Why and how do we use the SSI in trading? View our video and download the free indicator here

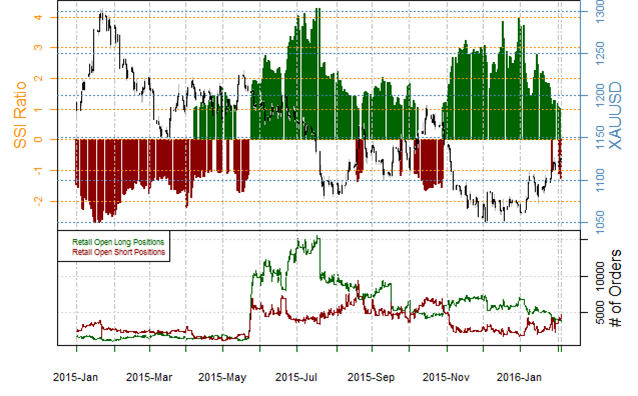

Gold– Our retail forex trader data accurately called a major Gold Price rally last week, and a sustained shift in sentiment leaves us plainly in favor of further near-term XAU/USD gains.

There are currently 1.3 Gold positions short for every 1 long; a contrarian view of crowd positions calls for continued strength. In fact, total short interest has surged by 22 percent as long interest fell 12 percent over the course of the past week. The combination of the recent price rally and sharp turn in positions points higher in XAU/USD until we see sentiment move sharply in the opposite direction.

See next currency section: EURUSD - Euro Breakout is the Real Deal

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX