USD/JPY News and Analysis

- Raised BoJ inflation forecasts and yield curve tweaks lay groundwork for policy pivot

- The yen heads lower, sending USD/JPY above the closely watched 150 marker

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Raised BoJ Inflation Forecasts and Yield Curve Tweaks Lay Groundwork for Policy Pivot

Minutes from the BoJ’s October meeting acknowledged that current conditions are making progress towards sustainably achieving the 2% inflation target. The updated October forecast raised the level of inflation over the forecast period into the end of 2025.

The bank has stated its preconditions for a monumental policy change which include: inflation meeting the 2% target stably and sustainably, as well as witnessing rising wage growth. The inflation condition comes with a caveat that the cause of the inflation cannot be ‘cost-push’ inflation like what we’ve seen in the wake of the energy crisis but rather as a result of ‘demand-pull’ inflation due to elevated local activity.

While wages and inflation have been rising, the bank’s Governor Ueda has stated that there is “still some distance to cover”. The BoJ Governor had previously hinted that the bank would have enough data on hand by the end of the year to make a decision on pivoting away from negative interest rates.

In the meantime, the bank is normalizing the local bond market, allowing more flexibility in yields which would see a greater tolerance around the 1% mark. Such a move attempts to reduce volatility when the bank eventually makes the call to normalize interest rates.

USD/JPY Rises after BoJ Minutes

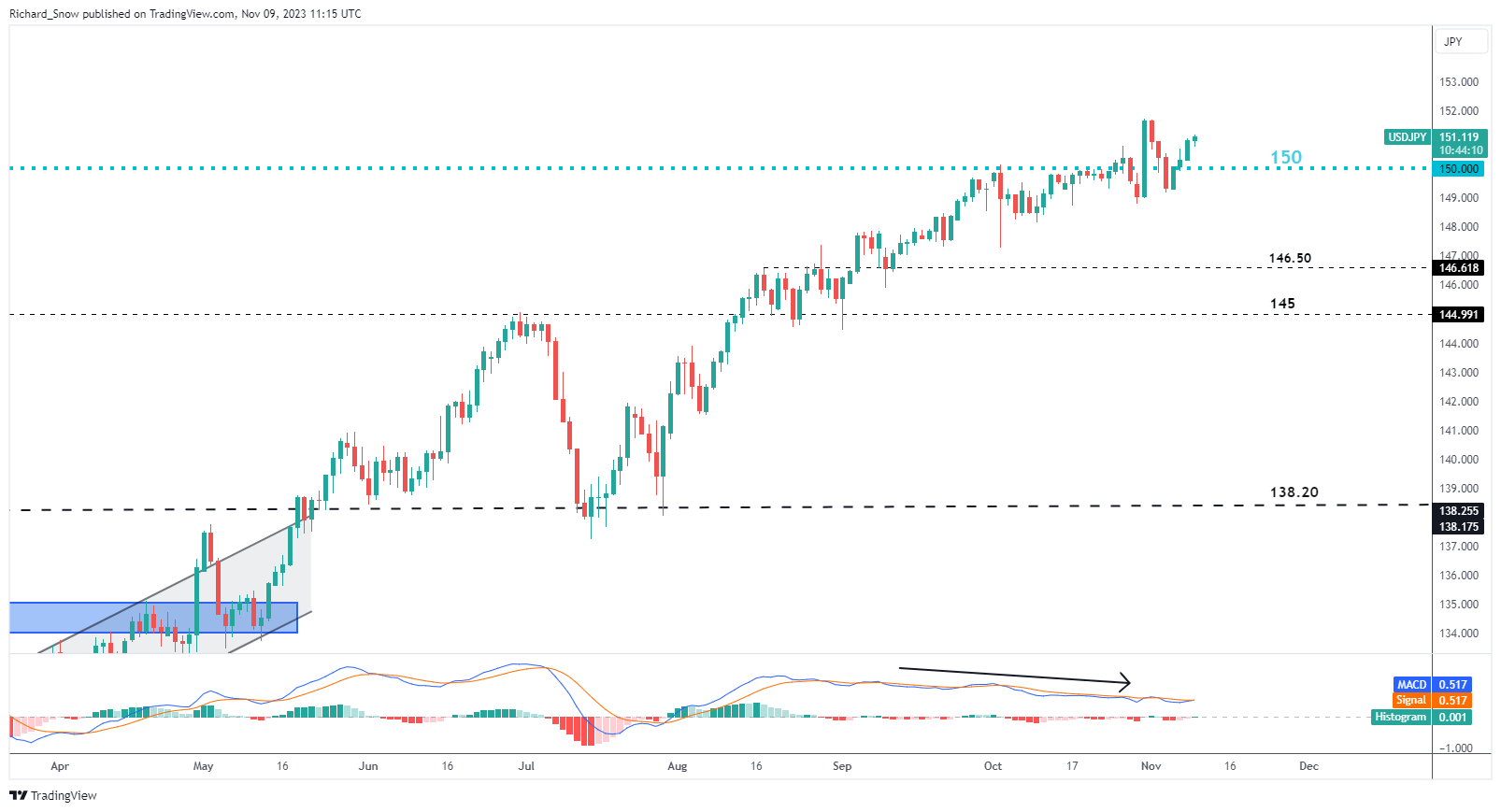

The daily USD/JPY chart reveals the effect of the broader USD recovery. The 150 mark has been highlighted as a potential tripwire for FX intervention directed by Tokyo officials but warnings around undesirable FX moves show a lack of urgency and perhaps contentment given the eventual policy pivot. Thus far markets have self-corrected whenever surpassing the 150 marker, removing the need for intervention.

The MACD reveals the declining momentum in the pair. It remains to be seen if a new yearly high, above the current market of 151.70 will inject a renewed sense of urgency into the conversation. Typically, laying the groundwork for policy normalization ought to see the yen trading firmer, something that has been notably absent of late.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | 4% | -7% | -4% |

| Weekly | 93% | -36% | -19% |

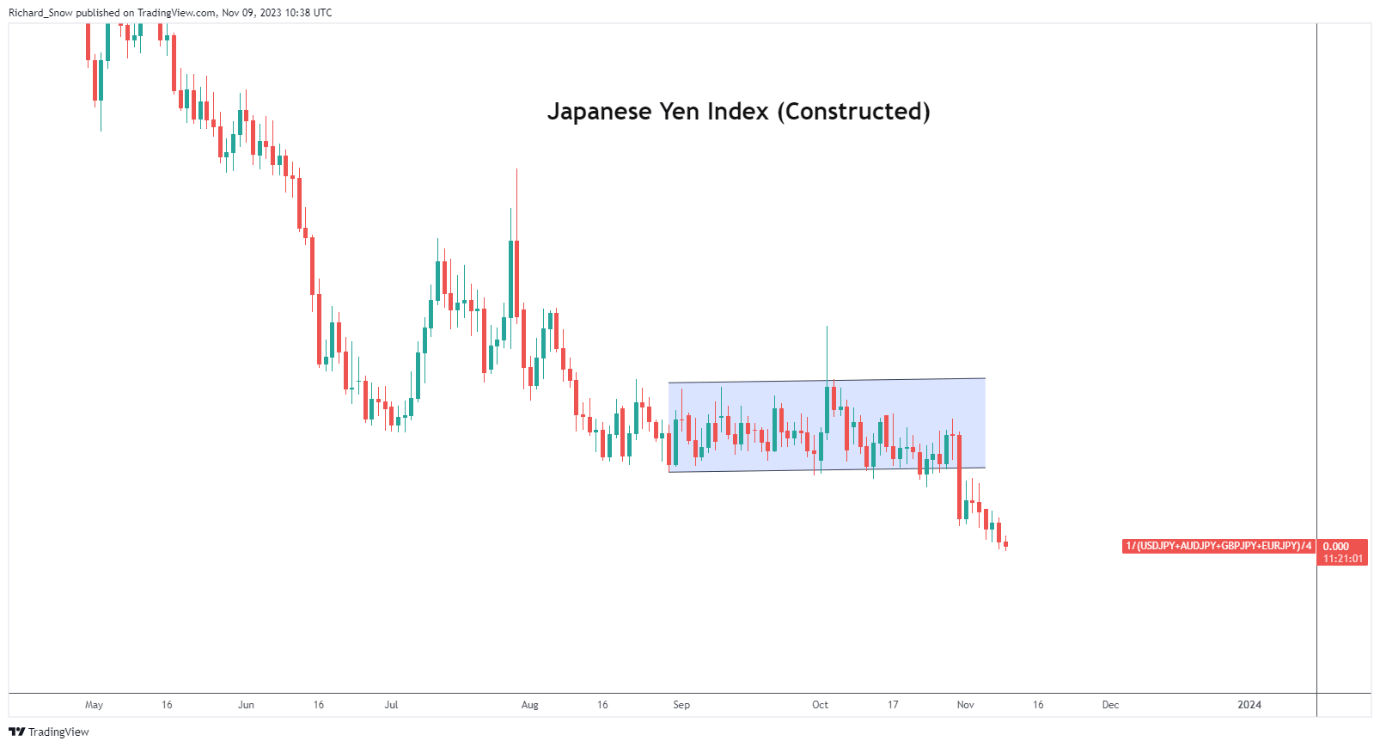

After a period of consolidation, the yen has moved lower when measured against a basket of other major currencies.

Japanese Yen Index

Source: TradingView, prepared by Richard Snow

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX