Oil (Brent Crude) News and Analysis

- The weekend premium was deflated on Monday as markets look to the Fed

- Oil heads lower after respecting resistance at $89 a barrel

- EU data underscores growth slowdown in major economies

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Oil Starts the Week on the Back Foot

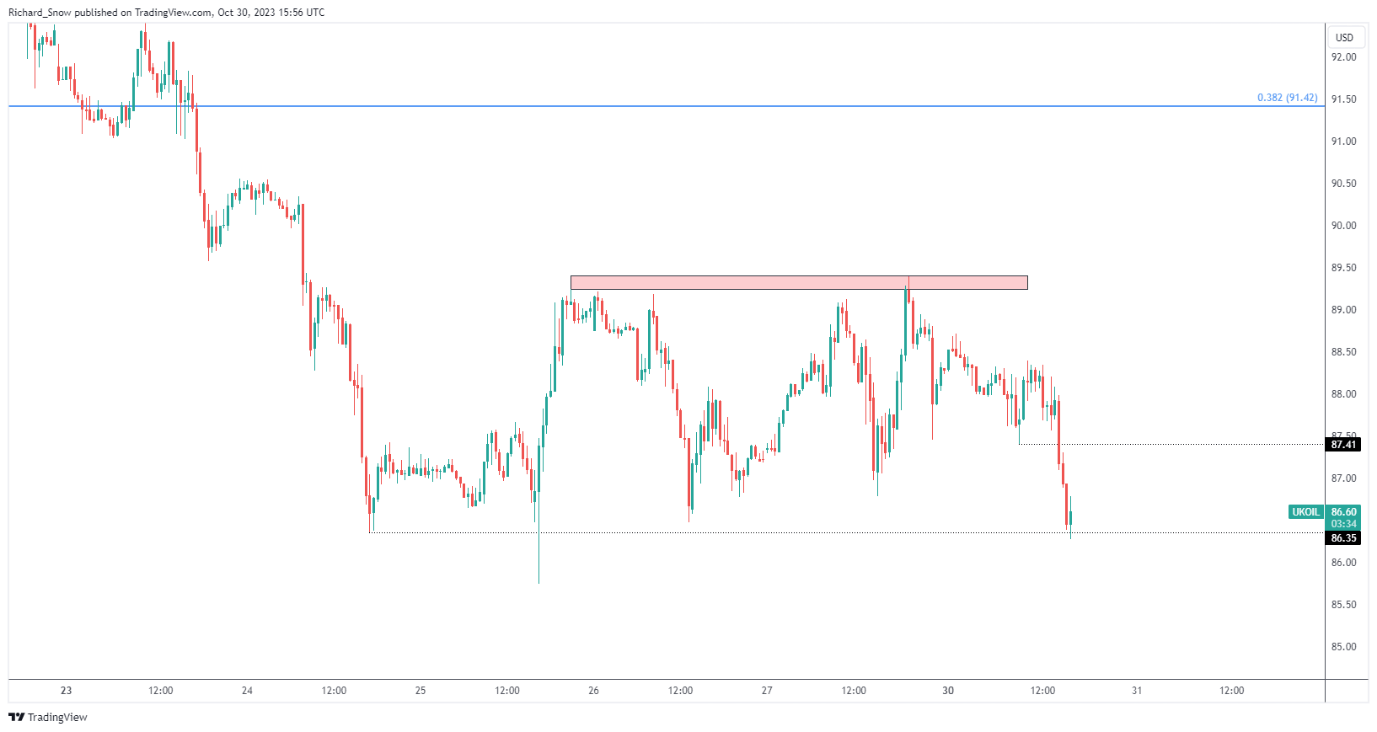

Oil prices were bid on Friday, retesting the $89 per barrel level once again. Two days prior, the same narrow intra-day range was observed between $87 and $89 where prices has remained.

However, today oil dropped sharply back to $87 once it became clear that the war in the Middle East had not escalated to a full ground invasion – a chance markets have not been willing to take. In fact, oil and gold had shown a tendency to rise into the weekend as traders positioned for the worst. Monday then represents a period of reflection and slight relief seeing that a massive operation was avoided or delayed.

Oil has also shown a lower sensitivity to news flow from the region after OPEC distanced itself from political responses after Iran called for an oil embargo on Israel. The focus appears to have become less about supply uncertainties and more about waning global demand for oil as major economies struggle under restrictive conditions. EU data this morning revealed another quarterly contraction in Germany, narrowly avoiding another technical recession after Q2 GDP came in flat. The negative outlook for growth is likely to feed into a lower global demand for oil which may see prices ease into the end of the year.

The 30-minute chart shows the oil price drop on a more magnified level, now testing the $87 level.

Brent Crude 30-Minute Chart

Source: TradingView, prepared by Richard Snow

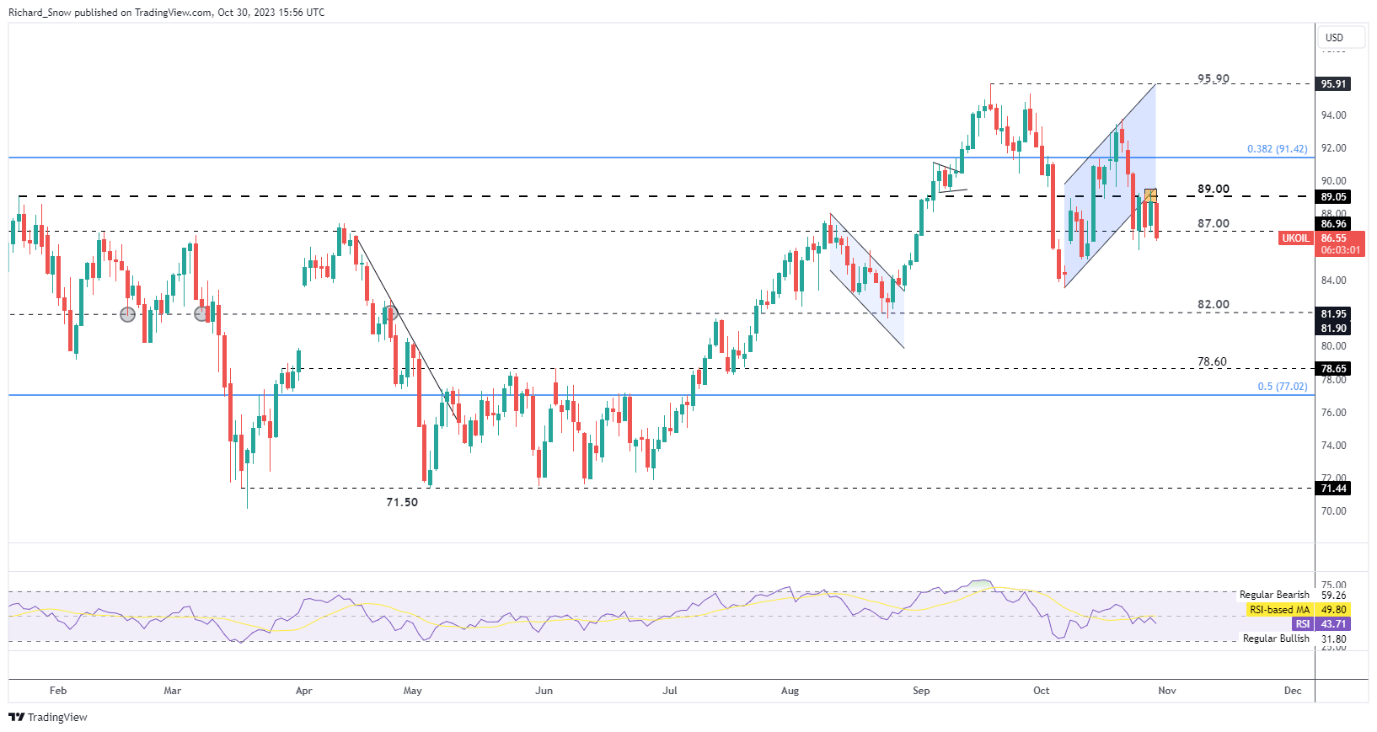

The daily chart shows the multi-day consolidation after invalidating the ascending channel. The direction of the commodity remains uncertain as incoming data shifts the focus from one concern to the next. However, oil supply in the region has been unaffected and therefore, concerns linked to the global growth slowdown may soon outweigh supply concerns, placing downward pressure on oil. A tight oil market should ensure prices do not drop too low, possibly facilitating range bound setups.

Brent Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

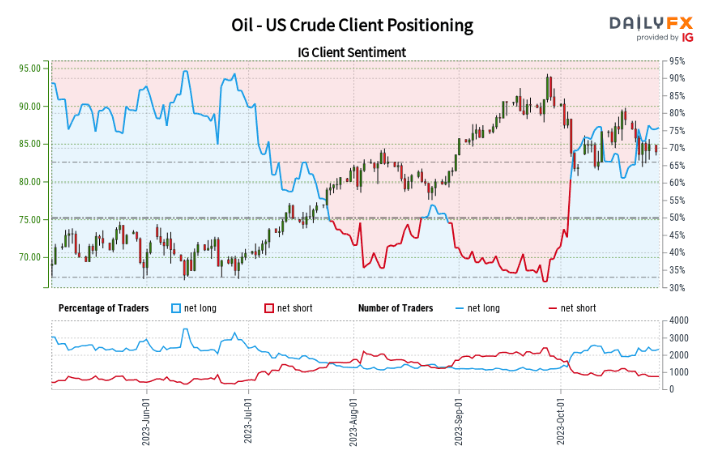

WTI oil sentiment data below can be used as a proxy for Brent crude oil:

Oil- US Crude:Retail trader data shows 77.02% of traders are net-long with the ratio of traders long to short at 3.35 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggestsOil- US Crude prices may continue to fall.

Find out why daily and weekly changes in sentiment can aid/invalidate contrarian signals based entirely on overall positioning data below:

| Change in | Longs | Shorts | OI |

| Daily | 4% | -11% | 1% |

| Weekly | 37% | -33% | 14% |

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX