Can CAD strength continue? Click here to see our forecast to find out what is driving market trends!

Highlights:

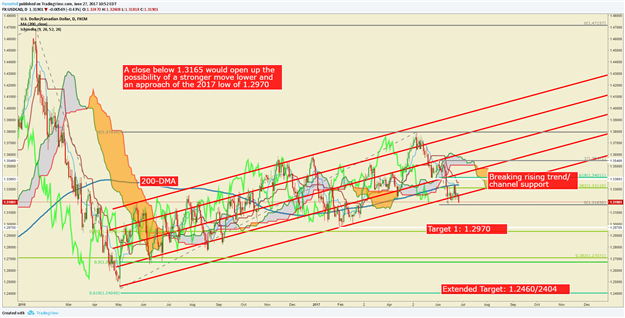

- USD/CAD technical strategy: trailing stop moved to 1.3347

- 3-Wave move higher to 200-DMA favors medium-term focus lower

- Previous Technical Note: USD/CAD Technical Analysis: Basing or Retracing? That is the Question

The rebound in the price of Crude Oil after retesting a long-term support zone near $43/bbl may come at a great time for CAD bulls. The Canadian Dollar has strengthened aggressively, sinking USD/CAD like a stone since May 5, and a boost was recently given when Bank of Canada members Wilkins and Poloz lauded the surprising growth of the economy despite Oil's weakness. After these comments, the markets began to price in a rate hike in 2017 for the Bank of Canada, and a swing of commodity momentum could boost that swing further still.

A welcomed bout of volatility may be ahead for USD/CAD traders as both Yellen (Federal Reserve), and Poloz (Bank of Canada) are set to speak in the coming 48-hours. After the dust settles on these speeches, the outcome to watch would be an extension lower below channel support that could signal a run to and below 1.3000.

A break below 1.3165 would increase the odds that we'll see a move to 1.2970, which is the 2017 low that we traded at in February. The wildcard, of course, will be the US Dollar that is the proud owner of a flattening yield curve that could signal waning confidence in future growth as the market is beginning to price is a more hawkish Bank of Canada. Resistance remains at the June 21 high of 1.3347. A close above this level would favor holding off and looking for better levels to sell.

The chart shows price breaking below the long-term price channel from last May alongside the momentum line (bright green) from Ichimoku showing a bearish break. Both developments favor focusing on the downside.

Click here to read a USD/CAD Analyst Pick: Bearish USD/CAD on BoC’s Hawkish Surprise & Fed’s Hawkishness In Doubt

Join Tyler at his Daily Closing Bell webinars at 3 pm ET to discuss key market developments.

Chart Created by Tyler Yell, CMT

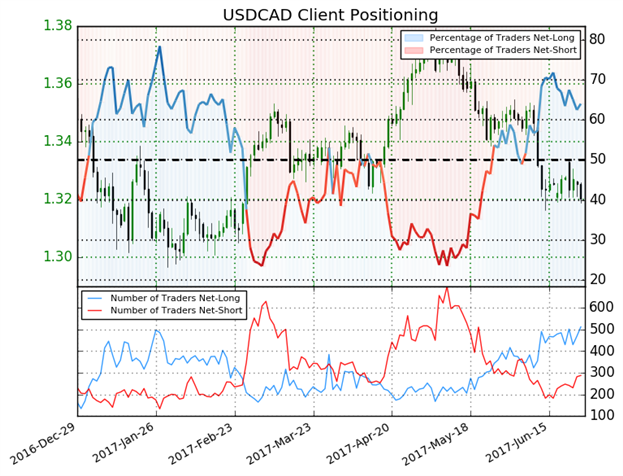

USD/CAD Insight from IG Client Positioning:Rise in Bulls may precede next breakdown

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

USDCAD: Retail trader data shows 64.0% of traders are net-long with the ratio of traders long to short at 1.78 to 1. In fact, traders have remained net-long since Jun 07 when USDCAD traded near 1.34768; price has moved 2.0% lower since then. The number of traders net-long is 11.3% higher than yesterday and 1.2% lower from last week, while the number of traders net-short is 6.3% higher than yesterday and 23.6% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDCAD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USDCAD trading bias.(Emphasis mine)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell