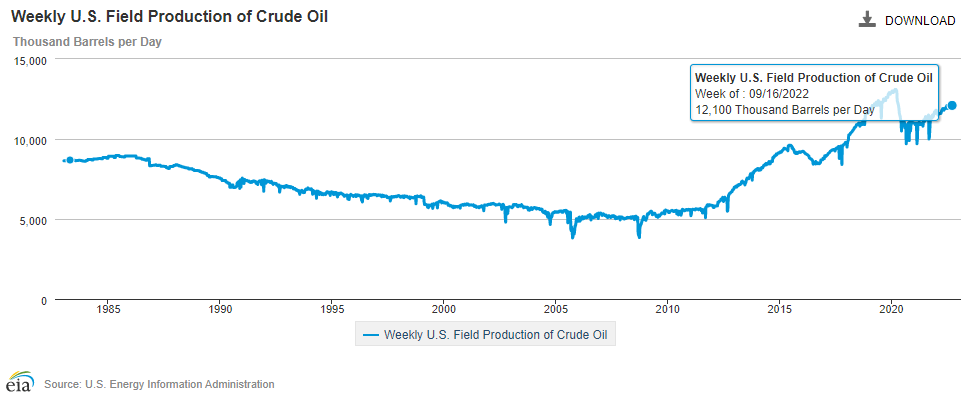

Until then, the price of oil may face headwinds if it fails to defend the monthly low ($81.20), but current market conditions may limit the downside risk for crude as US production remains below pre-pandemic levels.

A deeper look at the figures from the Energy Information Administration (EIA) show weekly field production printing at 12,100K for the four week, and expectations for strong demand along with indications of limited supply may act as a backstop for crude as OPEC reverts to its prior production schedule.

With that said, the price of oil may consolidate ahead of the next OPEC meeting as it appears to be unfazed by the data prints coming out of the US, but failure to defend the monthly range may push crude towards the January low ($74.27) as it appears to be tracking the negative slope in the 50-Day SMA ($91.27).

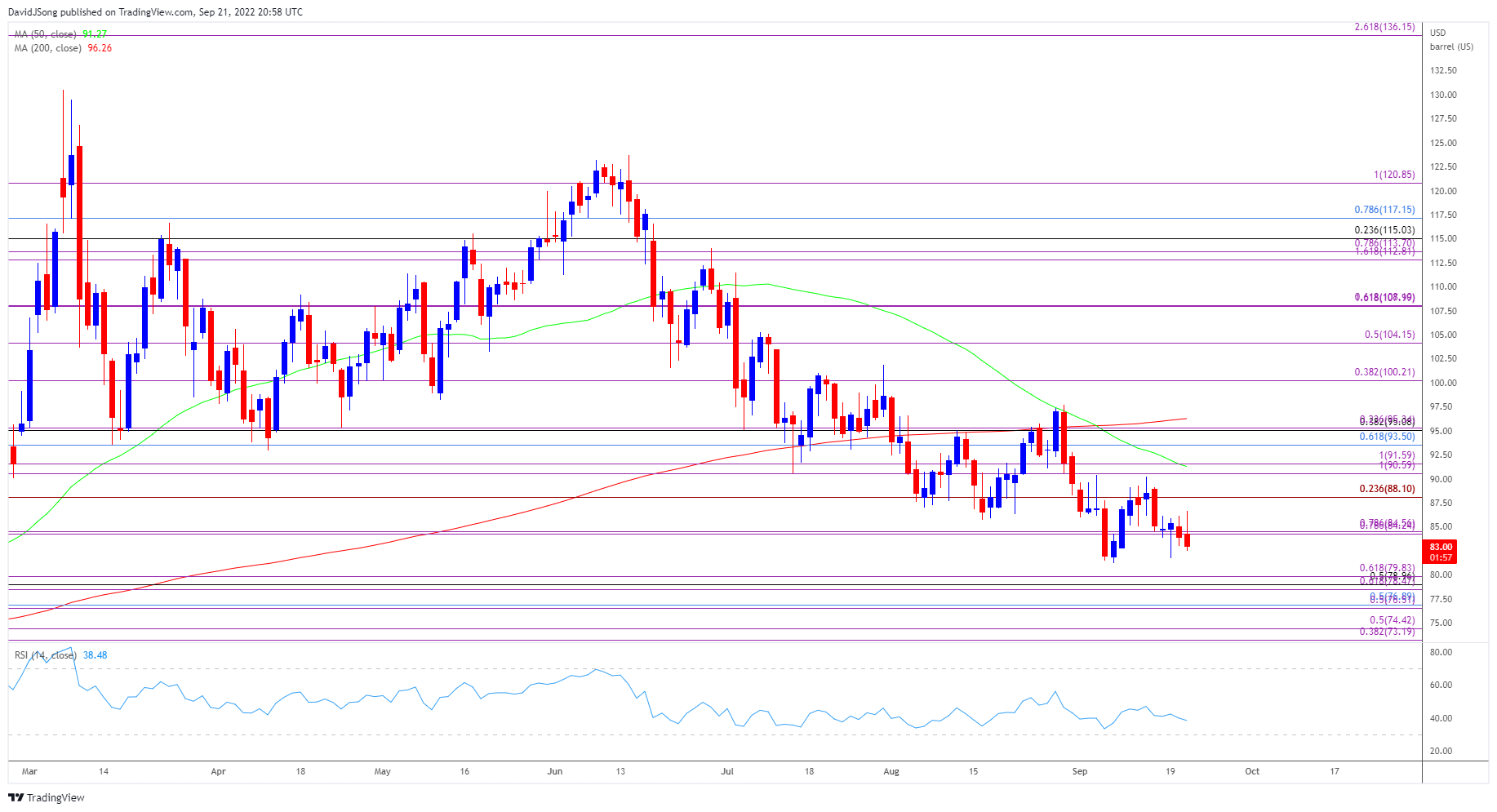

Crude Oil Price Daily Chart

Source: Trading View

- The price of oil appears to have reversed course ahead of the 50-Day SMA ($91.27) as it trades back below the $84.20 (78.6% expansion) to $84.60 (78.6% expansion) region, with a move below the monthly low ($81.20) opening up the Fibonacci overlap around $78.50 (61.8% expansion) to $79.80 (61.8% expansion).

- Next area of interest comes in around $76.50 (50% retracement) to $76.90 (50% retracement) area following by the $73.20 (38.2% expansion) to $74.40 (50% expansion) region, which lines up with the January low ($74.27).

- Nevertheless, the price of oil may face range bound conditions if it continues to hold above the monthly low ($81.20), but need a close above the $84.20 (78.6% expansion) to $84.60 (78.6% expansion) region to bring the $88.10 (23.6% expansion) area back on the radar.

Trading Strategies and Risk Management

Becoming a Better Trader

Recommended by David Song

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong