What’s inside:

- EURUSD one-day implied volatility pricing in one-standard deviation high/low of 11765/11643

- FOMC minutes to be released at 18:00 GMT could generate volatility, but not expected to be big; room for surprise

- Confluence of options-derived and price levels outlined

Looking for a longer-term view on EURUSD? Check out our Q3 Forecast.

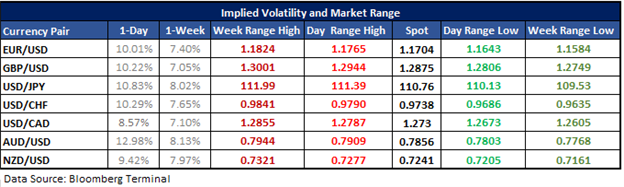

In the following table are implied volatility (IV) levels for major USD-pairs for the next one-day and one-week time periods. Using levels of IV we calculated the projected range-low/high prices from the current spot price within one-standard deviation for specified periods. (Statistically, there is a 68% probability that price will remain within the lower and upper-bounds.)

EURUSD one-day implied volatility ‘normal’, pointing to a one-standard deviation high/low of 11765/11643

EURUSD one-day implied volatility is currently at 10.01%, while one-week is at 7.40%. This implies a one-standard deviation range from current spot price of 11765/11643 and 11824/11584, respectively. Later today, at 18:00 GMT we have the release of the July FOMC minutes, and looking at short-term implied volatility there isn’t an expectation for a huge move to ensue upon the release. But as we have seen before, the market can have it wrong and larger than expected price swings can unfold as a result.

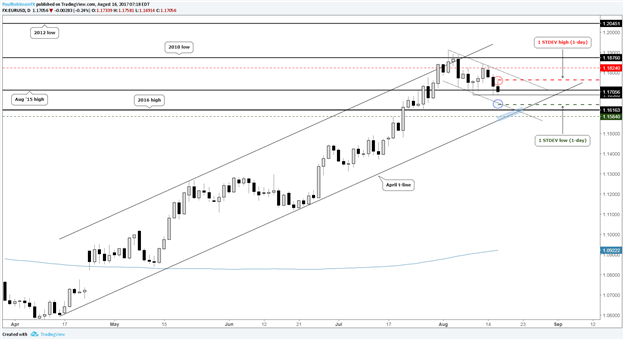

The one-day projected high of 11765 lies just above today’s current intra-day high of 11758 and the projected low arriving at 11643 is near the lower parallel of a developing channel (possible bull-flag). Given the generally negative short-term trend in the euro the bias is still for it to work off overbought conditions generated by the move from the middle of June to earlier this month. With that in mind, any pop higher may find itself with limited momentum. A move lower on the other hand could find support at the near confluence of the 2016 high of 11616, projected range-low of 11643.

Looking out over the next week, the projected low is of interest given it aligns relatively well with the April trend-line (and possibly the 2016 high), and should we see a drop there in the next few days buyers may step up and keep the euro supported at that juncture. A break higher would be come on a breach of the top-side trend-line and we could find one-week IV underpriced as the euro attempts to break above the monthly high at 11910.

For other currency volatility-related articles please visit the Binaries page.

EURUSD: Daily

See the Webinar Calendar for a schedule of upcoming live events with DailyFX analysts.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.